[ad_1]

⚈ BTC’s open interest is at a 3-month high, signaling strong speculative activity.

⚈ Short sellers have already lost $2.17 billion as Bitcoin surpassed the $100,000 milestone.

Bitcoin’s (BTC) rally above the psychologically crucial $100,000 mark has put a large amount of short positions at risk — particularly if the leading digital currency goes on to surpass $110,000.

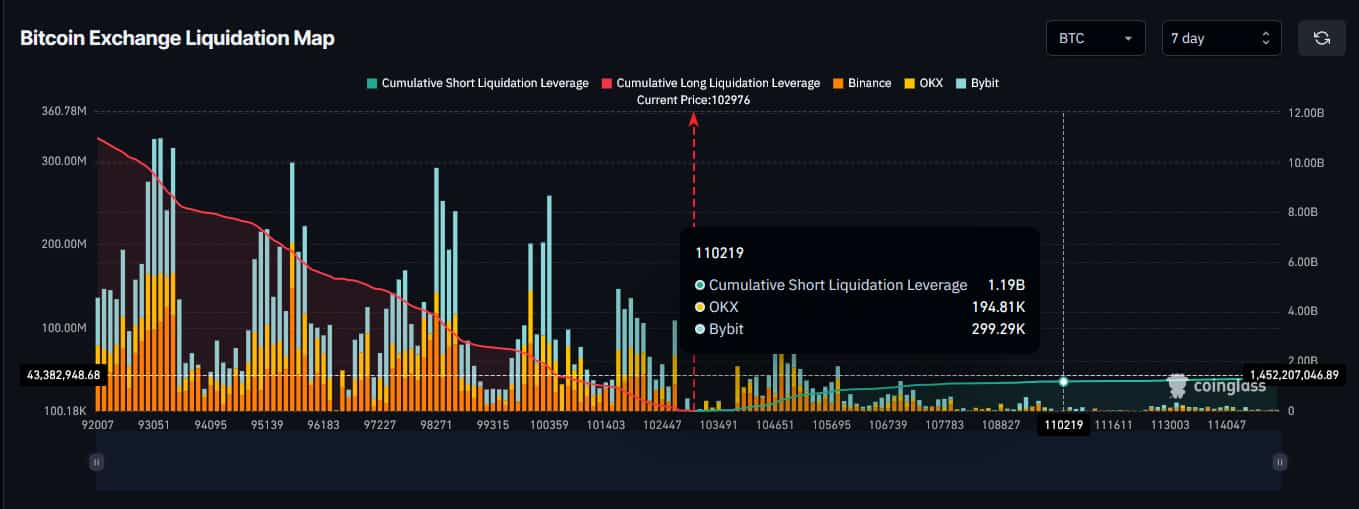

To be more exact, short sellers stand to lose roughly $1.19 billion should the price of Bitcoin reach levels above $110,000, per data retrieved by Finbold on May 9 from cryptocurrency market analysis platform CoinGlass.

Short sellers at risk as the odds of Bitcoin reaching $110,000 are high

The flagship cryptocurrency was changing hands at a price of $102,970 at the time of writing, having marked a 3.33% gain on the daily chart.

At present, the rally seems set to continue. Traders have intensified the opening of speculative positions, as Bitcoin’s open interest is at a 3-month high, and could soon reach a year-to-date (YTD) high.

In addition, short sellers have already lost roughly $2.17 billion through BTC’s climb above $100,000

With the ratio of Bitcoin being held at a loss steadily declining while the number of new BTC millionaires is on the rise, all signs point to one conclusion — that the digital asset’s rise above $110,000 is now a matter of when, not if.

Featured image via Shutterstock

[ad_2]