Following Bitcoin’s (BTC) flash crash below $100,000, new price levels are emerging that could potentially anchor the asset to reclaim its six-figure valuation.

According to on-chain data analysis, the most significant support zone to monitor is at $96,870, where 1.45 million addresses collectively hold approximately 1.42 million BTC, as per data shared by a prominent cryptocurrency analyst, Ali Martinez.

This analysis identified this position as the ‘In the money’ zone, signifying that these holders are currently in profit. The high demand at this price level suggests strong buyer interest, which could prevent Bitcoin from falling further.

Additionally, Bitcoin is encountering smaller resistance above $100,000, where the maiden digital currency faces increased selling pressure.

If the $96,870 support holds, Bitcoin’s downward trend and upward momentum will likely reverse. Interestingly, the level identified by Martinez also sits just above the key $95,000 resistance.

If these levels are maintained, they are likely to help cement Bitcoin’s bull cycle, which historical data suggests could be sustainable in the coming year.

Bitcoin’s price market top

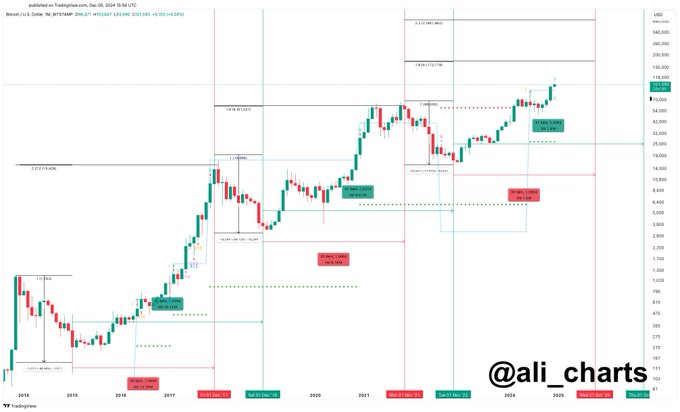

In this case, Martinez had earlier expressed fascination with Bitcoin’s price cycles, noting historical patterns that indicate a rhythm. In an X post, the analyst highlighted that in the last two cycles, it took 1,065 days for Bitcoin to climb from a market bottom to its peak and 1,430 days to complete a full cycle from one bottom to the next.

If this pattern holds, the expert suggested that Bitcoin could reach its next market top in October 2025. To this end, it can be assumed that Bitcoin bull run is just beginning.

Despite the asset’s volatility, some market players point out that Bitcoin will likely see continued growth in the next months.

As reported by Finbold, Standard Chartered predicted that Bitcoin could trade at around $200,000 in 2025, driven by sustained institutional capital inflows.

It is interesting to note that the banking giant correctly predicted the clinching of the $100,000 spot.

Indeed, Bitcoin continues to enjoy momentum triggered by the election of Donald Trump and the appointment of pro-cryptocurrency officials.

There is anticipation that this momentum will remain sustainable until the year-end, with prediction markets setting an ambitious target of nearly $130,000 for Bitcoin by year-end.

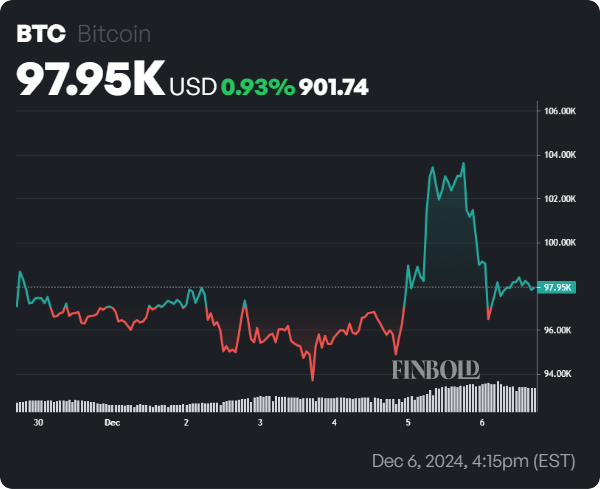

Bitcoin price analysis

At press time, Bitcoin was trading at $97,689. The asset had extended losses on the daily chart, where it was down over 5%. However, BTC has been up almost 1% over the past seven days.

Amid the drop on the daily chart, Bitcoin’s sentiment and technical setup point to possible sustained price growth both in the short and long term. This possibility is highlighted by Bitcoin’s position above key support levels, including its 50-day simple moving average (SMA) at $81,682 and 200-day SMA at $67,668.

The market sentiment is in the “Greed” zone, with a reading of 72 on the Fear & Greed Index, while the relative strength index indicates stability for the asset.

Featured image via Shutterstock