Ethereum must hold key support levels to avoid further declines and potentially target higher resistance zones, amid recent institutional outflows.

The latest Ethereum price chart still shows a decline over the past 24 hours, dropping by 0.9% to a current price of $3,020. Ethereum’s price fluctuated approximately between $2,872 and $3,103 during this period, suggesting a moderate level of volatility. In the last 24 hours, Ethereum’s trading volume stands at $35.9 billion, up 16.24%.

The 7-day and 14-day performance has indeed been lagging, with a notable drop of 14.7% and 10.6%, respectively. This decline points to a weaker market sentiment and potential resistance in the short to mid-term.

Ethereum Price Analysis

Notably, the 1-day Ethereum technical chart indicates a price pullback from recent highs, as evidenced by the strong downward movement. Using the Fibonacci retracement tool, key levels can be identified at various price regions.

Ethereum

Notably, the 0 Fibonacci support, which was located around $3,060, has already been breached and shifted into resistance, suggesting a deeper correction. The price is currently looking for a bounce above this level, which could help launch ETH towards higher liquidity zones.

If Ethereum fails to hold this level, the next possible support zone lies at the $2,878 mark. However, if ETH maintains the $3,060 mark and manages to bounce off it, it could potentially target higher resistance levels around $3,341 and $3,515, corresponding to the 0.236 and 0.382 Fibonacci levels.

Meanwhile, the Relative Strength Index on the chart is currently at 33.61, indicating that Ethereum is moving toward the oversold region, which suggests a potential for a price rebound. Typically, an RSI value below 30 is considered oversold, signaling potential bullish divergence or a correction in the price trend.

Ethereum ETFs Face Massive Outflows

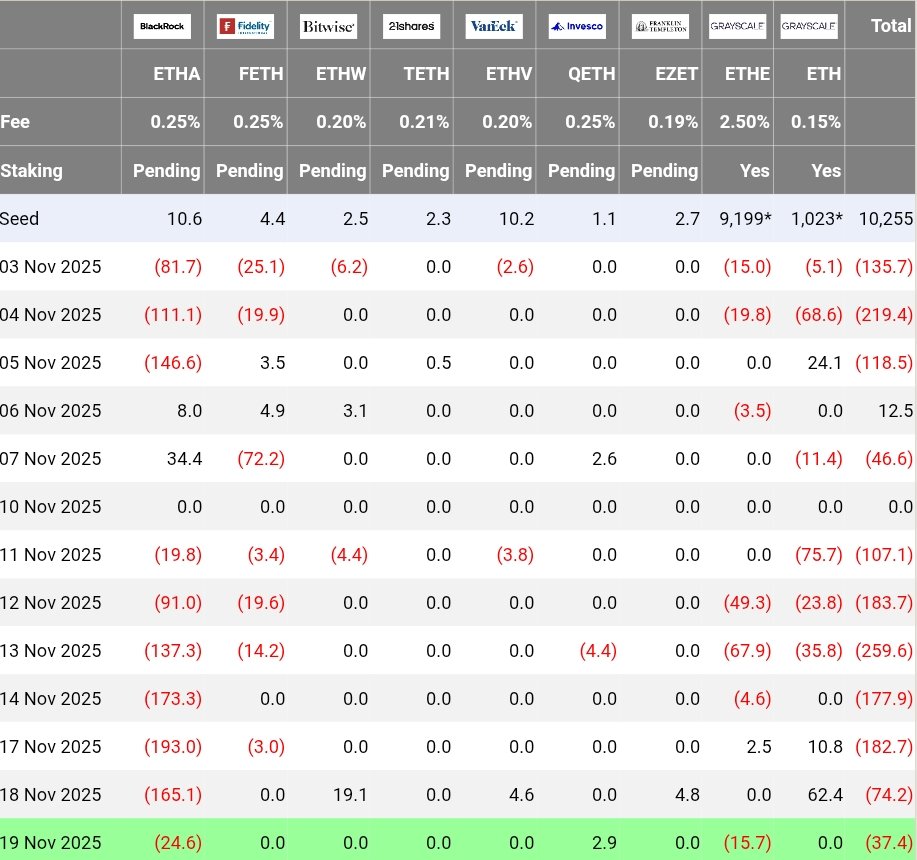

Adding on the bearish sentiment, data provided by analyst Ted shows recent Ethereum ETF outflows, totaling $37.4 million on November 19, 2025, with BlackRock accounting for a significant portion, offloading $24.6 million in Ethereum. Grayscale also saw outflows totaling $15.7 million on the same day.

This activity suggests a period of reduced confidence in those products or profit-taking. Other institutional players such as Fidelity, Bitwise, and VanEck, showed flat changes, with Invesco standing out with positive flows worth $2.9 million.

The outflows and sales by institutional investors could create downward pressure on the price of Ethereum in the short term. If such trends continue, it could signal a bearish sentiment towards Ethereum.