[ad_1]

- Circle share price has come under intense pressure in the past few months.

- The Federal Reserve interest rate cuts will impact the company.

- The GENIUS Act mandated stablecoin issuers to only invest in short-term government bonds.

The Circle stock price has pulled back in the past few months, moving from the record high of $298.54 in June to $130 today, erasing billions of dollars in value. This article explores what to expect now that the Federal Reserve has started cutting interest rates.

Federal Reserve interest rates and stablecoins

Circle, the second-biggest company in the stablecoin industry, could be affected substantially now that the Federal Reserve has started cutting interest rates.

In a statement on Wednesday, the Federal Reserve decided to cut interest rates by 0.25%, and officials signals that the bank will cut interest rates several times this year.

ING analysts hinted that the central bank will deliver two cuts this year and then two more in 2026. More analysts expect that the bank will deliver more cuts in 2026 after Donald Trump replaces Jerome Powell as the Federal Reserve chair.

Circle will be one of the top casualties of interest rates because of its business model, which relies on short-term government lending. The ten-year bond yield dropped to 4.05%, while the two-year moved to 3.5%.

Circle’s business model is relatively simple in that it operates as a bank, with the only limitation being that the GENIUS Act limited it to only lending to the government.

With the two-year yield standing at 3.5% and Circle’s USDC assets being at $73 billion, the company’s annual revenue will be about $2.5 billion if it invests all its funds to these bonds.

The two-year yield was about 4.4% a few months ago as the Fed insisted that it would not cut rates. Assuming the same assets, then the company would have made revenues of $3.3 billion.

On the positive side, low interest rates will likely stimulate risk-taking in the crypto space, a move that will see more money flow to cryptocurrencies. A surge in assets will likely help to offset the issue of interest rates.

A good example is what happened in the last twelve months as its revenues rose despite the Federal Reserve interest rate cuts in 2024. This growth happened as the amount of money in its stablecoins rose from about $30 billion to $73 billion today.

Coinbase relationship challenges

The other main challenge is that Circle is different from Tether, which runs the biggest stablecoin in the industry. Its main difference is its relationship with Coinbase, which owns 8.5 million shares of the company.

The relationship means that Circle does not keep all the interest it earns by investing in government bonds. Instead, Coinbase receives 50% of the residual payment base revenue from its reserves. In the second quarter of the year, Coinbase made over $300 million in revenue from this partnership , much higher than what Circle earned.

Circle stock price analysis

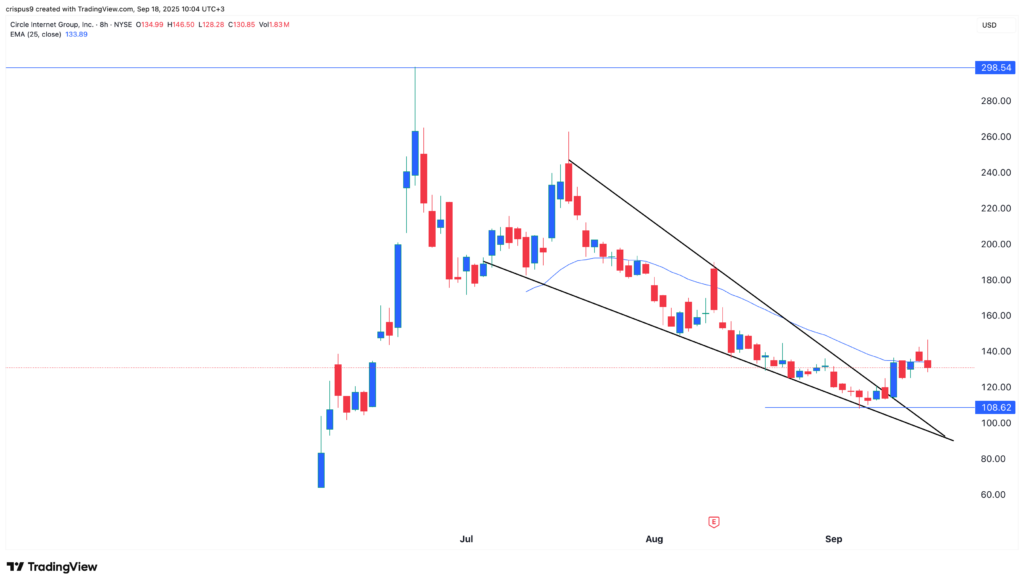

CRCL stock chart | Source: TradingView

The eight-hour chart shows that the CRCL stock price bottomed at $108.62 this month, much lower than the all-time high of $298.

It formed the highly bullish falling wedge pattern, which is made up of two descending and converging trendlines. It has now moved above the upper side of this pattern.

Also, the Relative Strength Index (RSI) and the MACD indicators have all pointed upwards. Therefore, while Circle’s fundamentals are deteriorating, there is a likelihood that the stock will rebound, and possibly retest the important resistance level at $200. A drop below the support at $108 will invalidate the bullish forecast.

[ad_2]