[ad_1]

Bitcoin (BTC) has recently completed its fourth Halving in history. We are now entering a new era for Bitcoin, and everyone’s attention is on what its price reaction will be in the near future.

Given the regularity with which in the past the completion of a Halving has marked the beginning of important bullish movements of Bitcoin, even this year’s has fueled the expectations of investors and industry operators. However, unlike the past, the one that recently occurred stood out from previous events for a series of unique factors, the consequences of which will all need to be evaluated in the coming months.

The fourth era of Bitcoin

The fourth Halving in Bitcoin’s history has now passed, occurring around 02:00 on April 20, 2024, when miner rewards were reduced from 6.25 BTC to 3.125 BTC per block. The halving took place at block number 840,000, marking the beginning of a new cycle (a new ‘era’) of approximately four years in which miners and investors will have to adapt to the new conditions of the network.

One of the main differences compared to the past is that the fourth Halving took place in a context of greater maturity of the cryptocurrency market, with a more established presence of institutional investors and a more defined regulatory framework, as evidenced by the launch of some ETFs on BTC spot.

The previous Halvings, in 2012, 2016, and 2020, occurred at different stages of Bitcoin’s growth. Each event was accompanied by an increase in public awareness and adoption of Bitcoin, which by 2024 can now be considered well established as a widely recognized financial asset, even by traditional financial institutions.

After the last Halving, the price of Bitcoin has not yet shown the surge that many had predicted, based on speculative expectations. This time the market had probably already anticipated the event, but that doesn’t mean we won’t see a significant impact on the price in the coming months.

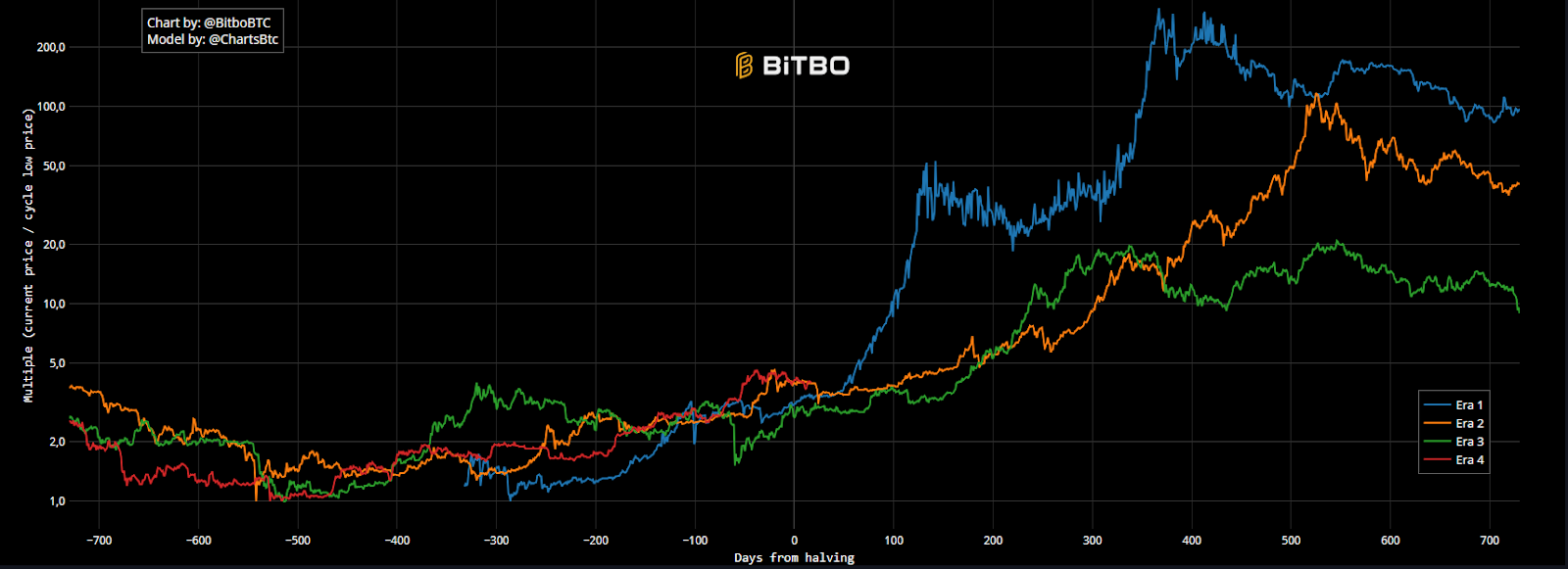

As seen from the graph in Figure 1 (source Bitbo.io), which shows the trend of the price of Bitcoin in various eras compared to the previous era’s minimum, the most important bull markets actually always started several weeks after the completion of a Halving.

Figure 1 – Comparison of different BTC eras: shows the price of BTC compared to the minimum price of the previous era

Furthermore, this time, the event was preceded by a new all-time high, a distinctive element compared to previous Halvings. This has created a unique market context, with high levels of attention and speculation, and an atmosphere of strong optimism and high expectations for the near future.

Another important factor to consider is that investors during previous Halvings were on average less prepared, with many people entering the cryptocurrency market for the first time, mainly driven by media frenzy and expectations of quick profits, but without even basic training. Today, an increasing number of informed investors potentially have already developed long-term strategies, based on in-depth analysis and a better understanding of the dynamics of this market. This has led to more informed investment decisions that have limited short-term volatility.

Over time, financial institutions and large companies have also started to enter the cryptocurrency market, mainly thanks to the recent approval of Bitcoin ETFs. For the 2024 Halving, the presence of these institutional players has likely helped support and stabilize the price, as these actors tend to operate with a more calculated and long-term investment perspective.

All this has certainly had an impact, but it does not alter the substance: the growth of Bitcoin continues its march, in parallel with its digital “scarcity” increasingly close to the limit of 21 million BTC. Currently, the circulating supply of Bitcoin amounts to about 19.6 million Bitcoin, so already today the majority of the tokens that will ever be in circulation have already been ‘mined’, but to reach their totality it will be necessary to wait until the next century, around 2140, precisely due to the effect of future Halvings.

The miners’ reaction

The first effects of each Halving primarily concern miners, who see their production costs of BTC doubled compared to the same resources needed for operation. As in past years, the mining industry will have to adapt to the new conditions, and it is not excluded that there will be fewer and fewer actors holding market shares in the sector. In the first Halvings, many miners found themselves in a difficult position, having to decide whether to continue their activity despite reduced rewards. This often led to increased volatility in the hash rate, with potential security vulnerabilities in the network. However, the growth in the price of Bitcoin should help miners, as has actually happened in every past cycle. In 2020, for example, Bitcoin went from about $10,000 to a rally that brought the asset above $60,000.

Figure 2 – Bitcoin price in its current cycle compared to past cycles (in red the historical highs)

However, it is not automatic that the same scenario will occur in 2024. Global economic conditions are very different from the past, and even Bitcoin itself has shown different price movements, with a particular bullish push in the pre-Halving period, leading to a new all-time high price. For this reason, investors are moving with particular caution in these weeks, waiting for the response of the first cryptocurrency in the short term.

Expectations for the end of 2024

Looking towards the end of 2024, although many analysts suggest caution, there is a moderately optimistic sentiment regarding the price prospects of Bitcoin, also thanks to the continuous increase in the adoption of Bitcoin as a store of value that could favor a stable price growth.

The reduced selling pressure from miners could have an impact in this sense, as they were generally better equipped than in the past to deal with the event, with more efficient technologies and optimized operational strategies, which allowed them to maintain a stable hash rate despite the decrease in rewards.

Furthermore, global macroeconomic conditions, such as inflation in major economies, and central banks’ monetary policies, will continue to influence the cryptocurrency market. A potential economic crisis or turbulence in traditional financial markets could see an increase in demand for Bitcoin as a safe haven asset, positively influencing its price.

The future of Bitcoin post-Halving appears anchored, not only to its induced scarcity, but also to its growing recognition as a legitimate asset class. Discussions between regulators and industry leaders could further shape the landscape, with potential impacts both positive and negative on the price.

Conclusions

In conclusion, the 2024 Halving reflects a more mature and stable Bitcoin market, with better informed investors and less susceptible to drastic fluctuations based on short-term speculation. This evolution signals a phase of consolidation for Bitcoin as a mainstream financial asset.

The measured reaction of the market reflects a maturation of both the cryptocurrency and its investor ecosystem. The coming months will be crucial to observe how these dynamics will evolve in response to global macroeconomic variables and developments in the cryptocurrency sector, which is increasingly focused on mass adoption.

Until next time and happy trading!

Andrea Unger

[ad_2]