Gopax, a prominent South Korean cryptocurrency exchange backed by Binance, disclosed a net loss of 51.3 billion Korean won ($37 million) for the fiscal year 2023, as reported in the year-end financial statement released by its parent company, Streamy.

This figure is an improvement compared to the net loss of 90.6 billion won in 2022. Gopax’s revenue grew 97% year over year amid recovering market sentiment.

GOPAX Reports Net Loss of $37 Million in 2023, Faces Challenges with GoFi-Linked Debt

On April 12, GOPAX released a financial statement that comprises its balance sheets as of December 31, 2023, and December 31, 2022. The balance sheets comprise the related statements of profit or loss, changes in equity, and cash flows for the years that ended.

GOPAX reported a net loss of 51.3 billion Korean won ($37 million) for the fiscal year 2023. As of the end of the reporting period, the company’s current liabilities exceeded its current assets by KRW 66 billion, and total liabilities exceeded total assets by KRW 101 billion.

Most of Gopax’s net losses stemmed from GoFi-linked debt, from deposits stuck in Genesis Global Capital. Genesis, which operated Gopax’s crypto custody service GoFi, suspended withdrawals in November 2022 due to a liquidity crisis associated with its involvement with FTX. According to the financial report, GoFi still owes users 63.7 billion won.

Despite the continued net losses, Gopax exhibited favorable year-over-year performances in 2023. The exchange reported a significant increase in revenue, which surged by 97% to reach 3.1 billion won. Furthermore, the net operating loss decreased substantially, contracting 78% to approximately 17 billion won.

The resurgence of bullish sentiment in the South Korean cryptocurrency market propelled Gopax’s enhanced financial results in 2023. Notably, South Korea remained one of the most active crypto markets globally, with the South Korean won overtaking the U.S. dollar as the primary fiat trading pair for cryptocurrencies in November 2023, according to Bloomberg.

Binance Grapples with Regulatory Delays and Financial Strain in Gopax Acquisition

Binance acquired Gopax at the end of 2022 to address the latter’s liquidity challenges and expand Binance’s presence in the South Korean market. However, financial authorities have been delaying the acceptance of Gopax’s change of virtual asset business report for over a year, impeding Binance’s plans for market entry.

Binance’s decision to acquire Gopax was driven by the latter’s inability to return funds to users following the FTX incident involving its virtual asset deposit service, ‘GoFi.’

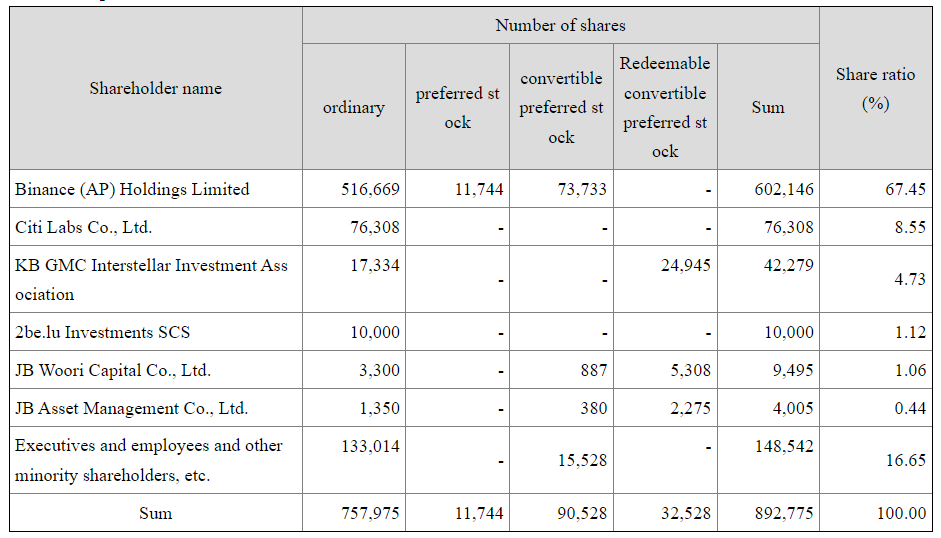

Gopax Shareholders Source: Streamy

Binance became the majority shareholder and took on the responsibility for GoFi’s debt, appointing Leon Singh Pung, the former head of Binance Asia Pacific, as CEO of Gopax. Despite submitting a report on the change in virtual asset business to the FIU, the decision regarding its acceptance has been consistently postponed.

Gopax later replaced its CEO with former CEO Lee Jung-hoon and submitted another change report, but the FIU continued to delay its decision.

In response to these challenges, Binance has initiated discussions to reduce its shares in Gopax to become the second-largest shareholder. This strategic move will alleviate Gopax’s financial burdens and regulatory compliance pressures. Binance CEO Richard Teng even traveled to Seoul in March to engage with local financial regulators to address these concerns.

As of the latest financial report, Binance remains the largest shareholder in Gopax, holding a 67.45% stake. However, a Binance spokesperson has stated that there are no updates regarding any changes to Binance’s ownership stake in Gopax.