[ad_1]

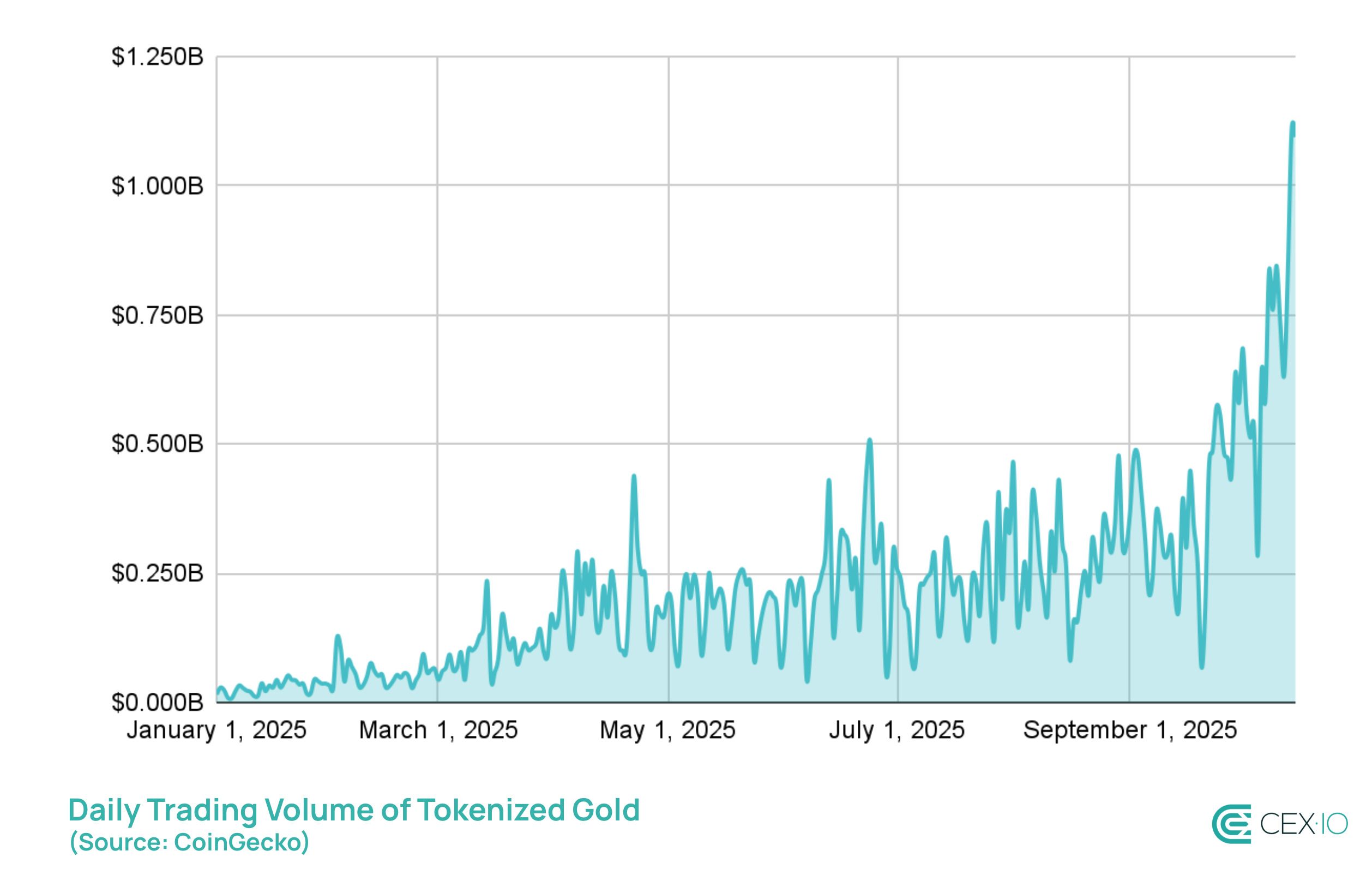

Gold-backed tokens hit a major milestone this week, topping $1 billion in daily trading volume for the first time on the back of the yellow metal’s record-breaking rally.

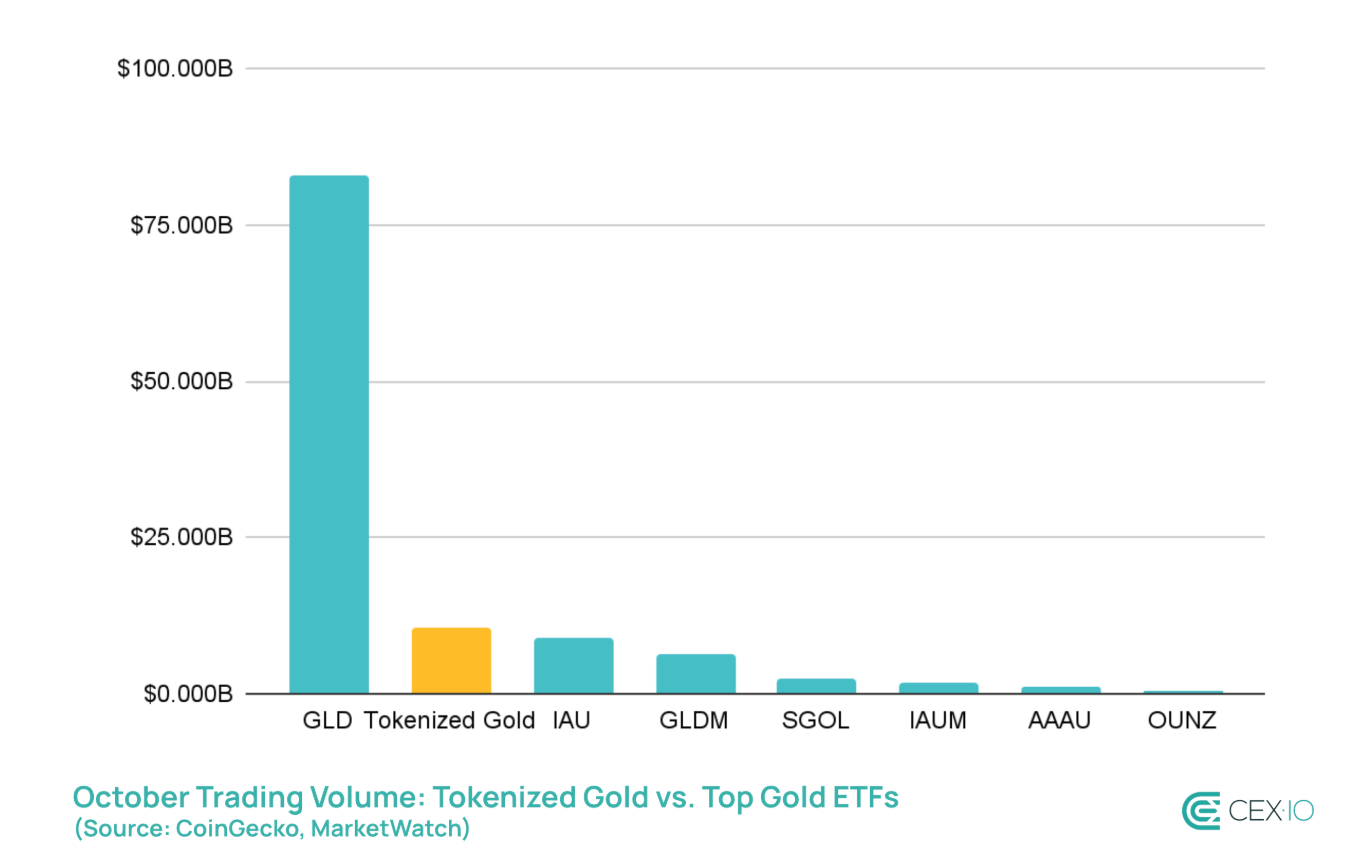

Since the start of the shutdown on October 1, tokenized gold products’ trading volume topped $10 billion, surpassing BlackRock’s iShares Gold Trust (IAU), the world’s second-largest gold ETF, according to a fresh report by CEX.IO.

Daily trading volume of tokenized gold products (CEX.IO/CoinGecko)

In that same window, the price of gold surged over 10% in October topping $4,300 per ounces as escalating U.S.-China trade spat, the U.S. government shutdown and emerging signs of credit and liquidity stress in the financial system pushed investors toward the traditional haven asset.

XAUT$4,205.31, a blockchain-based crypto token backed by physical gold, made up 37% of all tokenized gold volume this month, up from a 27% share in the previous quarter, according to data shared by CEX.IO. Its holder count also rose by more than 12%, outpacing competitors like Paxos Gold (PAXG), the report added.

Still, traditional ETFs still dominate in total market size: the $3.3 billion market capitalization of the tokenized gold sector is tiny compared to the SPDR Gold Shares (GLD) ETF’s $141 billion and IAU’s $62 billion in assets under management.

However, tokenized gold stands out in trading velocity. Tokenized gold’s volume-to-market-cap ratio is 34%, compared to GLD’s 5.6% and IAU’s 1.5%.

Trading volume of gold ETFs vs. tokenized gold in October (CEX.io)

This velocity suggests that investors are trading tokenized gold at a pace much higher than legacy gold instruments, with traders turning to the crypto tokens traded around-the-clock for active positioning and hedging against headline risks, the report said.

“[This] reflects how tokenized gold is used not only as a store of value but as an active utility asset within the crypto ecosystem,” research analyst Illya Otychenko wrote in the report. “Investors appear drawn by its accessibility and ability to respond quickly to macro shocks, including tariff uncertainty and geopolitical tensions.”

Read more: Gold Tests Key Resistance Level That Could Signal the Next Bullish Phase

[ad_2]