In recent days, the Bitcoin (BTC) price has hovered around the $52,000 mark, keeping investors on their toes. Meanwhile, the U.S. equity markets have been surging, with the S&P 500 reaching record highs of 5,000. Year-to-date, the index has already gained 5.54% in 2024, signaling strong performance.

S&P 500 Can Rally to 5,200

In a swift turnaround, Goldman Sachs Group Inc. strategists have revised their 2024 target for the S&P 500 Index after the index surged past the significant 5,000 milestone this month. In a recent note to clients, the team, led by David Kostin, highlighted increased profit estimates as the primary driver behind the adjustment.

Courtesy: Bloomberg

Kostin now predicts the S&P 500 will climb to 5,200 by the year’s end, reflecting a 2% uptick from the mid-December forecast of 5,100. This new target implies a 3.9% gain from Friday’s closing price.

It’s worth noting that Kostin’s initial projection in November 2023 had the S&P 500 reaching 4,700 by the end of this year, 2024. Goldman’s bullish stance, with a 5,200 price target for the S&P 500 in 2024, positions it among the most optimistic on Wall Street. Other market analysts like Tom Lee of Fundstrat Global Advisors and Oppenheimer Asset Management chief strategist John Stoltzfus, have shared a similar year-end outlook.

Will the Bitcoin (BTC) Price Follow?

Bitcoin and the S&P 500 have maintained a close and symbiotic relationship in the past. After Bitcoin’s strong rally last year in Q4 2023, the Bitcoin price has been largely catching up to it.

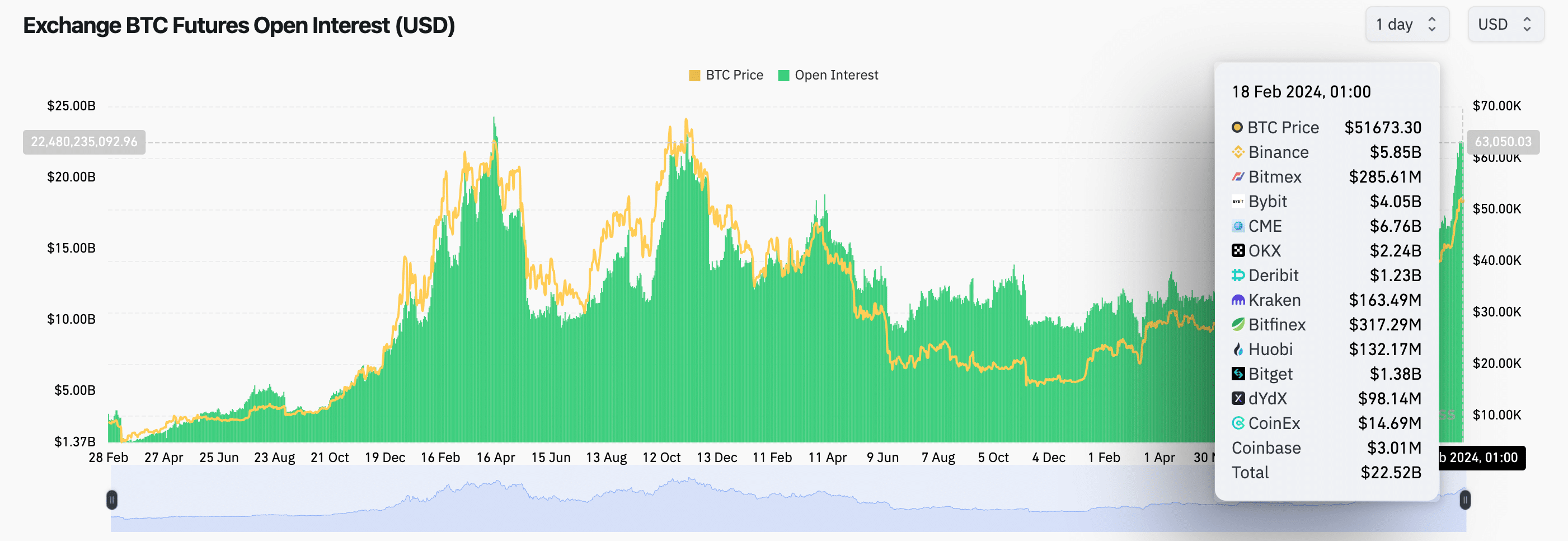

As the BTC price holds above the key support of $52,000, the derivatives data hints at further bullish price action. The chart below depicts a notable surge in Bitcoin open interest, reaching a new three-year peak of $22.5 billion on Feb 18, marking a substantial $1.12 billion increase from the previous closing balance on Friday, Feb 16.

Courtesy: CoinGlass

What’s particularly intriguing is that this figure has consistently remained above the $20 billion threshold for three consecutive trading days, indicating a sustained bullish sentiment among investors.

This development suggests that despite Bitcoin ETFs concluding trading on Friday, speculative traders have reaffirmed their confidence in the market by reinforcing their positions, anticipating further upward momentum in BTC price in the days ahead.

Furthermore, it’s noteworthy that the last time Bitcoin open interest surpassed the $22.5 billion mark was in April 2021, coinciding with Bitcoin trading above $60,300.

The Possible Downside

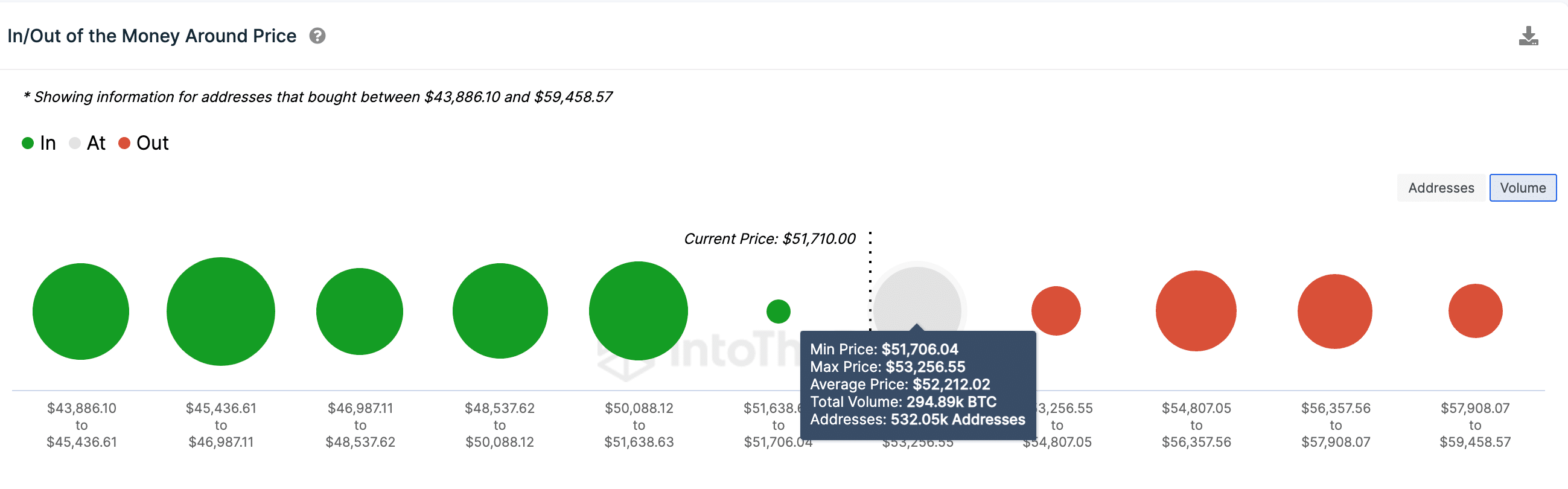

The historical accumulation trend reveals a formidable obstacle for BTC, as it encounters strong resistance around the $53,200 threshold. Analysis from IntoTheBlock’s in/out of the money data indicates that 532,050 addresses secured 294,890 BTC at the peak price of $53,256.

It’s worth noting that many of these investors have been holding at a loss since December 2021. As BTC approaches its break-even price, there’s a possibility that they may opt to exit their positions.

Courtesy: IntoTheBlock

However, if the bulls manage to surpass the $53,000 sell-wall, it could ignite a wave of robust bullish momentum, potentially paving the way for a retest of the $60,000 territory.