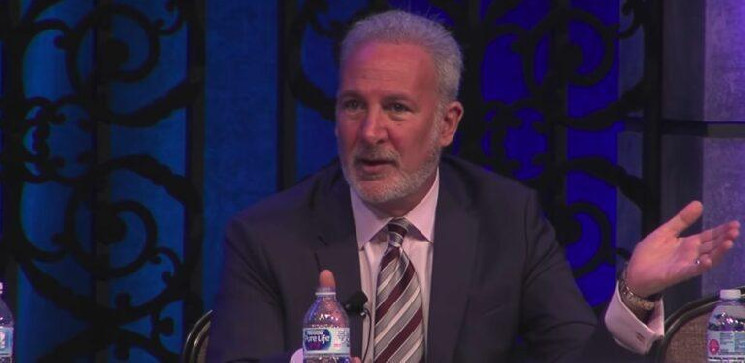

In a recent interview with Kitco News, Peter Schiff, the chairman of SchiffGold and founder of Euro Pacific Asset Management, made bold predictions about the future of the U.S. economy. Schiff argued that the Federal Reserve’s upcoming actions will lead to severe consequences for the U.S. dollar and global financial markets. He suggested that the Federal Reserve’s decision to cut interest rates would be a catastrophic error. According to Schiff, this move will allow inflation to run unchecked and expose the Fed’s inability to control the situation.

Schiff contends that once the Fed cuts rates, inflation will spiral out of control, damaging its credibility even further. He believes that this will result in the ultimate collapse of the U.S. dollar. Schiff went on to claim that the days of the dollar being the world’s reserve currency are coming to an end. He emphasized that the de-dollarization process is already underway but will accelerate rapidly in the near future. In his view, this shift will cause significant financial disruptions, particularly for the U.S. economy.

Moreover, Schiff predicted that gold would emerge as the ultimate safe haven during this economic turmoil. He confidently stated that gold prices could soar to $10,000 an ounce in the coming years. Schiff explained that as central banks move away from the U.S. dollar, gold will reclaim its role as the primary global reserve asset. In Schiff’s opinion, gold has always been the ultimate store of value, and its resurgence will reflect the growing instability of fiat currencies.

Turning to the labor market, Schiff highlighted that recent data revisions paint a much bleaker picture of the U.S. economy than previously reported. Schiff referenced the Bureau of Labor Statistics’ downward revisions to payroll data, arguing that the number of jobs created over the past year has been exaggerated. Schiff believes that many new jobs are part-time positions taken by workers struggling to cope with rising inflation. He further claimed that the labor market is artificially propped up by low-quality jobs, which are a direct result of inflation eroding real wages.

Additionally, Schiff criticized the U.S. government’s handling of economic data, accusing it of masking the real state of the economy. He stated that labor market and inflation data are often revised downward after initial releases, indicating that the numbers are unreliable. According to Schiff, this trend of revising data shows that the economy is not as strong as the government claims. He argued that these revisions reveal a much weaker labor market and higher inflation rates than what is publicly presented.

Schiff also expressed concern about the U.S.’s growing trade and budget deficits. He explained that the U.S. is running record trade deficits, which he believes indicates a weak economy. Schiff noted that a strong economy produces more goods domestically, reducing the need for imports. However, he pointed out that the U.S. economy increasingly relies on imports, further widening the trade deficit. In Schiff’s view, this trend will continue, exacerbating the country’s financial problems.

When asked about the Federal Reserve’s future actions, Schiff warned that the Fed’s reliance on flawed data could lead to more poor decisions. He stated that the Fed often uses inaccurate data to justify its policies, resulting in ineffective monetary decisions. Schiff argued that the Fed’s reliance on government-reported inflation data, which he considers unreliable, has blinded policymakers to the true extent of the economic crisis.

In addition, Schiff addressed the possibility that the U.S. government may be actively suppressing gold prices to mask the weakness of the dollar. While Schiff acknowledged the theory that governments might be manipulating the price of gold, he noted that the gold price has risen substantially over the last two decades despite any potential suppression efforts. Schiff asserted that gold’s long-term upward trend is a signal that the global economy is losing faith in fiat currencies.

Finally, Schiff concluded that we are heading towards an economic environment where quantitative easing (QE) will return and interest rates will be cut further. He predicted that this would fuel inflation, driving up long-term interest rates and making it difficult for the Fed to manage the economy. According to Schiff, the Fed will be forced to intervene in the markets by purchasing more bonds, a move he believes will further destabilize the dollar.