[ad_1]

An in-depth examination conducted by the onchain analytics firm Glassnode, alongside the researcher Cryptovizart, has shed light on bitcoin’s unexpected rise to record-breaking highs just before the halving occurrence, unveiling key aspects of market behavior.

Glassnode Report Sheds Light on ETF Net Inflows and Long-Term Bitcoin Holder Gains

In its analysis, Glassnode emphasizes the notable entry of institutional funds into bitcoin (BTC), especially after the green light for U.S. spot bitcoin exchange-traded funds (ETFs). This influx, contrary to the doubts of critics, has boosted bitcoin’s value, reaching $70,000 last week—a 58% leap from its $42,800 value before the ETF approval.

The report by Glassnode reveals a pivotal transformation in the bitcoin market, characterized by a rise in miner rewards from $22 million to $49 million daily, alongside alterations in exchange flows in the lead-up to and following the sanction of U.S. spot bitcoin ETFs. Prior to the ETF approvals, exchange flows were inconsistent. However, following the approval, a steady demand emerged, evidenced by a daily withdrawal of $17 million, according to Glassnode’s findings.

In parallel, U.S. spot BTC ETFs recorded an average daily net inflow of $299 million. Consequently, this led to a daily net capital influx of around $267 million into bitcoin, clarifying the market’s surge toward unprecedented highs. “Overall, this represents an on-balance, and back-of-the-envelope net capital inflow into bitcoin of around $267M/day (−49+17+299),” Glassnode explains. The report adds:

This represents a meaningful phase shift in market dynamics and a valid explanation for the market’s rebound towards new [all-time highs].

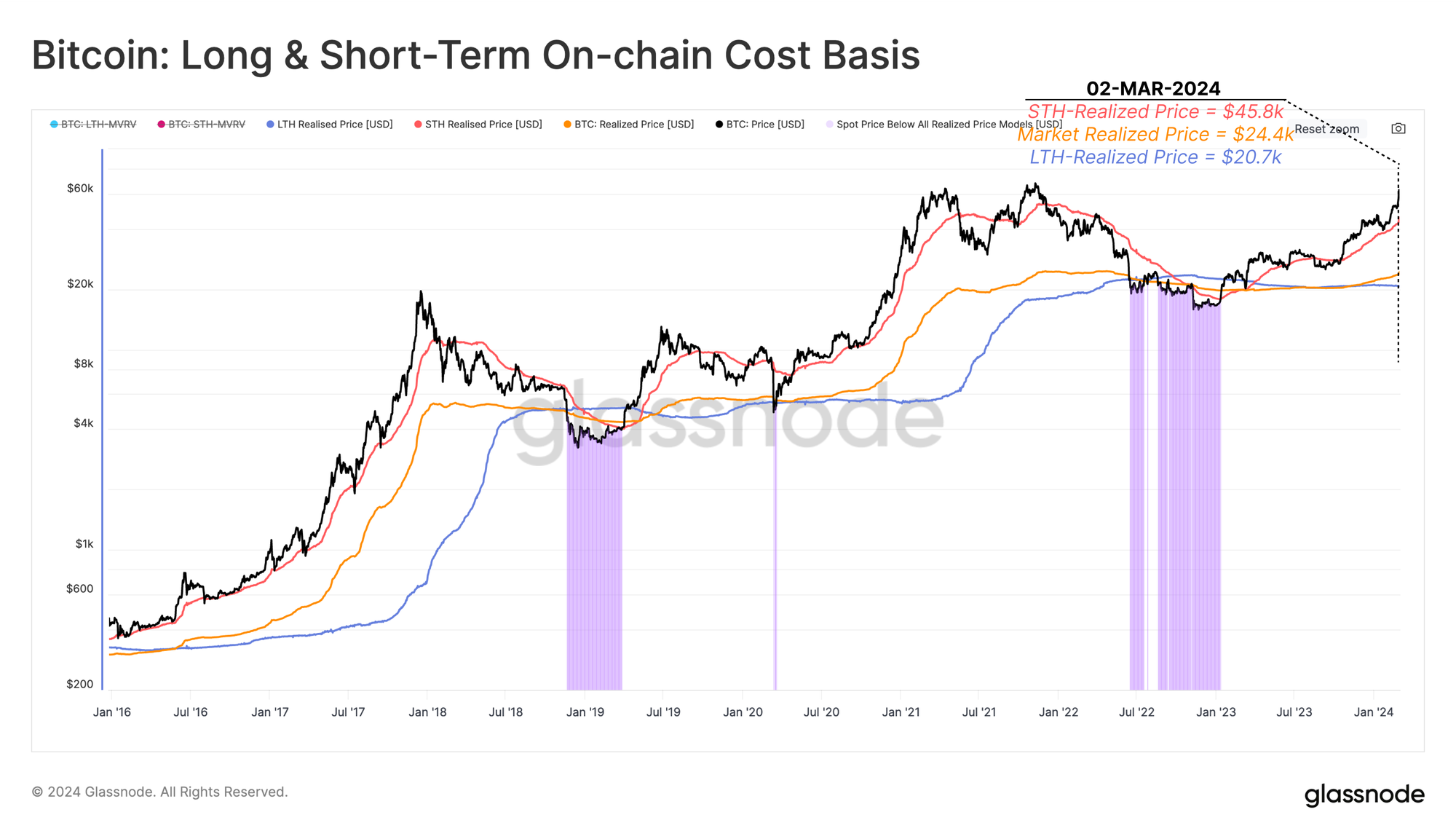

Glassnode’s analysis further explores the behavior patterns of long-term holders, who have increased their market presence as BTC nears record-breaking levels. This activity aligns with patterns observed in past cycles, hinting at a calculated reaction to the market’s upward trajectory and possibly signaling the onset of a new peak in the market cycle.

With BTC prices inching closer to their peak levels, long-term investors, currently holding an average unrealized gain of approximately 228%, have begun to intensify their selling activities. Nonetheless, Glassnode’s onchain analysts point out that this phase of selling by long-term holders has only persisted for 42 days to date, implying that incoming demand could counterbalance these selling pressures for several more months if past trends serve as a reliable benchmark.

What do you think about Glassnode’s latest report? Share your thoughts and opinions about this subject in the comments section below.

[ad_2]