On July 18, President Donald Trump signed the GENIUS Act into law, establishing the first comprehensive federal framework to regulate stablecoins in the United States, and bringing long-awaited clarity to the growing market for U.S. dollar-pegged tokens.

Since then, the market for stablecoins globally has shown a level of resilience and growth that even the most skeptical observers can’t easily dismiss, at least for now.

Just weeks after being signed into law, the regulatory clarity around how stablecoins must be backed, audited, and supervised seemed to calm big institutions and everyday investors, pushing the stablecoin market cap up an additional $18 billion, from about $260 billion on July 18 to over $278 billion by Aug. 21, a nearly 7% jump in just over a month, per data from DefiLlama.

Long-Awaited Clarity

The GENIUS Act, shepherded through Congress by Senator Bill Hagerty (R-Tenn.) and passed with rare bipartisan consensus, mandates that all so-called payment stablecoins be backed one-to-one by low-risk assets — namely cash or U.S. Treasury bills — subject to monthly attestations by a Big Four auditor and ongoing Bank Secrecy Act obligations.

It also creates a tiered oversight regime: issuers under $10 billion in market capitalization may operate under state supervision, but crossing that threshold triggers a mandatory shift to federal regulators, or a temporary halt in new coin issuance until the cap recedes below the limit.

Supply Surge Led by Yield-Bearing Tokens

Compared with the broader crypto market capitalization, which sits just below $4 trillion as of today, stablecoins have carved out a steadily growing niche, now accounting for roughly 6.8% of the total crypto market.

Since the stablecoin legislation was signed into law on July 18, total stablecoin supply globally climbed by almost 7% — a marked acceleration compared to the 1% monthly drift observed in the first half of 2025.

Tether’s USDT — by far the largest stablecoin by market cap — alone has added over $7 billion to its circulating supply, keeping its more than 60% market dominance, and boasting a market cap of over $167 billion as of Aug. 21 — a 4.3% increase since GENIUS became law.

The supply of the largest yield-bearing stablecoin, Ethena (USDE), increased even more notably, growing by around $6 billion over the same interval, or 107% — from $5.6 billion to $11.6 billion. The sharp increase since GENIUS’s signing signals burgeoning demand for stable tokens with built-in yield, despite the U.S. legislation’s ban on such products. USDE’s issuer, Ethena Labs, is headquartered outside of the U.S., however.

USDE 3-month market cap chart. Source: CoinGecko

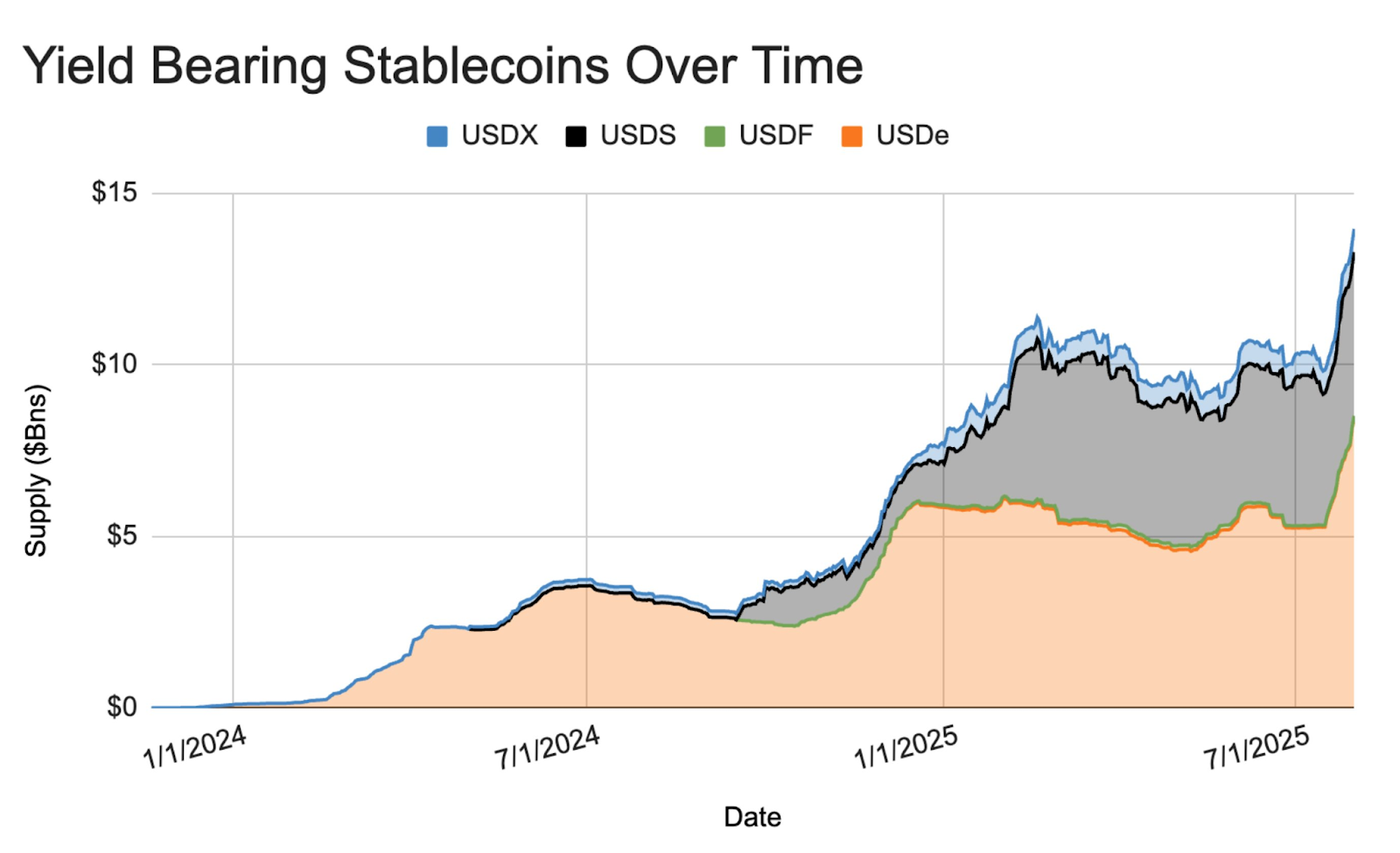

In fact, Anthony Yim, co-founder of analytics firm Artemis, noted in an X post earlier this month that yield-bearing stablecoins are emerging as the “surprising winners” since the GENIUS Act was approved, with supplies surging, despite being restricted in the U.S. under the proposed bill. Per the legislation — which is explicitly focused on USD-pegged stablecoins designed for payments — stablecoin issuers cannot directly offer yield to holders.

Yield-bearing stablecoins over time, as of Aug. 4. Source: X.com

Among stablecoins from U.S. issuers, PayPal’s PYUSD is the largest yield-bearing token. Its supply has also risen sharply over the last month, growing 35% from $885 million to $1.2 billion as of today. PYUSD skirts the GENIUS Act’s yield restrictions by separating out the issuer and the yield offerer — PYUSD is actually issued by New York-based Paxos Trust Company, while payments giant PayPal pays out yield to holders.

Meanwhile, Circle, the largest U.S.-based stablecoin issuer and second-largest globally, saw the supply of its non-yield-bearing USDC grow about 4% since signing. USDC supply at first grew more modestly, from $64.8 billion on the eve of the GENIUS Act to $65.5 billion by mid-August, though that figure eventually jumped to $67.5 billion over the past ten days.

USDC 3-month market cap chart. Source: CoinGecko

Just last week, the company announced its latest development on the infrastructure side. Circle is building its own blockchain protocol, Arc — what the firm describes as a Layer 1, designed for stablecoin transactions and using USDC as native gas.

Leaders React

Industry leaders have been quick to praise the legislation. Jeremy Allaire, co-founder and CEO of Circle, lauded the GENIUS Act as “one of the most transformative pieces of legislation in decades.”

Meanwhile, Tether CEO Paolo Ardoino said in an interview with Bloomberg on July 23 that the company is “well in progress” on building its U.S. domestic strategy under the GENIUS Act, with plans to target institutional markets and offer a stablecoin designed for payments, interbank settlements, and trading.

Just this week, the leading stablecoin issuer — which is registered in the British Virgin Islands — announced a key strategic hire that marks the firm’s official post-GENIUS push into U.S. markets. USDT’s issuer has hired Bo Hines, the former executive director of the White House Crypto Council under the Trump administration, as strategic advisor for its United States strategy.

USDT 3-month market cap chart. Source: CoinGecko

Tether’s treasury minted over $6 billion USDT in July alone, primarily channeling the new tokens into centralized exchanges and DeFi platforms to meet surging liquidity demands.

Meanwhile, Sergey Nazarov, co-founder of blockchain oracle Chainlink, said that the GENIUS Act could prompt more tech and financial institutions to launch their own stablecoins, potentially growing the market tenfold, from $200 billion to about $2 trillion.

On Wall Street, JPMorgan has also forecasted that the stablecoin market could swell to $2 trillion, propelled by tokenized payments, cross-border settlements, and programmable finance use cases.

As supplies climb, smaller issuers face a tough decision. The GENIUS Act requires those with more than $10 billion in assets to either obtain a federal charter — a costly and lengthy process — or halt growth.

Charting the Course Ahead

With the regulatory scaffold now in place, attention turns to the GENIUS Act’s broader economic ripple effects. Proponents argue that by undergirding stablecoins with Treasury bills, the legislation will support demand for short-term government debt, indirectly subsidizing U.S. borrowing costs.

Detractors, however, fear it could amplify systemic risk if issuers undertake maturity transformation — a process of borrowing from the short-term debt market and issuing long-term loans on the funds — or excessive rehypothecation, activities scrutinized heavily after the 2022 Terra collapse.

Meanwhile, international developments are accelerating in lockstep. The European Union’s MiCA regime and Hong Kong’s new stablecoin guidelines have developed in parallel to the U.S. model, prompting global issuers to reassess compliance frameworks on a multi-jurisdictional basis.

Amram Adar, co-founder and CEO of Oobit, a Tether-backed stablecoin payments platform, told The Defiant that the Act is a milestone that sends a clear message: “digital dollars aren’t going away, and now there’s a framework to regulate them responsibly.” Still, he emphasized that regulation alone isn’t enough.

“But it says nothing about spending. That’s the gap. While Washington focuses on the supply side: who can issue how reserves are managed, the demand side is wide open. Who’s building for the actual users? Who’s making it possible to tap your phone and pay with a stablecoin like it’s any other currency?” Adar noted.

The Oobit CEO noted that regulation can “pave the road, but it’s up to innovators to build the vehicles.”

Similarly, Gitay Shafran, founder of The Fedz, an issuer of fractional reserve stablecoin FUSD, sees the GENIUS Act as “a positive milestone” and a signal that the U.S. is taking digital dollars seriously. But Shafran warned against complacency, saying the Act is just the beginning of what’s needed to build resilient and decentralized financial systems.

“We read about new stablecoin by traditional financial institutions every day but we also need decentralized stablecoins and synthetic dollars that aren’t tied to a single company,” Shafran told The Defiant.

Meanwhile, just this week, Wyoming became the first U.S. state to issue its own stablecoin. The USD and Treasury bill-backed Frontier Stable Token (FRNT) is being hailed by some as a milestone for the industry, but others have expressed concern about privacy and centralization.