With the recent passing of the GENIUS Act, a landmark US regulation for stablecoins, global attention has intensified. To discuss the growing stablecoin landscape in Asia, BeInCrypto sat down with Dr. Sam Seo, Chairman of Kaia. As one of Asia’s leading crypto platforms, Kaia is at the forefront of shaping regional stablecoin strategies.

Stablecoins Take the Spotlight in Asia

President Donald Trump has signed the GENIUS Act, the first US federal law governing stablecoins, just one day after it cleared the House. The landmark legislation requires one-to-one reserves, regular audits, and limits issuance to licensed banks, credit unions, and certain approved non-banks, while banning algorithmic or unbacked coins.

The move has already triggered a wave of corporate interest. Within weeks, major US retailers such as Amazon and Walmart began exploring proprietary stablecoins to cut card-network fees, speed settlement, and integrate loyalty programs. Supporters see this as a step toward mainstream adoption; critics warn it could pull deposits from traditional banks and force them to accelerate digital-currency strategies.

The timing comes as the US dollar faces its sharpest first-half drop since 1973, prompting European investors to turn to euro-denominated trading and euro-pegged stablecoins to reduce FX risk. While the dollar remains dominant, the regulatory clarity of the GENIUS Act could strengthen its position in crypto just as Asia weighs how to benefit from USD-based liquidity without undermining local currencies.

Kaia DLT Foundation’s Chairman, Dr. Sam Seo, discussed with BeInCrypto how Asian policymakers and platforms should respond — and why a regional stablecoin alliance may be critical for the region’s long-term autonomy.

Stablecoinvs Fiat. Source: Kaiko

Seo did not hesitate to pick the stablecoin when asked about the most critical trend in Asia’s digital asset market.

“The most trendy one is stablecoin,” he said. “Even before the Genius Act, the increasing usage and volume of stablecoin actually ignited the discussion and attracted much attention in Asia.”

He stressed that stablecoin adoption is expanding rapidly across Asia, making it far from a phenomenon limited to the US or Europe. USD-backed coins are also heavily used by Asian individuals and businesses. The surge extends beyond speculative trading, with stablecoins increasingly embedded in everyday transactions, cross-border commerce, and regional regulatory agendas.

Leaders and Regional Defenders

When asked which countries are driving innovation, Seo pointed to two leading ones.

“I would say probably Singapore or the UAE, because they were quite advanced in terms of making regulations for stablecoins. In Singapore, they already made the single currency stablecoin regime in 2023, not only about the Singapore dollar, but also other major 10 currencies. And also the UAE, they made many regulation frameworks related to crypto and stablecoins.”

Singapore’s early action placed it ahead of other Asian jurisdictions in setting clear, enforceable rules. The UAE, led by Dubai and Abu Dhabi, has also built a comprehensive regulatory framework for digital assets, including stablecoins.

By contrast, Seo said, several countries focus on stablecoins pegged to their own currencies.

“Japan, Korea, Hong Kong, China, and the Philippines are more focused on their currency-based stablecoins because they care about their people and their currency.”

This reflects a shared priority: protecting domestic monetary systems and safeguarding national currencies from being displaced by foreign-backed coins.

Genius Act: Both Threat and Opportunity

The GENIUS Act has created a clear framework for regulated USD stablecoins such as USDC and PayPal USD. For Asia, Seo sees both danger and potential.

“If we don’t have local currency stablecoins, the fiat currency would be less used as the usage of USD stablecoins can increase a lot. But if we prepare the regional stablecoin and the proper usage of USD stablecoins, then this could be an opportunity for the Asian countries.”

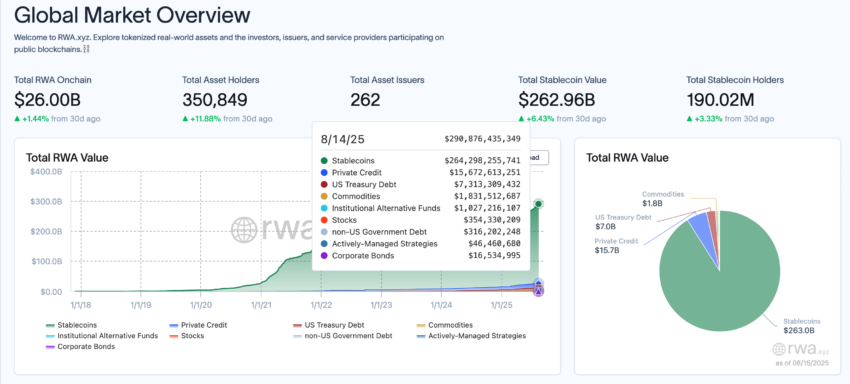

Global Market Overview. Source: RWA.xyz

Seo noted that regulated USD stablecoins under the GENIUS Act could also unlock new capital flows for Asia’s tokenized asset markets — from government bonds to real estate — boosting fundraising and trading activity. He also emphasized that because stablecoins are typically issued and transacted on public blockchains, they are transparent to all participants. At the same time, privacy can still be preserved through selective anonymization of user data.

Japan’s Strict Model and the Need for Balance

Japan’s Payment Services Act allows only banks, trust companies, and licensed remittance providers to issue stablecoins, requiring full reserve backing and regular audits. Seo sees this as a strong safeguard for the yen.

“Regulation for stablecoin is a way of protecting the Japanese currency and the Japanese market. Requiring a strong reserve inside certain jurisdictions actually can prevent the money from going out from the country.”

But he also cautioned against overreach.

“If the reserve requirement is too strict, that might prevent the non-local players from entering and reduce the interoperability with stablecoins backed by denominations of other countries, which is one of the most significant roles of digital currencies. We need a balance for non-local players to play.”

Payments, E-Commerce, and Inclusion

Seo believes stablecoins could push Web3 into the mainstream in Asia, especially in payments and e-commerce.

“Absolutely yes,” he affirmed. “In some countries, for example, in Vietnam and Indonesia, QR payments are nearly dominant, rather than credit card payments.”

By integrating stablecoins into QR-enabled wallets, millions could transact without needing a bank account or card, which requires them to go through the complexity of the bank’s authentication process.

“We don’t have to reinvent the interface by having the stablecoin as another means of currency we can increase the transactions of payment and lower the difficulty of the payment.”

Europe’s Edge and Asia’s Alliance Gap

Seo noted that Europe enjoys easier liquidity coordination thanks to the euro and the MiCA framework. With its multiple currencies alongside the regulatory diversity, Asia does not have this advantage.

“A single currency is unnecessary in Asia, but a multi-currency stablecoin alliance is very effective. It can improve liquidity between different currency-backed stablecoins.”

Such an alliance could be a foundation for cross-border interoperability and reduce friction between regional markets.

Kaia’s Roadmap for Regional Cooperation

Kaia is focused on expanding real-world use cases for stablecoins and driving adoption in Asia. It already supports USDT natively and plans to onboard yen-, rupiah-, and Hong Kong dollar–backed stablecoins. The second phase is to build an on-chain FX market for seamless currency swaps and efficient cross-border settlements. This would improve liquidity, lower transaction costs, and enable faster payments.

The final stage is to ally Asian stablecoin issuers to standardize practices and expand regional network effects.

“We are definitely working on that,” Seo said of Kaia’s collaboration with LINE Messenger, one of the most popular ones in the region. “Someday, the LINE users from Japan or other countries could use different stablecoins inside the LINE messenger. But it requires proper regulation as well.”

Kaia is working closely with LINE to explore stablecoin integration, expecting that once the legal framework is ready, LINE users can send and receive stablecoins seamlessly, domestically and internationally.

Kaia is a Layer 1 blockchain platform launched in August 2024. It combines Klaytn from Kakao and Finschia from Naver, Korea’s dominant tech giants. Naver’s LINE Messenger has a massive Asian user base in Japan, Taiwan, and other countries.

Kaia chain network onboarded Tether’s USDT in May this year, and it is also in discussions with other stablecoin and fintech companies to create potential KRW, JPY, and other currency-backed stablecoins.

Asia’s Defining Choice

For Seo, the strategy is clear: build local currency stablecoins, selectively integrate USD liquidity, and connect them through a regional interoperability framework.

“Stablecoins are no longer just a crypto tool. They are becoming the connective tissue of digital finance in Asia… capable of linking payments, tokenized markets, and everyday commerce.”

The GENIUS Act may solidify the dollar’s regulated role in global crypto. Whether Asia responds with fragmentation or a united strategy will determine the region’s financial autonomy for years.

The post GENIUS ACT and Beyond: Kaia Explains Asian Perspective appeared first on BeInCrypto.