-

Gemini shares drop below its IPO price just days after its debut on Nasdaq

-

The company reported a $283 million loss in H1 2025

-

Gemini is also nearing a settlement with the SEC

2025 has been a milestone year for crypto companies entering public markets. From Coinbase to Circle and Bullish, major digital asset firms have launched IPOs that drew major attention and big first day gains.

However, not all IPOs have been able to maintain their early momentum. Here’s what’s happening with Gemini.

Gemini IPO Hype Sees Quick Pullback

Gemini Space Station has slipped below its IPO price just days after its public debut. Its shares dropped over 12% to around $24 on Wednesday, falling below the IPO price of $28.

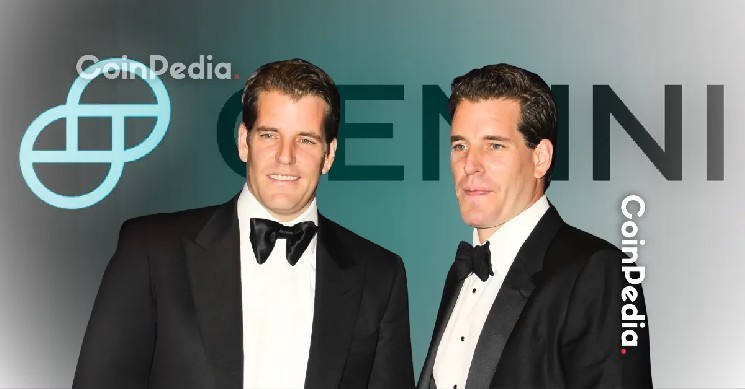

The Winklevoss-led exchange raised $425 million in its IPO at $28 per share, giving it a $3.3 billion valuation. Its stock initially surged 14% on the first day, reaching a high of $45.89 and closing at $32. However, momentum has since faded, and its market capitalization has now fallen below $3 billion.

Gemini, founded in 2014 by Cameron and Tyler Winklevoss, now oversees over $21 billion in crypto assets. The New York-based platform offers an exchange, a USD-backed stablecoin, staking, custody services, and also a crypto rewards credit card. Notably, Nasdaq also agreed to invest $50 million in Gemini through a private placement timed with the IPO.

Gemini’s Losses Pile Up as SEC Settlement Nears

Behind the scenes, Gemini appears to be struggling.

The company reported a $283 million net loss in the first half of 2025, up from $159 million for all of 2024.

It is also moving to settle a long-running dispute with the SEC over its Gemini Earn lending program. Lawyers told a Manhattan court that the settlement in principle would fully resolve the lawsuit, pending SEC approval, and asked the judge to extend the deadline for final paperwork to December 15.

Still, despite the clear interest, day-one pops are cooling. Here is the first-day performance of recent crypto IPOs:

Circle: +168%

Bullish: +90%

Figure: +24%

Gemini: +14% pic.twitter.com/fdWNHMVfvU— GSR (@GSR_io) September 15, 2025

How Are Other Crypto Stocks Are Performing

Coinbase, the first crypto exchange to go public, set a $250 reference price but opened at $381, peaked at $429, and closed day one at $328. Today, it trades around $320.

Stablecoin issuer Circle also raised over $1 billion. Its IPO price was $31, and it soared around 168%. It is currently trading around $131.

Figure Technology debuted on Nasdaq at $25 per share, then jumped 44% to open at $36, giving the company a $7.6B valuation and marking another strong first-day gain for a crypto-linked firm. It is currently trading around $37.

Crypto exchange Bullish’s shares also more than doubled on their NYSE debut. Bullish was priced at $37 per share. However, it opened its first trading day at $90 and raised over $1 billion. It is currently trading at $54.

IPOs as a Bridge

The run of crypto IPOs shows how the industry is building ties with mainstream markets.

Earlier this year, Binance founder CZ said that the trend of crypto companies going public doesn’t mean the industry is moving away from crypto toward the stock market. Instead, he notes that IPOs act as a bridge, attracting traditional stock market investors into the crypto space.

Investors gain indirect crypto exposure in two ways: through shares in crypto companies and via Bitcoin held on company treasuries, ultimately a win for the industry.