[ad_1]

The following is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock.

Staking

Staking is a fundamental yield generation strategy in DeFi. It involves locking a blockchain’s native tokens to secure the network and validate transactions, earning rewards in transaction fees and additional token emissions.

The rewards from staking fluctuate with network activity—the higher the transaction volume, the greater the rewards. However, stakers must be mindful of risks such as token devaluation and network-specific vulnerabilities. Staking, while generally stable, requires a thorough understanding of the underlying blockchain’s dynamics and potential risks.

For example, some protocols, like Cosmos, require a specific unlock period for stakers. This means that when you’re withdrawing your assets from staking, you won’t be able to actually move your assets for a 21-day period. During this time, you are still subject to price fluctuations and can’t use your assets for other yield strategies.

Liquidity Providing

Liquidity providing is another method of generating yield in DeFi. Liquidity providers (LPs) usually contribute an equal value of two assets to a liquidity pool on decentralized exchanges (DEXs). LPs earn fees from each trade executed within the pool. The returns from this strategy depend on trading volumes and fee tiers.

High-volume pools can generate substantial fees, but LPs must be aware of the risk of impermanent loss, which occurs when the value of assets in the pool diverges. To mitigate this risk, investors can choose stable pools with highly correlated assets, ensuring more consistent returns.

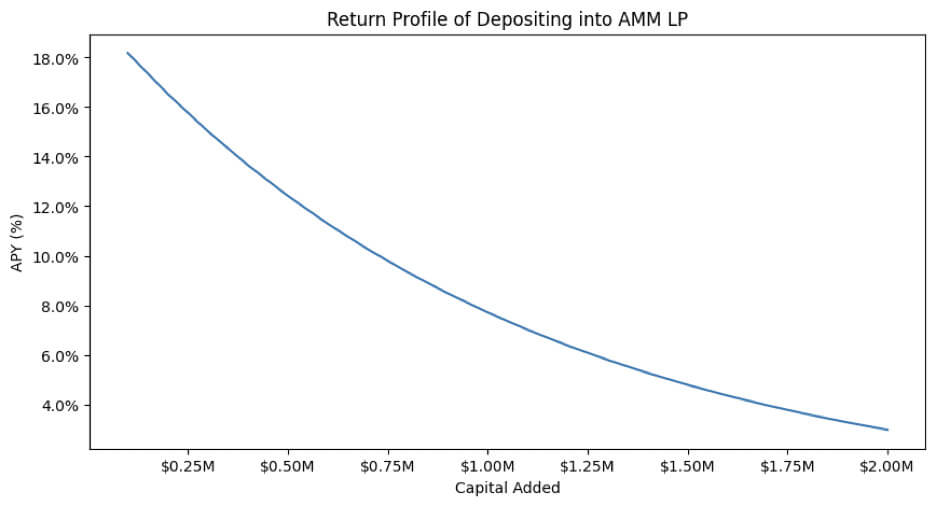

It is also important to remember that the projected returns from this strategy are directly dependent on the total liquidity in the pool. In other words, as more liquidity enters the pool, the expected reward decreases.

Lending

Lending protocols offer a straightforward yet effective yield-generation method. Users deposit assets, which others can borrow in exchange for paying interest. The interest rates vary based on the supply and demand for the asset.

High borrowing demand increases yields for lenders, making this a lucrative option during bullish market conditions. However, lenders must consider liquidity risks and potential defaults. Monitoring market conditions and utilizing platforms with strong liquidity buffers can mitigate these risks.

Airdrops and Points Systems

Protocols often use airdrops to distribute tokens to early users or those who meet specific criteria. More recently, points systems have emerged as a new way to ensure these airdrops go to actual users and contributors of a specific protocol. The concept is that specific behaviors reward users with points, and these points correlate to a specific allocation in the airdrop.

Making swaps on a DEX, providing liquidity, borrowing capital, or even just using a dApp are all actions that would generally earn you points. Points systems provide transparency but are by no means a fool-proof way of earning returns. For example, the recent Eigenlayer airdrop was limited to users from specific geographical areas and tokens were locked upon the token generation event, sparking debate among the community.

Leverage in Yield strategies

Leverage can be used in yield strategies like staking and lending to optimize returns. While this increases returns, it also increases the complexity of a strategy, and thus its risks. Let’s look at how this works in a specific situation: lending.

Recursive lending capitalizes on incentive structures within DeFi lending protocols. It involves repeated lending and borrowing of the same asset to accrue rewards offered by a platform, significantly enhancing the overall yield.

Here’s how it works:

- Asset Supply: Initially, an asset is supplied to a lending protocol that offers higher rewards for supplying than the costs associated with borrowing.

- Borrow and Re-Supply: The same asset is then borrowed and re-supplied, creating a loop that increases the initial stake and the corresponding returns.

- Incentive Capture: As each loop is completed, additional governance tokens or other incentives are earned, increasing the total APY.

For example, on platforms like Moonwell, this strategy can transform a supply APY of 1% to an effective APY of 6.5% once additional rewards are integrated. However, the strategy entails significant risks, such as interest rate fluctuations and liquidation risk, which require continuous monitoring and management. This makes strategies like this one more suitable for institutional DeFi participants.

The future of DeFi & Yield Opportunities

Until 2023, DeFi and traditional finance (TradFi) operated as separate silos. However, increasing treasury rates in 2023 spurred a demand for integration between DeFi and TradFi, leading to a wave of protocols entering the “real-world asset” (RWA) space. Real-world assets have primarily offered treasury yields on-chain, but new use cases are emerging that leverage blockchain’s unique characteristics.

For example, on-chain assets like sDAI make accessing treasury yields easier. Major financial institutions like BlackRock are also entering the on-chain economy. Blackrock’s BUIDL fund, offering treasury yields on-chain, amassed over $450 million in deposits within a few months of launching. This indicates that the future of finance is likely to become increasingly on-chain, with centralized companies deciding whether to offer services on decentralized protocols or through permissioned paths like KYC.

This article is based on IntoTheBlock’s most recent research paper on institutional DeFi. You can read the full report here.

[ad_2]