Who would have thought we’d see Bitcoin shoot through the roof this quickly, soaring past $100K, albeit retreating slightly at present?

As we move forward into 2025, the main question on our minds is: what lies ahead? Is Bitcoin (BTC) a bubble about to burst, or are we on track for $150,000–$200,000 soon? Are there any rational tools to predict its trajectory, or are we left to just play guessing games?

From what I’ve observed, the fog starts to lift when you examine on-chain and technical indicators, while also factoring in the macro perspective. Let’s layer these three types of analysis in this article to see what picture emerges for Bitcoin’s next move.

Table of Contents

Extreme greed, rising active addresses, and record hash rate

The Crypto Fear and Greed Index is currently at 78, indicating Extreme Greed, which often signals potential tops in the short term. However, sustained levels of extreme greed during bull markets often align with parabolic price increases before final peaks.

This typically precedes short-term pullbacks due to market exuberance, which appears to be what we’re witnessing now as Bitcoin’s price hovers around the $100K level.

Crypto Fear & Greed Index | Source: Alternative.me

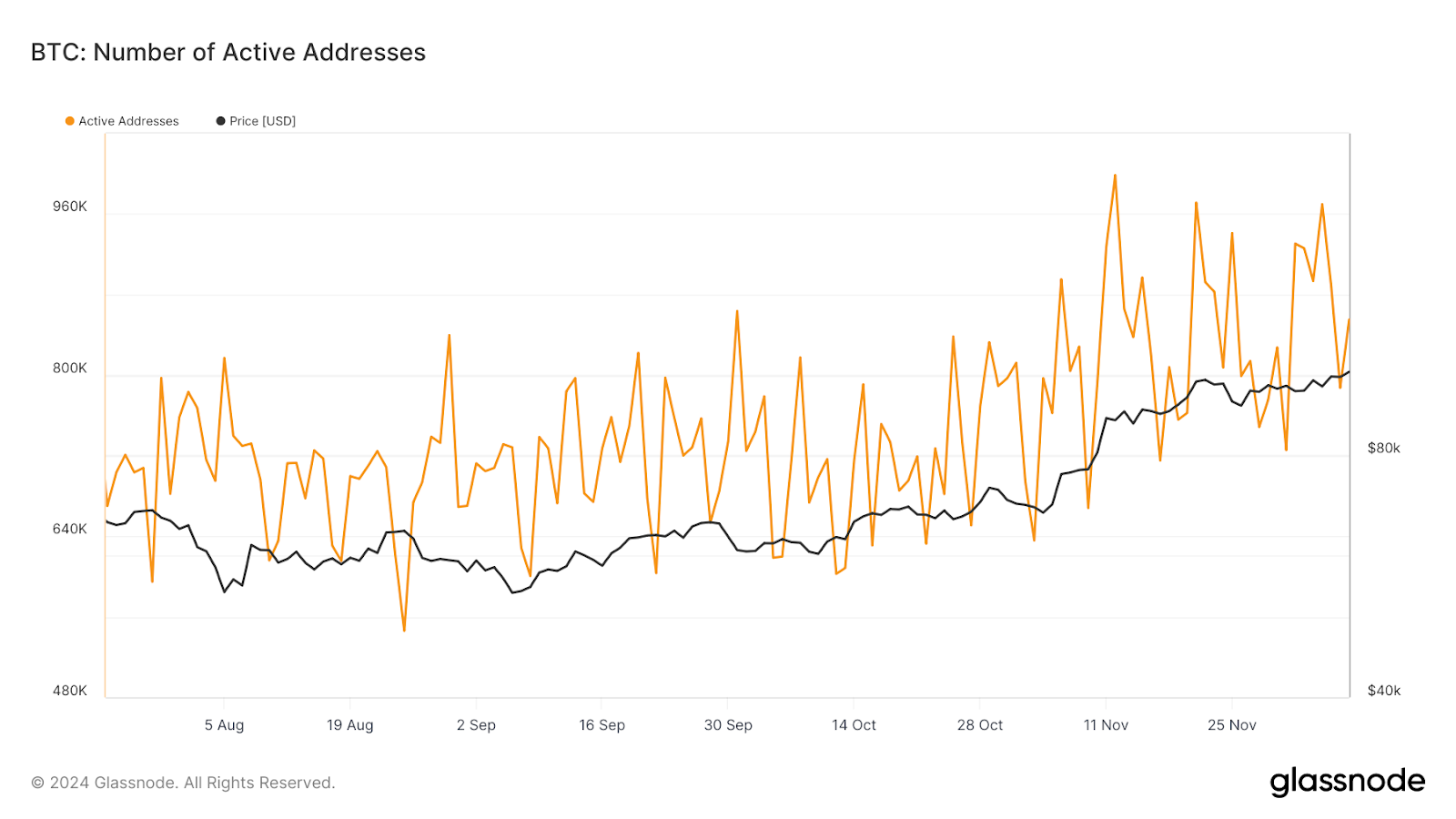

The number of active addresses is increasing and, as of Dec. 8, stands at 855,153, suggesting heightened interest and usage of the Bitcoin network.

Number of active BTC addresses | Source: Glassnode

As of Dec. 9, 2024, Bitcoin’s hash rate is approximately 850.70 EH/s, reflecting a significant recovery from recent fluctuations but remaining below its all-time high of 949.98 EH/s, recorded on Nov. 26, 2024. While the current hash rate hasn’t yet reclaimed the ATH, this sustained strength reflects miner confidence and network security—long-term bullish signals. Bitcoin’s price tends to follow the hash rate; the more confident miners are about price appreciation, the less likely they are to sell.

BTC hash rate | Source: CoinWarz

Weekly Golden Cross signals bull market with $150K-$250K potential

The weekly Golden Cross, where the 50-week moving average crosses above the 200-week MA, is a highly significant signal for long-term investors because it often marks the start of major bull markets and the conclusion of prolonged bearish phases.

The previous instance of this signal occurred when Bitcoin recovered from the 2018 bear market and eventually surged to an all-time high of $69,000 in 2021.

Mirroring its behavior in previous bull cycles, this signal reappeared in early 2024 and preceded Bitcoin’s parabolic rise to its recent all-time high of $103,647. Previous bull cycles following weekly Golden Crosses have led to gains of 300%–600%.

If this pattern holds, Bitcoin could potentially reach $150,000 to $250,000 before the next major cycle correction. Meanwhile, the next Golden Cross is unlikely until 2026 or 2027, assuming Bitcoin undergoes a complete cycle of price appreciation, correction, and consolidation.

BTC Golden & Death Cross pattern | Source: TradingView

RSI signals overbought conditions, hints at pullback or consolidation

On the weekly timeframe, the Relative Strength Index is at 74.47, consistent with overbought conditions. However, this does not imply a trend reversal right away but rather reflects the possibility of a short-term pullback or a period of sideways price action.

In the past, many bull cycles saw similar RSI readings, followed by temporary pullbacks that were then succeeded by renewed rallies to higher highs.

In the 2021 bull cycle, the RSI reached similar levels multiple times before peaking above 90, after which Bitcoin experienced a significant correction. Assuming Bitcoin stays in the most recent consolidation range around $100K and the RSI retraces back to a healthier range of 60–65, the next leg upward could occur.

A healthy correction of 10%–20% or a sideways period would allow the markets to reset before experiencing sustained growth. For reference, a 10% correction from the all-time high of $103,647 would bring Bitcoin’s price to approximately $93,282.

Relative Strength Index | Source: TradingView

Fibonacci levels and Bollinger Bands signal key support and potential cooling

Fibonacci retracement levels, used in technical analysis to identify potential support and resistance zones, help indicate where a price might retrace before continuing its trend. Based on the chart below:

Key Levels:

- $71,858 (0.618): Major retracement level, acting as a strong support zone (a 30.67% pullback from the all-time high of $103,647).

- $103,135 (0.786): Significant resistance zone, near the all-time high.

Bitcoin’s price is currently trading slightly below the upper Bollinger Band, signaling strong bullish momentum. However, this position also indicates potential overextension, as prices often retrace or consolidate when deviating significantly from the midline (20-week simple moving average, currently at $71,858).

A pullback to $71,858 or further consolidation near the current price of $99,249 would represent a normal cooling-off period within the Bollinger Band framework and prepare the market for potential further gains.

Fibonacci retracement levels & Bollinger Bands | Source: TradingView

Visualizing Bitcoin’s market behavior through key indicators

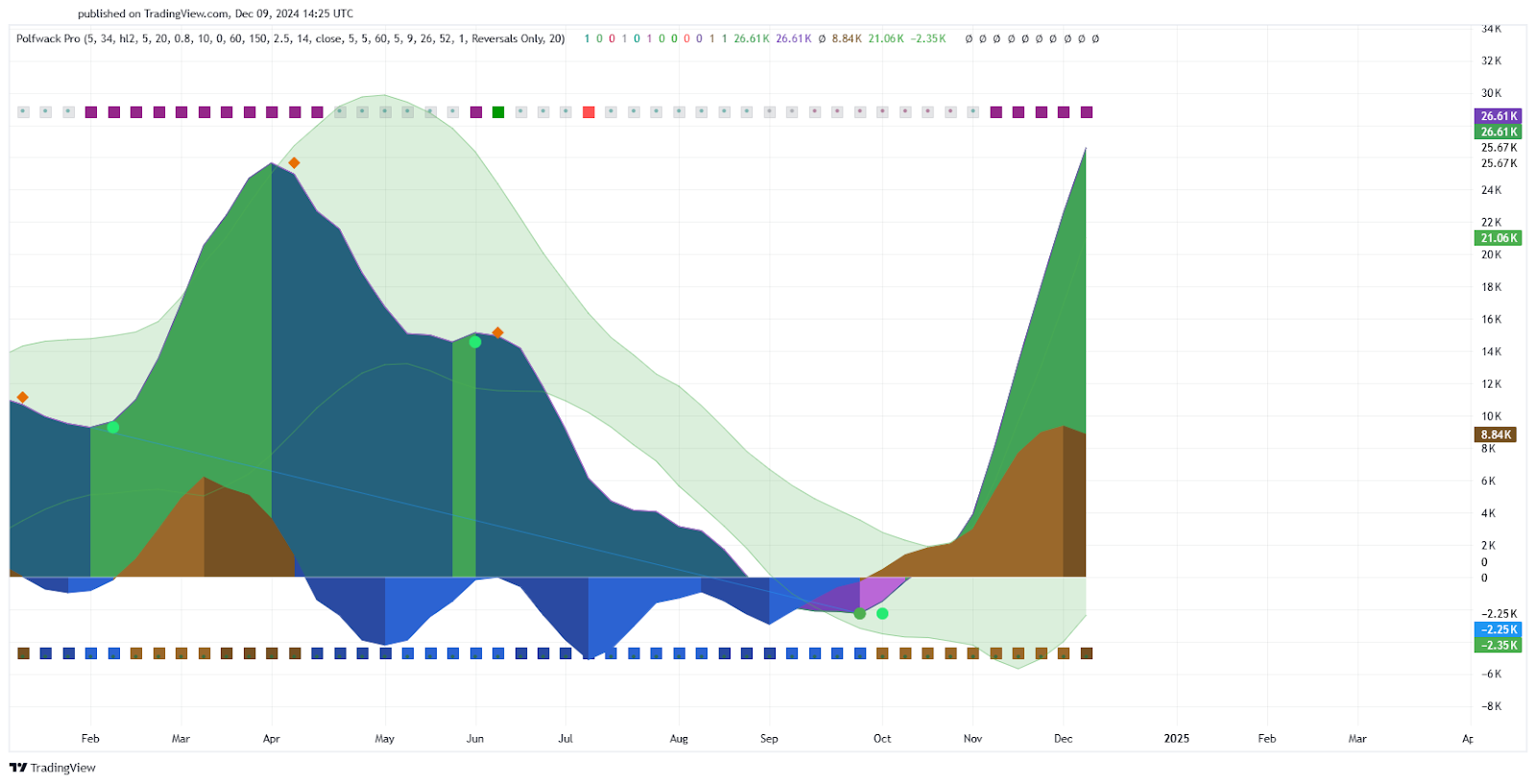

To further visually represent Bitcoin’s market behavior, let’s look at this colored chart below. It includes a color-coded bar at the top that reflects RSI conditions. The currently visible purple and green color blocks suggest periods of oversold or bullish divergence, reflecting bullish momentum and aligning with RSI overbought levels.

The second bar shows market structure trends (e.g., ranging, bullish, or bearish). From the chart, we see green blocks that suggest the market is in a bullish phase, confirming breakout behavior.

Next, the main oscillator displays the Awesome Oscillator with divergences and pivot points, where the green peaks above zero and brown regions below confirm positive momentum and bullish pivots.

The secondary oscillator below the AO displays similar momentum indications, with positive bars (green above zero) suggesting accelerating upward momentum and a strong bullish bias.

Bitcoin Rainbow Indicators | Source: TradingView

Potential crypto space developments in 2025

Post-halving supply shock, increasing retail and institutional participation, institutional accumulation (companies like MicroStrategy and other corporate treasuries adopting Bitcoin as a strategic reserve asset) could push demand for it to new highs.

The proportion of institutional investors will likely grow, stabilizing price movements but also making Bitcoin more correlated with traditional markets.

Bitcoin’s dominance (currently around 55%) could rise further as investors favor its “digital gold” narrative over altcoins, especially if regulatory scrutiny tightens around smaller tokens.

Bitcoin wallet growth will continue as adoption in emerging markets increases, with Bitcoin used as a hedge against local currency devaluation.

Major corporations could start settling cross-border transactions in Bitcoin, while in regions with high inflation or de-dollarization trends central banks may increase interest in Bitcoin as a reserve asset.

Countries like the U.S., the EU, and the UAE are likely to finalize crypto-friendly regulations, while other jurisdictions may clamp down on decentralized finance and self-custody to maintain control over financial systems.

Closing thoughts

With a loud explosion of excitement, Bitcoin shattered the $100K barrier, an achievement deemed nothing short of astonishing. Technical indicators, including the weekly Golden Cross and RSI, point toward the possibility of further growth, with projections suggesting a potential climb to $150K–$250K in this bull cycle.

However, a healthy period of consolidation or correction would likely provide a stronger foundation for future price action. By 2025, Bitcoin may achieve what was once considered nearly impossible—establishing itself as a major player in the global financial system.