[ad_1]

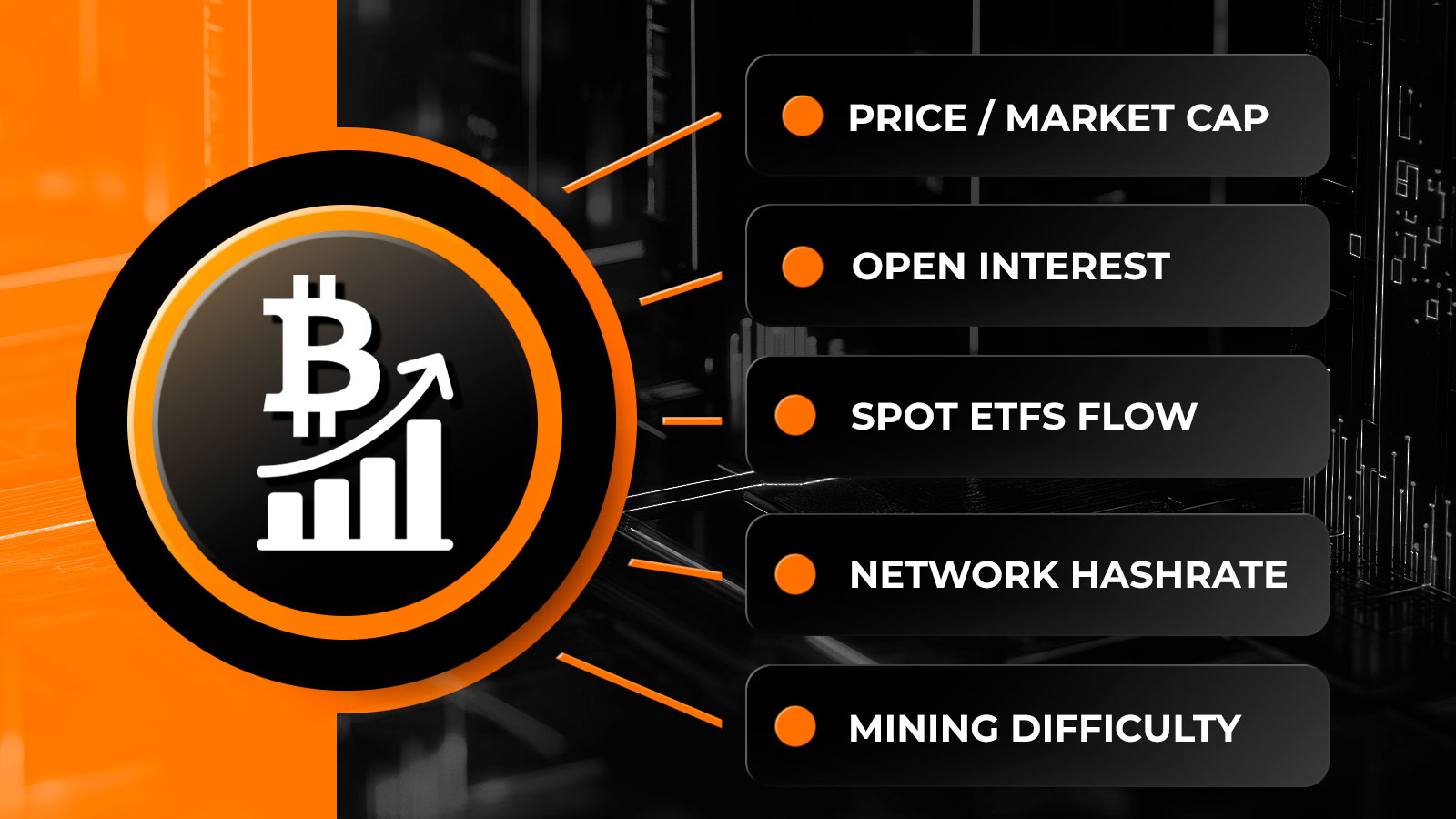

Bitcoin (BTC), the largest cryptocurrency, just hit its long-anticipated $100,000 milestone. Here are five metrics you need to know to navigate through the opportunities bull market unlocks for crypto traders and investors.

Five Bitcoin (BTC) metrics for 2025 bull run: Highlights

As Bitcoin (BTC) and the entire cryptocurrency market are gearing up toward new highs, let’s dive into five metrics that indicate the current status of the crypto market:

- Bitcoin (BTC) price and market capitalization. Since BTC remains the largest crypto by market cap, its performance is a critical catalyst for every large-cap cryptocurrency, market sentiment and global macro processes.

- Bitcoin Open Interest (OI) on contract exchanges. The USD-denominated volume of open positions in various types of contracts on crypto prices demonstrates market optimism and potential volatility dynamics.

- Bitcoin ETFs flow, i.e., a net USD-denominated change of aggregated balances of major exchange-traded funds (ETFs) on spot Bitcoin in the U.S.

- Bitcoin (BTC) hashrate, a total number of hashes calculated by all mining computers competing for the right to add the next block to the Bitcoin (BTC) blockchain.

- Bitcoin (BTC) difficulty, a metric of how difficult it is to mine the next Bitcoin (BTC) block to maintain consistent block production.

This is the basic set of Bitcoin (BTC) network and cryptocurrency metrics you should understand to benefit from the ongoing bullish rally.

What is Bitcoin (BTC)?

Bitcoin (BTC) is the first-ever blockchain and its eponymous cryptocurrency. Bitcoin (BTC) itself is a pioneering realization of the concept of blockchain, i.e., a decentralized database. Bitcoin (BTC) was designed by Satoshi Nakamoto, an anonymous developer, in 2008.

In 2009, Bitcoin (BTC) transactions went live. From the onset of its operations, Bitcoin (BTC) leverages the proof-of-work (PoW) consensus. It means that new coins are created thanks to mining, i.e., distributed computations on millions of computers.

While the concept of cryptocurrency became mainstream since the inception of Bitcoin (BTC), it still remains the largest and most popular crypto.

Bitcoin (BTC) hits $100,000 level: What to know

The Bitcoin (BTC) price surged step by step together with the popularity of the cryptocurrency and its role as a new type of asset — not unlike Gold, the U.S. dollar or Crude Oil futures.

At the same time, the Bitcoin (BTC) price demonstrates a unique pattern as its performance goes through four-year cycles. Roughly, these cycles correlate with halving events. Halving is a specific event in the Bitcoin (BTC) network when the issuance of new coins drops by 50% every four years. This feature was hard-coded into Bitcoin (BTC) tech design to prevent the asset from inflation.

For the first time, Bitcoin (BTC) reached $1 in 2011, and made headlines by becoming more expensive than the U.S. dollar.

After every upsurge, Bitcoin (BTC) entered a decline phase called the “bear” or “bearish” market.

In Q4, 2024, following the devastating bearish market of 2021-2022 that culminated in collapses of Terra/Luna and FTX/Alameda ecosystems, Bitcoin (BTC) finally reached $100,000. The previous high, registered in November 2021 at about $70,000, was smashed on Nov. 6, 2024, following the euphoria triggered by the U.S. Presidential elections.

What to expect from Bitcoin (BTC) in 2024-2025?

Just like other cryptocurrencies, Bitcoin (BTC) remains highly volatile. As such, given the fact that digital assets are still in their very nascent state, no one can be sure about the potential prospects of the Bitcoin (BTC) price.

Positive scenario

Lifting of legal restrictions and surging institutional adoption should be called two main catalysts for Bitcoin (BTC) holders optimism.

- Bitcoin (BTC) benefits from increasing institutional adoption in various forms. Starting from 2024, spot Bitcoin ETFs are available in the U.S. and Hong Kong. Also, a number of public companies inspired by Michael Saylor’s Microstrategy are adding Bitcoin (BTC) to their corporate balances. Some nation states are also considering making BTC part of their currency reserves.

- The results of the 2024 U.S. Presidential Elections are treated as a bullish catalyst for BTC by those who expect the regulatory hostility toward cryptocurrency to end. First of all, the community expects SEC Chairman Gary Gensler to step down in early Q1, 2025.

Other positive factors for the largest cryptocurrency include its understandable narrative, accessibility, high liquidity and more mature performance.

The most aggressive bulls are publishing $1,000,000 per BTC forecasts in 2024.

Negative scenario

At the same time, Bitcoin (BTC) has a lot of challenges ahead in the coming years. Its technology is lagging behind while too many competitors are surging here and there.

- Bitcoin (BTC) remains too conservative in terms of tech: Due to the lack of developers and funding, its upgrades are released with big delays. Also, some speakers accuse Blockstream, a key development studio in the BTC segment, for suppressing the tech progress of the first cryptocurrency.

- Bitcoin (BTC) is competing with thousands of altcoins. Some of them are aggressively promoted and can be used for many purposes while Bitcoin (BTC) can only be used as a payment system, which can be relatively slow and cost-ineffective.

Combined with growing geopolitical tensions across the world, the potential QE activity in the U.S. and China, these factors make some pessimists talk about the “worst crisis since 1929 coming.” The hypothetical recession will hit Bitcoin (BTC) harder than traditional assets.

Top Bitcoin (BTC) metrics to track in 2025

Now let’s review key Bitcoin (BTC) metrics every trader should know in 2025.

They might be helpful in development and adjustment of portfolio management strategy and capital protection.

Bitcoin (BTC) price

The Bitcoin (BTC) price is a USD-denominated value of one Bitcoin. While the definition itself is quite simple, some clarifications are needed to properly understand what the BTC price is at this or that moment.

First, by “the price of Bitcoin,” we mean the rate of BTC on major spot exchanges. Since these Tier 1 exchanges like Binance, Bybit, OKX have the largest liquidity, the Bitcoin (BTC) price in pair with USDT is more protected from manipulations than on illiquid exchanges. Simply put, a large buy/sell deal on a small exchange might ruin or boost the BTC/USDT rate while on Binance it is next to impossible.

Not unlike with other assets, the Bitcoin (BTC) price surges together with demand for it. However, it can be quite volatile: 10% overnight moves should not be surprising to Bitcoiners.

BTC/USDT contract prices on futures exchanges might be even more volatile.

Also, traders should be aware of “Kimchi premium” and “Coinbase premium.” The first metric indicates the difference between the price of Bitcoin on Korean exchanges and the BTC/USDT rate on Binance (BNB).

“Coinbase premium” should be referred to as the difference between the BTC/USD rate on Coinbase, the largest U.S. exchange, and the BTC/USDT rate on Binance. The premiums demonstrate the retail interest performance in South Korea and USA, two major crypto markets.

Bitcoin (BTC) market capitalization is the aggregated price of all Bitcoins (BTC) in circulation. Currently, over 19.97 million Bitcoins (BTC) are mined with a total value exceeding $1.1 trillion.

Bitcoin (BTC) open interest

Bitcoin (BTC) open interest or Bitcoin OI refers to the aggregated volume of BTC derivative contracts, such as futures or options, that have not yet been settled. It indicates the level of trading activity and investor interest in the BTC-USDT derivatives market. Thus, OI surges when new contracts are created and falls when contracts are either settled (closed) or liquidated.

For example, if traders open more positions in Bitcoin futures, the open interest increases, signaling growing market participation and potential price volatility. Conversely, declining open interest may suggest reduced activity or traders closing positions.

Monitoring BTC open interest helps traders and analysts assess market sentiment and liquidity. A surge in open interest, paired with significant price movement, might signal strong conviction in a price trend. However, high open interest without corresponding price action could indicate indecision or a potential reversal. It’s a key metric for understanding market dynamics and planning trading strategies.

Bitcoin OI can be tracked on special services like Coinglass. Traders should pay extra attention to risk management when OI is too high.

Bitcoin (BTC) ETFs flow

Bitcoin (BTC) ETFs flow refers to the movement of value into or out of exchange-traded funds (ETFs) based on spot Bitcoin. As of Q4, 2024, such publicly tracked funds are working in the U.S. and Hong Kong. The status of these flows indicates investor sentiment toward Bitcoin (BTC), influencing the broader cryptocurrency market.

When inflows are registered, investors are purchasing shares of Bitcoin ETFs, pushing the funds to acquire more Bitcoin (BTC) to grow the balance of their baskets. This is a reliable indicator of strong short-term bullish sentiment and often boosts Bitcoin’s price due to increased demand.

Conversely, outflows signal investors are selling their ETF shares, causing the fund to reduce its holdings. This in turn spells bearish sentiment and potentially generates extra pressure on the Bitcoin (BTC) price.

BTC ETF flows are closely watched as they represent institutional and retail interest in Bitcoin through a regulated and traditional investment vehicle. Significant inflows or outflows can provide insights into market trends, risk appetite and broader adoption of Bitcoin in mainstream finance.

Besides tracking cumulative ETFs flow, traders also watch the statistics of largest ETF issuers, including iShares, Grayscale, Fidelity and Bitwise. Statistics of Bitcoin ETFs can be found on Coinglass, TradingView and Dune Analytics websites.

Bitcoin (BTC) hashrate

Bitcoin (BTC) hashrate indicates the total computational power used by computers in Bitcoin (BTC) network (miners) to keep it secure and support the process of transaction validation.

The metric is calculated in hashes per second (H/s), indicating the number of attempts to solve the cryptographic puzzle required to add a fresh block to the chain. A higher hashrate signifies a more secure network, as it becomes increasingly difficult for malicious actors to gain control over the majority of the mining power. In turn, this reflects the confidence of miners investing extra resources into new computers and electricity.

At the same time, a declining hashrate may signal reduced mining profitability or geopolitical impacts, like energy restrictions or regulatory crackdown. When hashrate declines, it means that miners are switching off their equipment expecting lower profit, and, therefore, a BTC price drop. Once the Bitcoin (BTC) price dips below a certain level, less and less ASICs (mining computers) are able to mine Bitcoin (BTC) with profits.

Bitcoin (BTC) hashrate can be tracked on many platforms, including CoinWarz, Bitiforcharts. As of December 2024, Bitcoin (BTC) hashrate is over 800 Ehashes per second.

Bitcoin (BTC) difficulty

Bitcoin (BTC) difficulty is an auto-adjustable measure of how hard it is for miners to solve the cryptographic puzzles and, therefore, become the signer of the next BTC block. This metric adjusts every 2,016 blocks, or approximately every two weeks, based on the total computational power (hashrate) of the network. The goal of this adjustment is to maintain a consistent block production time of roughly 10 minutes, regardless of fluctuations in mining activity.

Simply put, once hashrate surges, Bitcoin (BTC) network difficulty is due to positive adjustment. Once miners reduce the hashrate, Bitcoin (BTC) difficulty is reduced in the next bi-weekly adjustment.

This unique self-regulating mechanism keeps the Bitcoin network secure and ensures a predictable issuance rate for new BTC. Also, it keeps the Bitcoin (BTC) block time relatively stable: It takes about 10 minutes for the network participants to mine one new block regardless of BTC price volatility.

Wrapping up: What to know about Bitcoin (BTC) in 2025

Bitcoin (BTC) is the largest cryptocurrency by price and market capitalization. In late Q4, 2024, it conquered $100,000 for the first time ever.

Bitcoin (BTC) price and market capitalization, Bitcoin Open Interest on futures and options, spot Bitcoin (BTC) ETFs flow, Bitcoin (BTC) network hashrate and difficulty are key metrics for Bitcoin (BTC) network status in 2025.

[ad_2]