[ad_1]

Ethereum wiped out nearly half its value in 2025, with price dropping over 46% year-to-date as ETFs failed to attract capital inflows and the largest altcoin lost revenue. After months of debate on the future of the Ethereum Foundation and Vitalik Buterin’s new proposal for higher scalability, Ethereum eyes a comeback, likely the biggest one of the year.

Table of Contents

Ethereum could rise from the dead with three catalysts

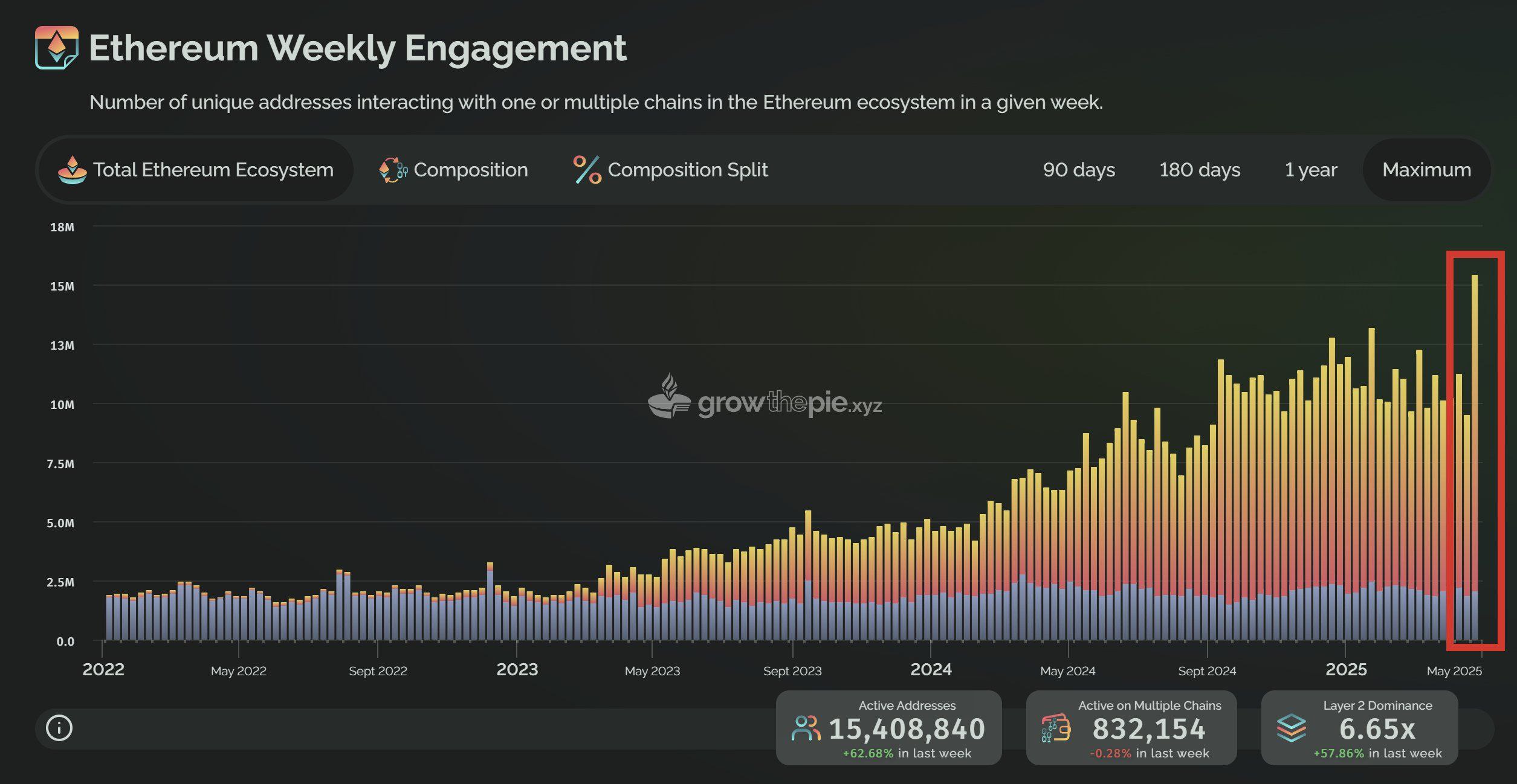

Ethereum (ETH) lost relevance, revenue and demand from new users over the past four months of 2025. Data from Growthepie shows that a key metric that measures a chain’s demand and relevance among market participants, the number of unique addresses interacting with one or more chains within the ETH ecosystem within a given week, hit a new all-time high.

A week-on-week increase of 62% was recorded in the number of active addresses, with a 57% increase in Layer 2 dominance.

Ethereum weekly engagement | Source: Growthepie.xyz

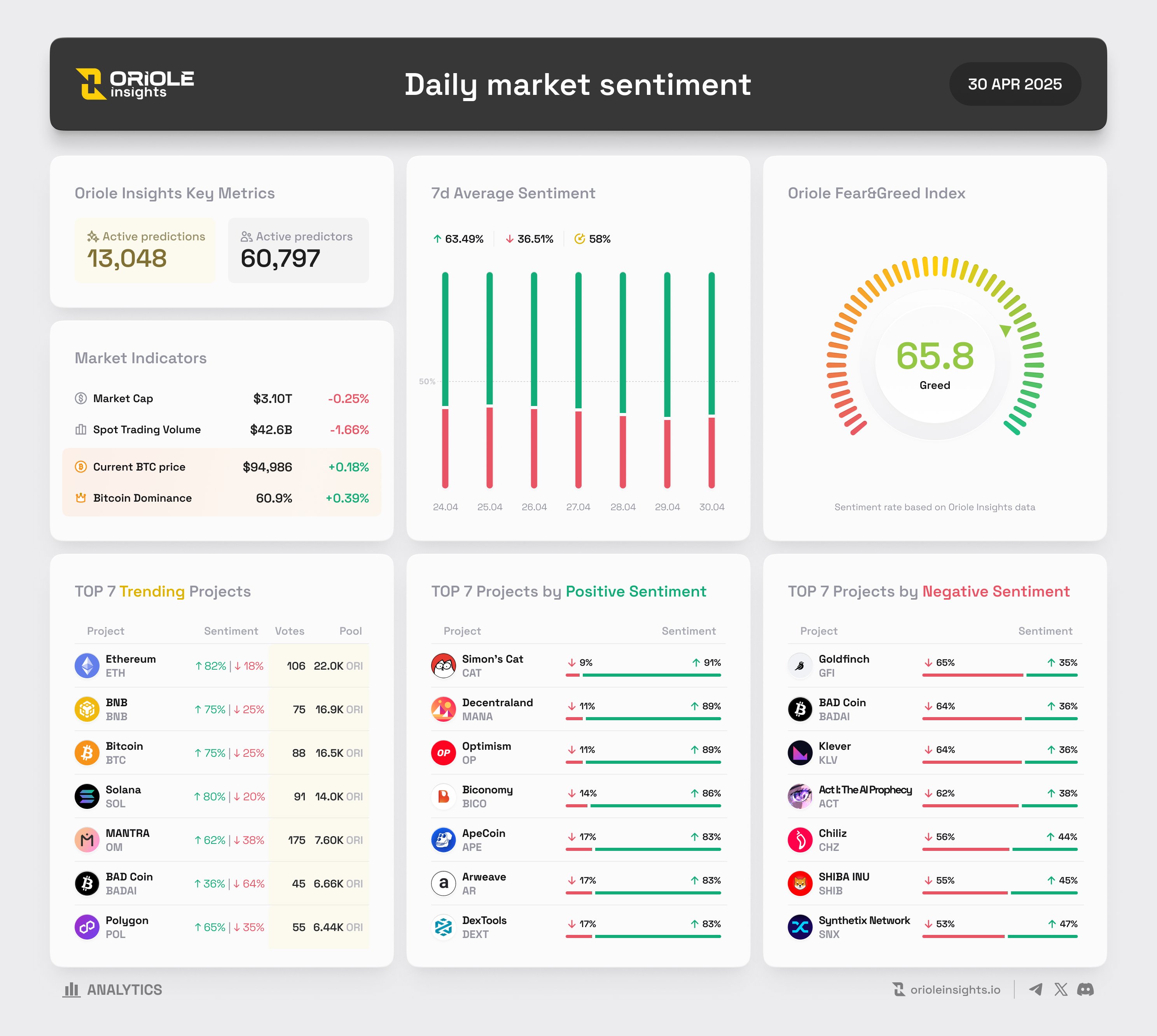

On Wednesday, April 30, Etheruem leads the market sentiment among traders with 82%, followed closely by Solana (SOL) and Bitcoin (BTC). Data gathered by Oriole Insights shows that as market participants turn greedy, scoring 56 on a scale from 0 to 100, Ethereum gains relevance and bullish sentiment from traders.

Daily market sentiment trending projects | Source: Oriole Insights

After underperforming most altcoins and Bitcoin since the beginning of 2025, Ethereum is gearing for a comeback in light of recent announcements and updates.

From Vitalik Buterin’s plan to scale the Ethereum network to the Ethereum Foundation’s management changes, the altcoin could attempt to resurrect from the dead and compete with Solana, a giant that captured a large volume of new users, revenue and activity on decentralized exchanges and applications in 2024 and 2025.

The pivot proposed by the Ethereum Foundation is toward the key product, the token. Scaling Layer 1 chains, blobs, and improving the user experience could drive higher adoption, boost revenue generation, and bring back lost interest from traders in the ecosystem.

You might also like: New report suggests over half of the U.S. millennials own crypto. What else did we learn?

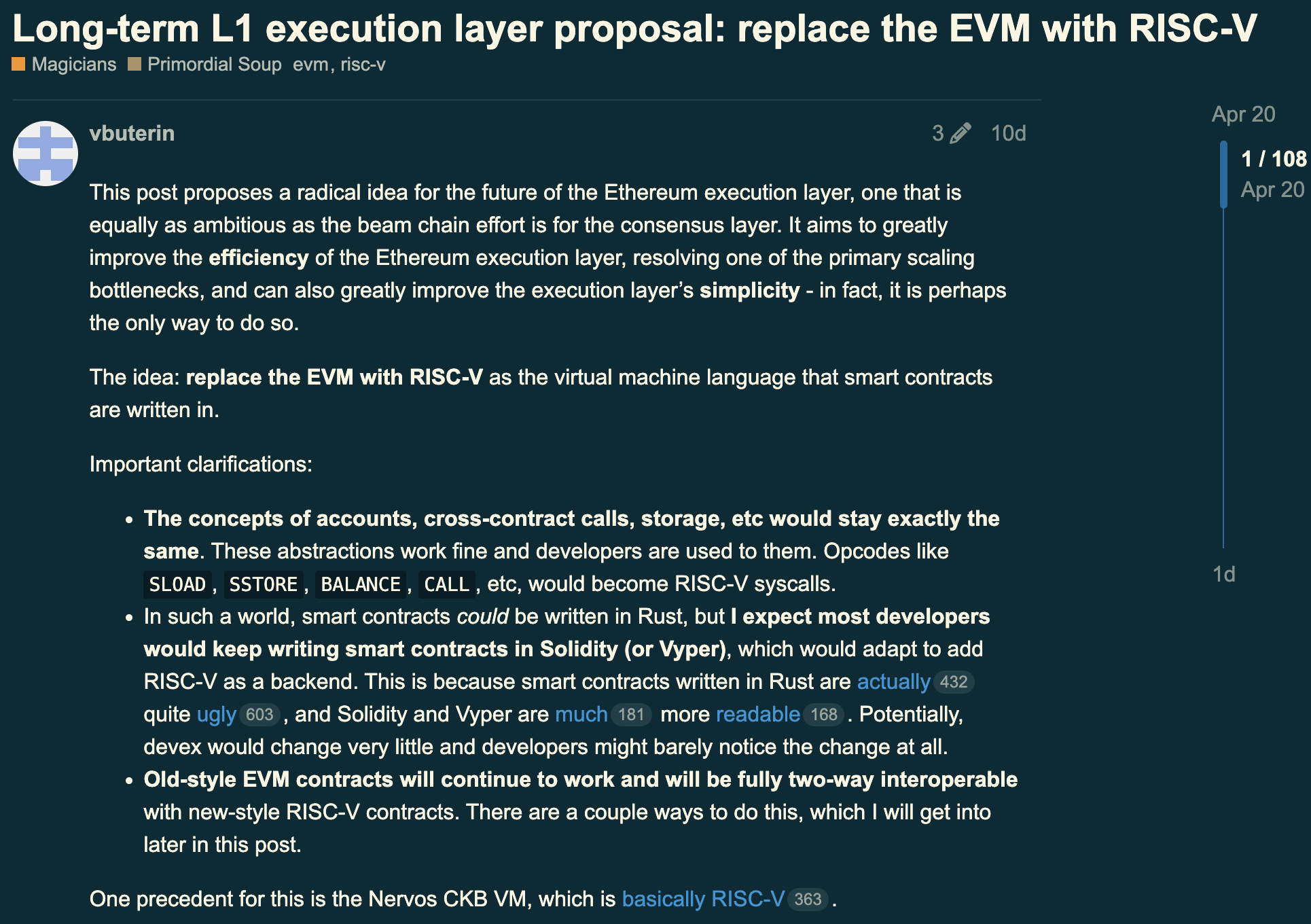

Vitalik Buterin’s plan for Ethereum scalability

In mid-April, Ethereum creator Vitalik Buterin proposed to boost the scalability of the Ethereum execution layer. Buterin suggested an idea to resolve the key problem facing the ETH network, a primary scaling bottleneck, and said it could greatly improve the execution layer’s simplicity for users.

Key concepts for developers building on the Ethereum chain remain unchanged. Buterin says the change would be “barely noticeable.” The ETH holder community is debating the impact of the proposal and whether the change is enough to make Ethereum relevant again.

Ethereum scalability proposal | Source: Ethereum Magicians blog

You might also like: Analysts project high approval odds for pending crypto ETFs as SEC delays mount

Ethereum v. Solana

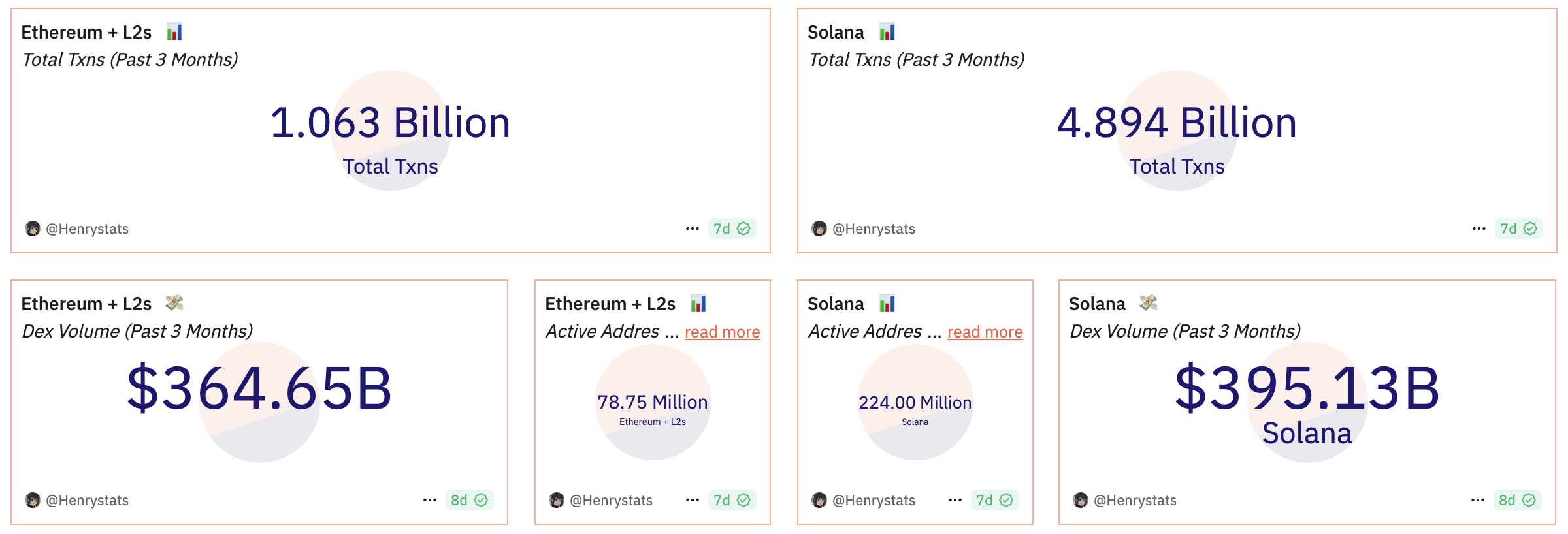

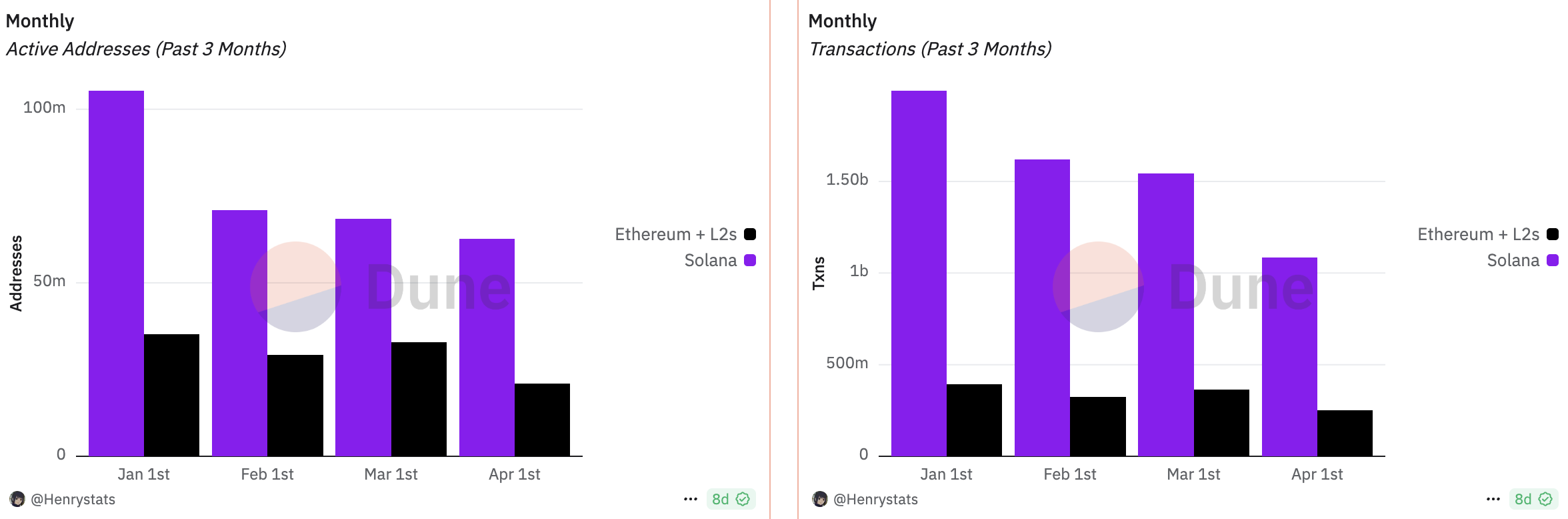

The Ethereum vs. Solana debate rages on, with SOL leading in several key Layer 2 and DEX metrics. A Dune analytics dashboard that compares Ethereum and its Layer 2 chains with Solana over the past three months shows that SOL noted nearly four times as many transactions as Ethereum and its L2 chains during the same period.

SOL leads by nearly $30 billion in DEX volume, and the active address count on Solana is nearly three times that of ETH and its Layer 2 chains.

Ethereum and L2s v. Solana metrics | Source: Dune Analytics

The month-on-month comparison of Ethereum Layer 2s and Solana transactions and active addresses shows the complete picture. A massive surge in both metrics is required for Ethereum to beat Solana in the decentralized sector.

Monthly active addresses and transactions in Ethereum L2s v. Solana | Source: Dune Analytics

Five burning questions and Ethereum’s future

What does BlackRock’s $150 billion deal mean for the future of Ethereum?

BlackRock, the largest asset manager in the world, is set to introduce a digital share class for its 150 billion dollar Treasury Trust Fund. The Ethereum developer and holder community believes this could benefit ETH and the altcoin’s price in the long term.

The infusion of capital into the RWA sector would utilize DLT through BNY Mellon, a firm that uses the Ethereum blockchain. CEO Larry Fink has highlighted the potential of tokenization and its importance to the U.S. economy’s global dominance.

Ethereum could gain from the capital inflow.

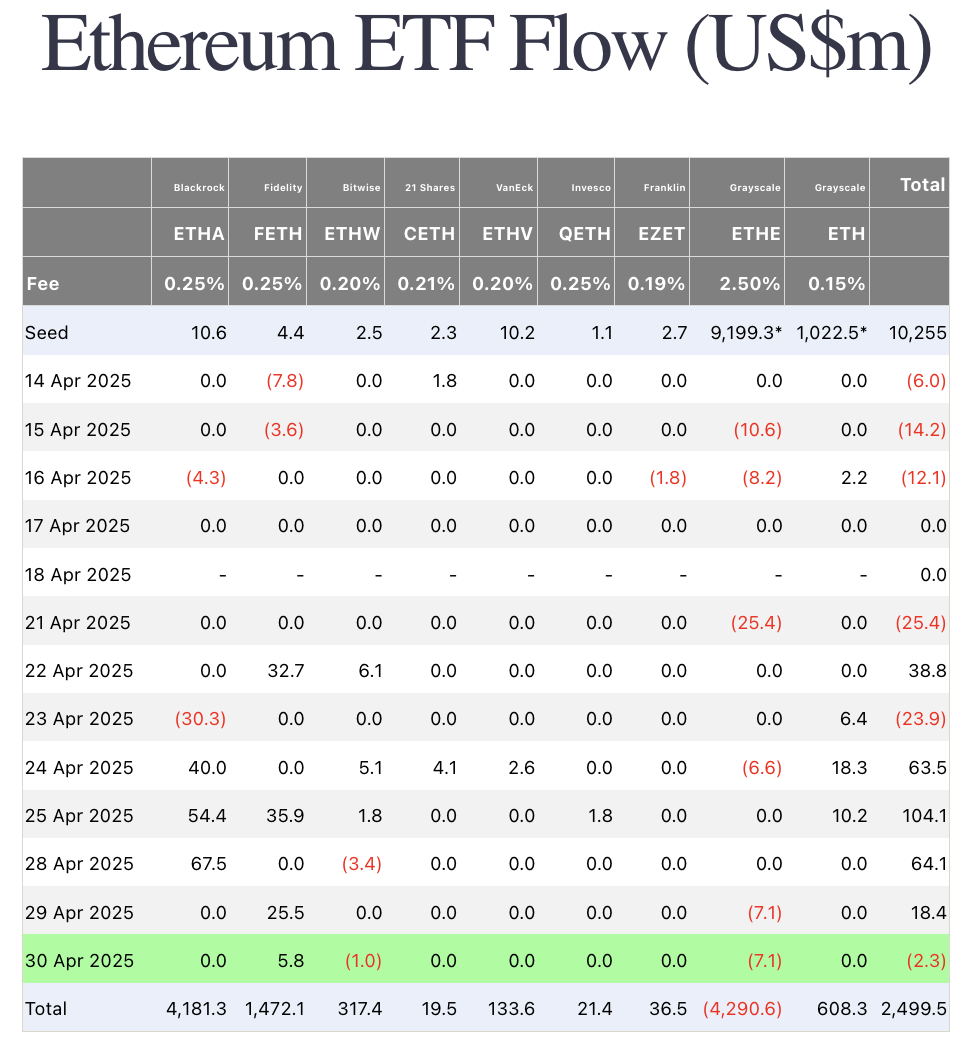

Will Ethereum ETFs catch up with Bitcoin?

Data from Farside Investors shows five consecutive days of capital inflows to U.S.-based Spot Ethereum ETFs, except on April 30, when net flow was negative $2.3 million. A total of nearly $2.5 billion in institutional capital was poured into Ethereum in the last fifteen days.

Ethereum ETF flows | Source: Farside Investors

While this number is relatively low compared to Bitcoin, the altcoin is catching up in terms of institutional demand, steadily in the second quarter of 2025.

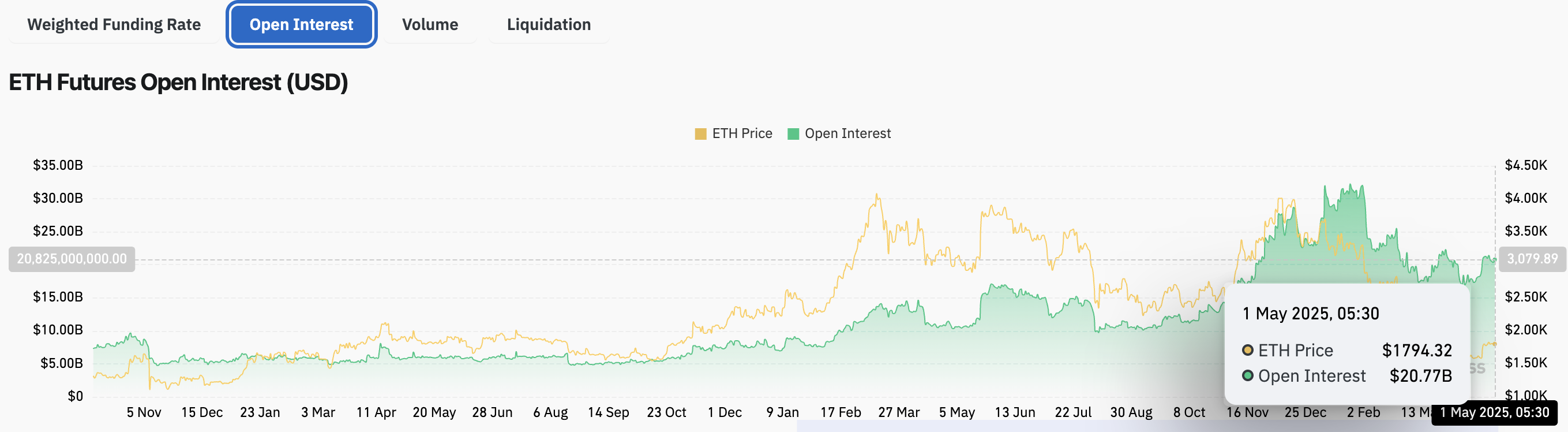

What does derivatives data show for the future of Ethereum?

Derivatives data from Coinglass shows that derivatives volume, options open interest, and options trade volume have all climbed in the last 24 hours. While derivatives traders are not entirely bullish on Ether and the long/short ratio is less than one, it stands at 0.9771 as of May 1.

Open interest in Ethereum has climbed nearly $3 billion between April 9 and April 30, indicating a steady increase in the value of all open derivatives contracts across exchanges.

A rise in OI is typically considered bullish for an asset.

Ethereum futures open interest | Source: Coinglass

Will Ethereum price climb in the short-term?

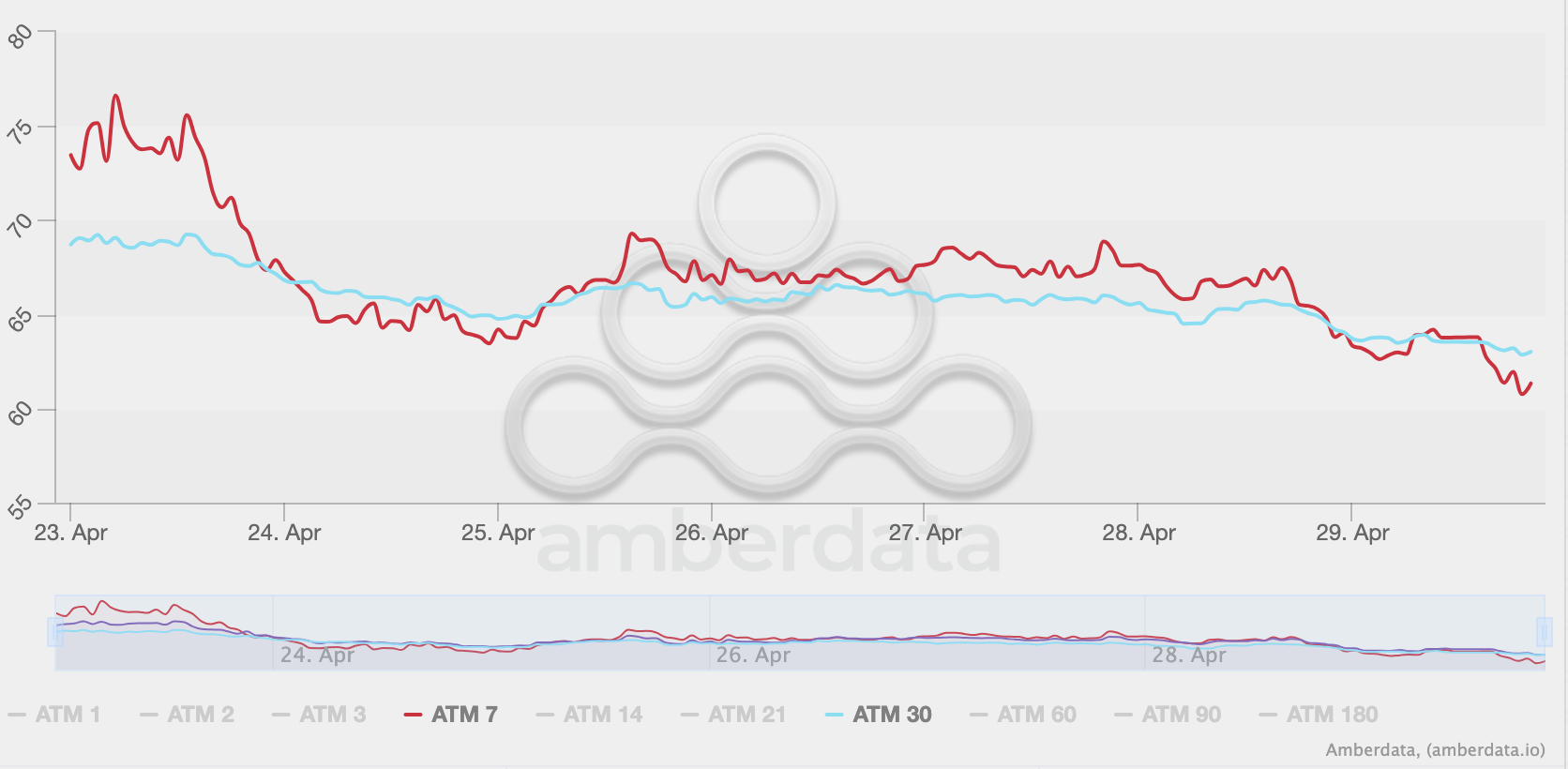

Data from Derive.xyz shows that while retail traders expect ETH price to decline, sentiment on Derive is bullish, with calls outnumbering puts by as much as four to one. The prediction platform places the odds of a rally above $2,300 by May 30 at 9 percent and the chance of a drop under $1,600 at 21 percent, as of April 30.

A staggering 81.8 percent of all Ethereum options premiums are being used to buy calls.

Ethereum 7-day and 30-day implied volatility | Source: Amberdata

Has Ethereum price hit a cycle bottom?

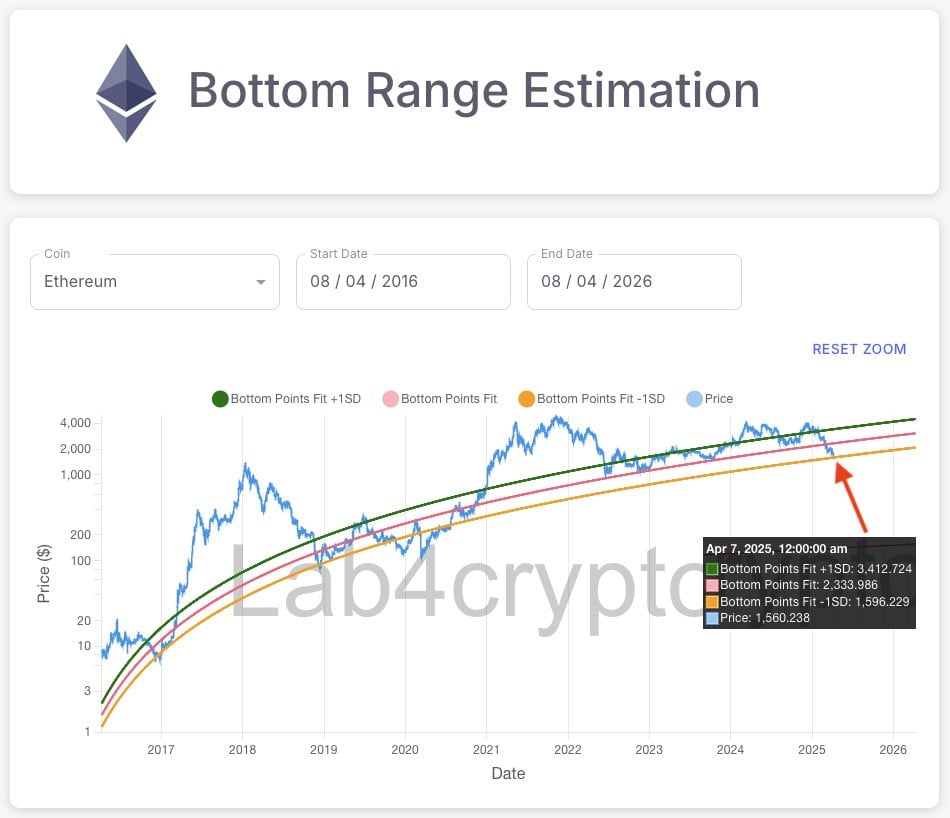

Ethereum has finally touched the -1SD line, according to Lab4Crypto, marking an opportunity for sidelined buyers to dollar-cost average into ETH. The chart shows a final touch on the -1SD line, a level that is historically considered a bottom for the altcoin.

Ethereum hit this level on April 8, after nearly three years, as seen in the bottom range estimation chart below.

Bottom range estimation for Ethereum | Source: Lab4crypto

Ethereum price prediction

Ethereum price could gain nearly 11 percent and test the upper boundary of the Fair Value Gap at $2,000, a key psychological level for the altcoin. Two key momentum indicators, RSI and MACD, support a bullish thesis for Ether.

RSI reads 55 and is sloping upwards. MACD flashes green histogram bars above the neutral line. Both point to further gains in the altcoin.

Ethereum could test resistance at $2,533, the lower boundary of the Fair Value Gap on the daily timeframe, and target the $3,000 level in the medium to long term.

ETH/USDT daily price chart | Source: Crypto.news

In the event of a flash crash in Bitcoin or a market correction, Ethereum could test support at $1,658, the lower boundary of the Fair Value Gap on the daily timeframe.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

[ad_2]