Credit rating company Fitch Ratings has flagged a high degree of risk associated with Bitcoin-backed securities, a warning that could complicate the expansion of crypto-linked credit products among institutional investors.

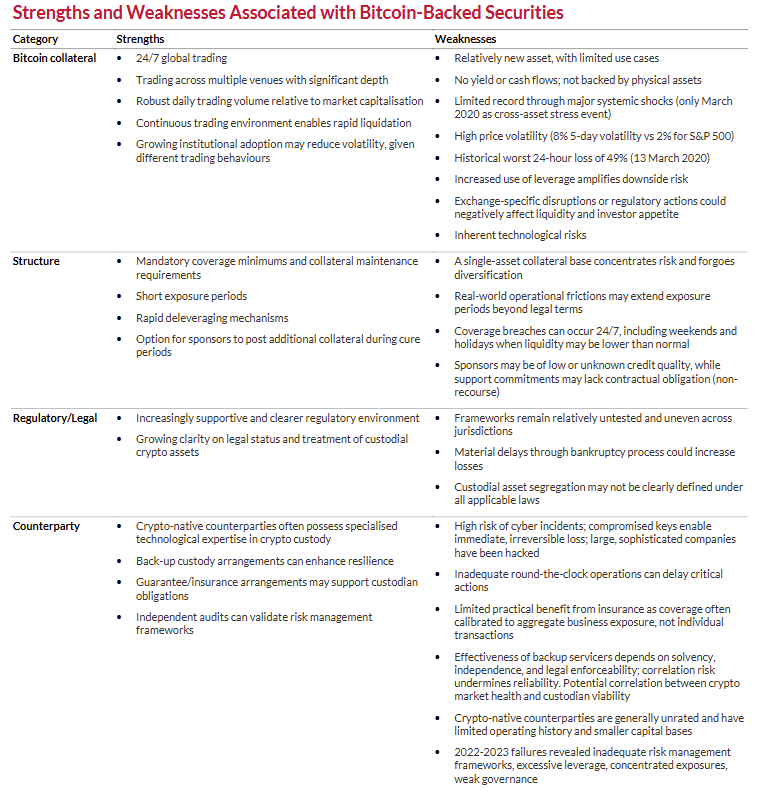

In a Monday assessment, Fitch said Bitcoin-backed securities, financial instruments typically structured by pooling Bitcoin ($BTC) or Bitcoin-linked assets and issuing debt against that collateral, carry “heightened risks” that “are consistent with speculative-grade credit profiles.”

The agency said such characteristics could place the products in speculative-grade territory, a designation associated with weaker credit quality and a higher likelihood of losses.

As one of the three major US credit rating companies, Fitch’s evaluations play an influential role in how banks, asset managers and other institutions assess emerging financial instruments, particularly those tied to volatile asset classes.

Fitch pointed to the “inherent” price volatility of Bitcoin as well as counterparty risks embedded in these structures.

The agency also referenced the wave of crypto lender failures during the 2022–2023 downturn, likely a reference to BlockFi and Celsius, as cautionary examples of how quickly collateral-backed models can unravel during periods of market stress.

Source: DustyBC Crypto

“Bitcoin’s price volatility is a main risk consideration,” Fitch said, warning that breaches of coverage levels could rapidly erode collateral value and crystallize losses.

Coverage levels refer to the ratio of Bitcoin collateral to the amount of debt issued against it. Sharp price declines can cause that ratio to fall below required thresholds, triggering margin calls and forced liquidations.

The latest assessment follows an earlier warning from Fitch last month, when the agency cautioned US banks about elevated risks tied to significant digital asset exposure. At the time, Fitch cited potential reputational, liquidity and compliance risks for banks that are actively engaged in crypto-related activities.

Bitcoin’s growing role in corporate credit, and where Fitch draws the line

Bitcoin has increasingly become central to the credit profiles of public companies with large digital asset holdings, particularly those issuing convertible notes or secured debt.

A prominent example is Strategy, led by Michael Saylor, which has amassed nearly 688,000 Bitcoin.

The company has financed this strategy through repeated capital raises, including convertible notes, secured debt and equity issuances, to expand its Bitcoin exposure. As a result, Strategy’s balance sheet and credit profile are now correlated with movements in Bitcoin’s market price.

Fitch’s warning, however, appears to focus more narrowly on credit and securitized instruments where repayment is directly dependent on the value of underlying collateral. The assessment does not reference spot Bitcoin exchange-traded funds, which are structured as equity-like investment vehicles rather than credit products.

In fact, Fitch noted that ETF adoption could contribute to “a more diverse holder base,” a development that may “potentially dampen” Bitcoin’s price volatility during periods of market stress.

The strengths and weaknesses of $BTC-backed securities. Source: Fitch Ratings