[ad_1]

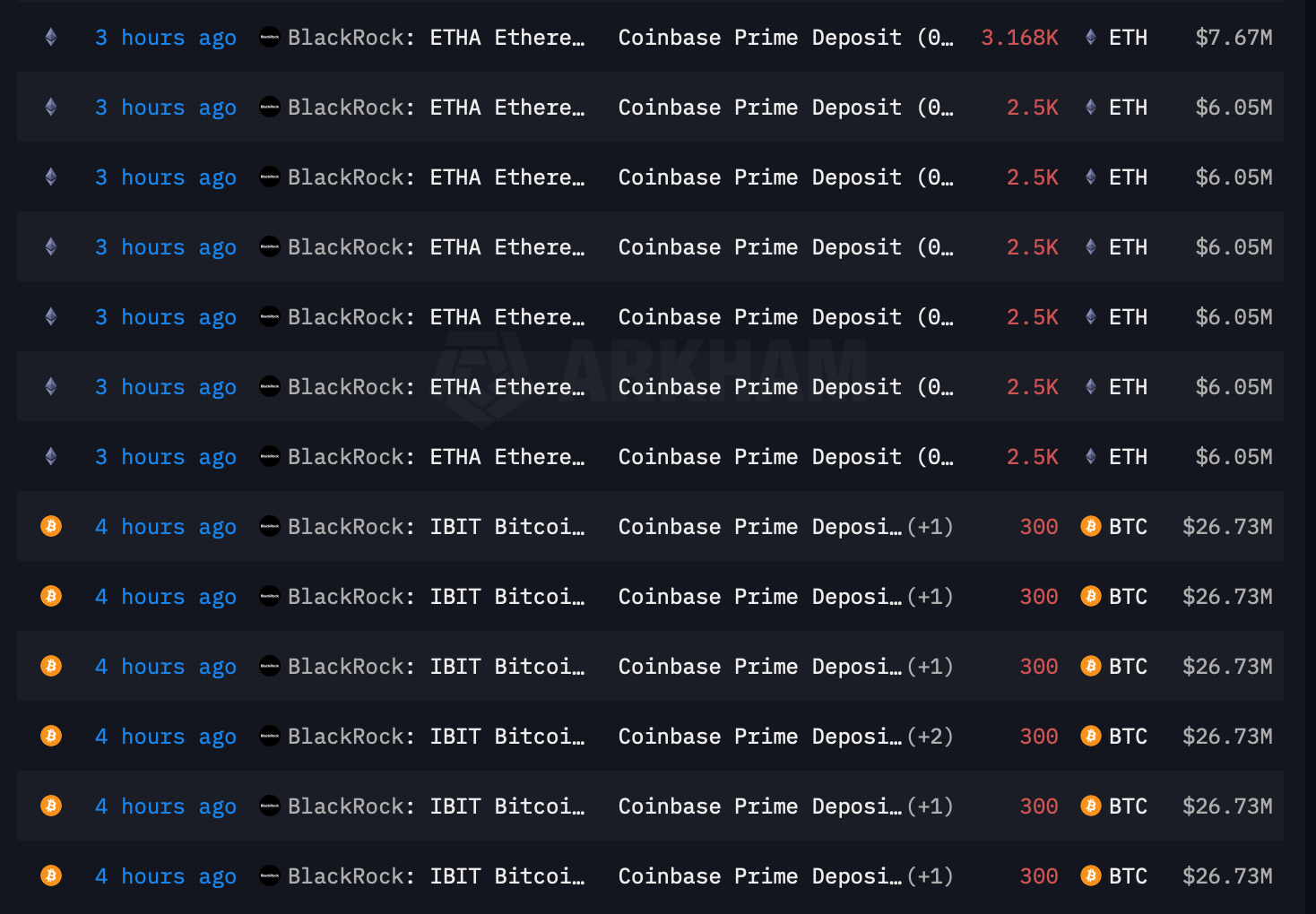

Blackrock has transferred about 18,168 ether and 1,800 bitcoin, worth around $44 million and $160 million, to the centralized crypto platform Coinbase.

Blackrock’s Digital Asset Strategy and Rebalancing in the Spotlight

Onchain observers noted that the transfers occurred within a short window, indicating that the financial giant Blackrock is actively moving its digital asset holdings. In total, the estimated combined value stands around $204 million, signaling a strong presence in the cryptocurrency sector.

Of course, Blackrock has not issued a formal statement on its intentions, leaving analysts to speculate on whether it aims to redistribute, sell, rebalance, or simply custody these assets. The assets are likely tied to its two spot crypto exchange-traded funds (ETFs) Market observers also note that market conditions and institutional participation may shape the firm’s next moves.

Blackrock’s IBIT and ETHA funds moving coins to Coinbase Prime, according to data collected from Arkham Intelligence.

Traders and crypto enthusiasts have flooded social media with theories on the transaction’s significance. Some view it as routine portfolio balancing, while others believe it could foreshadow a larger market shift as traditional finance deepens its involvement in digital assets.

The ETH and BTC shifts have been a topical discussion on X alongside the broader crypto market rout that ensued following Trump’s tariff threats. Although it has issued no formal announcements, and is likely disinclined to do so, Blackrock is presumably recalibrating the holdings of its two managed spot crypto ETFs.

[ad_2]