Crypto outflows totaled $415 million last week, marking a sharp reversal from a streak of net positive flows since the beginning of the year.

This downturn is largely attributed to Federal Reserve Chair Jerome Powell’s recent hawkish remarks and higher-than-expected US inflation data.

Bitcoin Succumbs As Crypto Outflows Hit $415 Million

The latest CoinShares report indicates that crypto outflows amounted to $430 million last week. Bitcoin (BTC), known for its sensitivity to interest rate expectations, bore the brunt of the investor retreat, indicating a broader risk-off sentiment in the crypto market.

Crypto Outflows Reach $415 Million Last Week. Source: CoinShares

The negative flows come after the US Federal Reserve (Fed) indicated that inflation climbed to 3% year-on-year (YoY) in January, effectively beating expectations. Similarly, core inflation reached 3.3%, raising market concerns.

As BeInCrypto reported, crypto investors reacted negatively, with the overall market cap falling by 5% and Bitcoin slipping below $95,000 immediately. However, the main concern was remarks from Fed chair Jerome Powell, who hinted that he was not hurrying to cut interest rates.

During his testimony to Congress, Powell emphasized the need to keep interest rates elevated for an extended period to combat inflation. This dashed investor hopes for early rate cuts, rattling crypto markets, as higher interest rates generally weigh on speculative assets.

“A bit of reverse wealth effect may be the top factor to alleviate inflation, which means highly speculative crypto’s at the forefront… It may be silly to expect inflation to drop until risk assets do,” wrote analyst Mike McGlone.

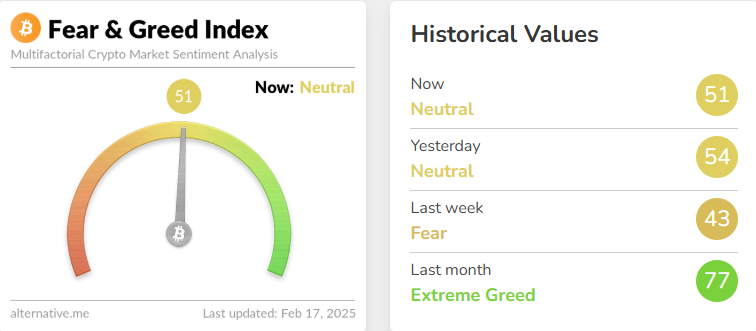

Not forgetting that the market was already reeling from US President Donald Trump’s tariffs on Canada, Mexico, and China, Powell’s stance weighed heavy on risk-on assets. Bitcoin’s Fear and Greed Index, a widely followed measure of market sentiment, dropped into ‘Fear’ territory following the CPI release.

Notably, it has since resorted to neutral territory, reflecting continued investor uncertainty ahead of FOMC minutes this week.

Bitcoin Fear and Greed Index. Source: Alternative

Against this backdrop, most of last week’s crypto outflows, totaling $464 million, originated from the US. According to CoinShares researcher James Butterfill, US-based investors reacted strongly to domestic economic signals.

“We believe these outflows were triggered by the Congressional meeting with Fed Chair Jerome Powell, who signaled a more hawkish monetary policy stance, coupled with US inflation data exceeding expectations…The majority of outflows originated in the US…most other countries remained largely unaffected by the news,” an excerpt in the report read.

First Net Crypto Outflows in 2025

Meanwhile, the $415 million crypto outflow marks the first net withdrawal from digital asset investment products in 2025, disrupting a streak of positive flows. A week earlier, crypto inflows had reached $1.3 billion, highlighting the rapid sentiment shift in response to macroeconomic conditions.

Before this pullback, the crypto market had also seen a series of strong inflows, extending the positive flows since the first week of the year. Specifically, the first week of January saw $585 million in inflows, signaling early-year investor confidence, while inflows soared to $2.2 billion later in the month amid optimism surrounding President Trump’s inauguration. However, in early February, inflows slowed to $527 million as China’s DeepSeek drained liquidity.

These figures illustrate how fast investor sentiment can shift in response to economic data and policy signals.

It is also worth noting that the impact of inflation data was particularly evident in Bitcoin ETF (exchange-traded funds) outflows. As BeInCrypto reported, Bitcoin ETF outflows stretched from $56.76 million to $243 million as inflation and Powell’s stance on rate cuts shook investor confidence.

Nevertheless, Ethereum ETFs showed greater resilience, avoiding similar capital flight. The latest CoinShares report also indicates that the impact was more pronounced on Bitcoin than Ethereum. This suggests that investors may reassess their digital asset allocations in light of shifting macroeconomic conditions.

This aligns with a recent JPMorgan survey, which established that 51% of traders view tariffs and inflation as the most influential market factors in 2025.

Inflation and Tariffs to Influence Markets in 2025. Source: JPMorgan Chase Survey Findings

Additionally, 41% of respondents expressed heightened concerns about volatility, particularly in response to unpredictable political developments.

Based on this outlook, the minutes of the FOMC (Federal Open Market Committee) meeting later could have a bearing on crypto inflows or outflows this week.