[ad_1]

The Federal Reserve called stocks and real estate risky investments on Friday, dropping the warning just one day after loosening its grip on crypto rules.

The Financial Stability Report, released by the Federal Reserve, said asset prices were still “notable” even though some markets took hits earlier this month.

According to the report, “even after recent declines in equity prices, prices remained high relative to analysts’ earnings forecasts, which adjust more slowly than market prices.” The report also made it clear that Treasury yields across all maturities stayed near the highest levels anyone has seen since 2008.

The Federal Reserve also pointed to leverage in the market as a big issue and said funding risks still looked serious. The report, covering market conditions up to April 11, said funding markets stayed strong through the rough patches in early April, but that didn’t mean everything was fine.

The central bank made sure to mention that fair value losses on fixed-rate assets were still “sizable” for some banks and that these losses were very sensitive to changes in interest rates.

Federal Reserve highlights asset prices, debt, and leverage trouble

The Financial Stability Report broke down how bad things looked across four big areas. Starting with asset valuations, the Federal Reserve said stocks stayed pricey compared to earnings even after April’s selloffs.

Treasury yields stayed stubbornly high, and spreads between corporate bonds and Treasurys stayed moderate. Liquidity problems built up through the end of March and got worse in April, but trading still worked.

On the real estate side, home prices stayed high, and the ratio of house prices to rents hovered near record peaks. Commercial real estate indexes, adjusted for inflation, showed some signs of leveling off, but the Fed warned that refinancing needs could still cause problems soon.

Debt didn’t look much better. Business and household debt as a share of GDP dropped to the lowest point in twenty years. But business leverage stayed high, and private credit deals kept growing.

Source: The Federal Reserve

Household debt looked tame compared to recent history. Most mortgages are fixed-rate and have low-interest rates, and overall debt service ratios are a bit better than before the pandemic. Still, the Fed flagged that credit card and auto loan delinquencies are up, especially for people with non-prime credit scores and lower incomes.

When it came to leverage, the Federal Reserve said banks still looked sound, with capital levels above regulatory minimums. However, losses on fixed-rate assets kept hitting some banks hard. Some banks, insurance companies, and securitization shops kept piling into commercial real estate, too.

The Fed said that bank lending to nonbank financial firms kept climbing, thanks in part to better tracking methods. Hedge fund leverage sat near the highest levels of the past ten years and was mostly packed into larger funds. Some leveraged investors started dumping positions during the April volatility to cover margin calls, with hedge funds in relative value trades being some of the hardest hit.

Federal Reserve flags funding risks and ongoing market fragility

The Federal Reserve said funding risks slid to moderate levels over the past year but didn’t vanish. Runnable money-like liabilities stayed near historic medians, still posing a long-term threat. Banks cut down their dependence on uninsured deposits since the highs of 2022 and 2023.

Prime money market funds looked better, but other cash vehicles with the same risks kept growing. Bond and loan funds, holding assets that can turn illiquid fast under pressure, saw bigger-than-usual outflows during early April’s market stress.

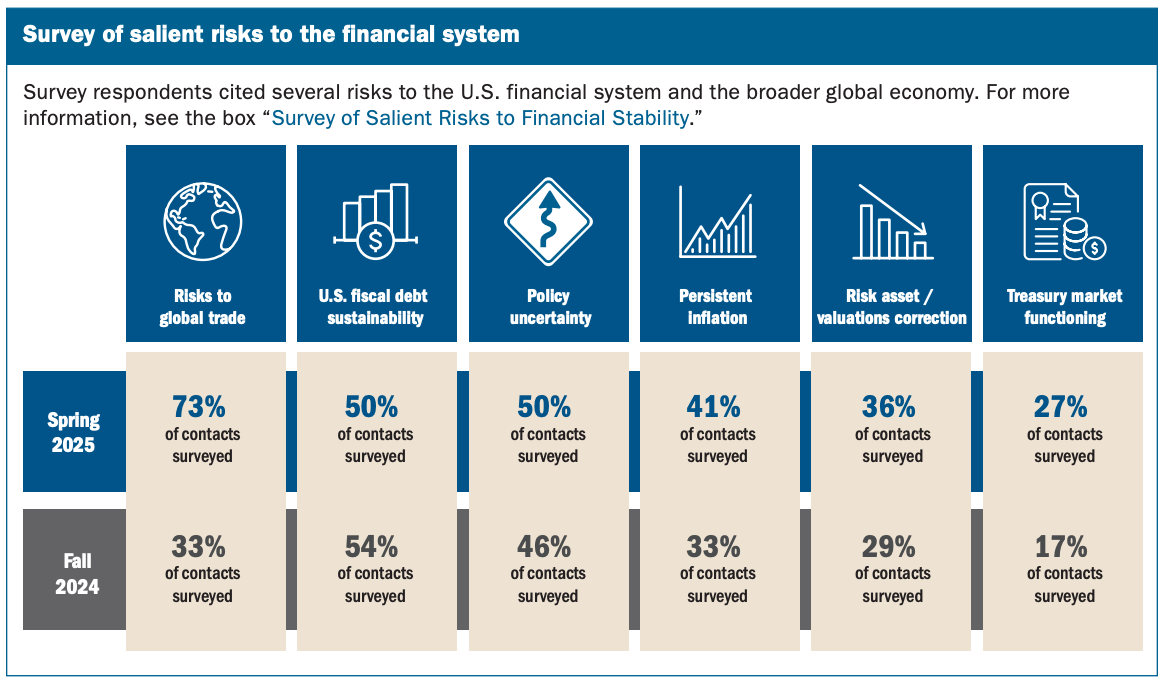

The Financial Stability Report also said global trade risks, debt concerns, and inflation were getting worse. It added, “a number of respondents also cited persistent inflation and corrections in asset markets as salient risks,” and most of the feedback was collected before April 2.

Just a day before blasting stocks and real estate, the Federal Reserve rolled back years of crypto restrictions. It dropped earlier rules that told banks to get pre-approval before doing anything in crypto. In the Thursday announcement, the Federal Reserve said, “these actions ensure the Board’s expectations remain aligned with evolving risks and further support innovation in the banking system.”

[ad_2]