The Federal Reserve may need to implement an emergency rate cut before its scheduled May meeting due to severe market stress, said Bob Michele, Global Head of Fixed Income at JPMorgan Asset Management, in a recent interview with Bloomberg Surveillance.

The US stock market is entering its third trading session after losing over $5 trillion just two days after President Trump unveiled an aggressive tariff policy.

Michele said the market chaos last week was exceptionally severe, comparable to historical crises—the 1987 stock market crash, the 2008 financial crisis, and the 2020 COVID-19 market downturn.

In previous crises, the Fed acted quickly with a decision to cut rates. Michele suggested current market conditions may require similar intervention, meaning the Fed may not be able to wait until May to cut rates.

“I don’t know if they can even make it to the May meeting before they start bringing rates down.”

Ever since Trump kicked off his second term and threatened tariffs on imports from US key partners like Canada, Mexico, and China, Fed Chair Jerome Powell has repeatedly stated that the central bank is not in a hurry to adjust its policy.

In a statement last Friday, Powell reiterated the Fed’s cautious stance toward rate adjustments.

He stressed that Trump’s new tariffs are likely to cause higher inflation and slower economic growth in the US. The Fed is committed to anchoring inflation at a rate of 2%.

Commenting on the Fed’s current stance of waiting for clear signs of economic stress before acting, Michele expressed doubt that the central bank could wait until its upcoming meeting, scheduled for May 7, to begin lowering rates.

“They talked about the long, invariable lags. So now they’re saying they’re going to wait for the accident before they respond, and then wait for the long, invariable lags to take hold,” he said. “I don’t think so.”

The analyst is critical of the idea that the Fed would wait for the damage and then wait for its policy to take effect.

Addressing arguments that there isn’t evidence of a systemic breakdown yet, Michele said the recent market drops signal deeper economic problems, especially with lower-rated businesses.

“I think if you step back and look at the totality of what’s going on, you cannot believe that there’s nothing under the surface that’s going to break,” Michele added.

Michele also noted that vulnerable companies that have already been struggling with debt now face a package of higher borrowing costs, lower sales, and higher expenses. These underlying issues are likely to worsen and cause a huge collapse if the Fed doesn’t take action.

“This is a serious moment. I do not think the Fed can just sit on the side,” Michele said.

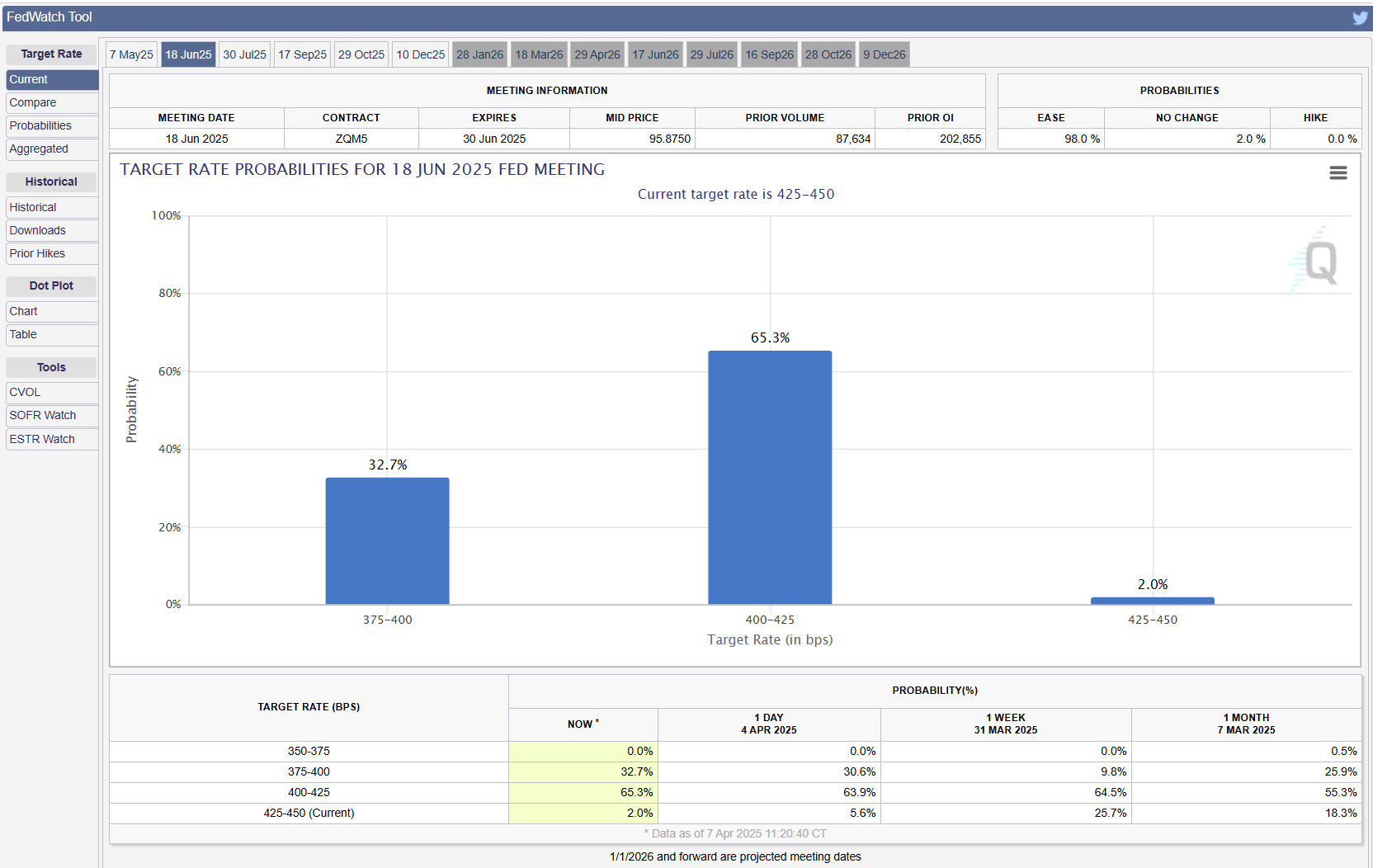

The CME FedWatch Tool shows only a 34% chance that the Fed will lower rates at its May meeting.

While this figure has fluctuated, the majority of market participants still view a June rate cut as more likely, with odds of around 98% as of the latest data.

Traders are also pricing that the Fed will adjust rates at the November and December 2025 meetings.

Trump has persistently urged the Fed to cut interest rates. In January, the president demanded lower interest rates immediately, claiming that better monetary policy was needed to support the economy.

As the Fed maintained its interest rates and forecast two cuts for the year, Trump encouraged the central bank to reduce rates to ease the economic transition to his tariff policies.

He continued to advocate for rate cuts ahead of Powell’s speech last week, stating it was a “perfect time” for the Fed to lower rates.