[ad_1]

Stablecoins—cryptocurrencies pegged to stable assets like the USD—are drawing increasing attention from top payment companies. Recent reports claim stablecoin transaction volumes over the past year have surpassed Visa.

However, industry experts are skeptical of these numbers. This article explores the reasons behind that skepticism.

Why Experts Suspect Stablecoin Volume Might Be Inflated

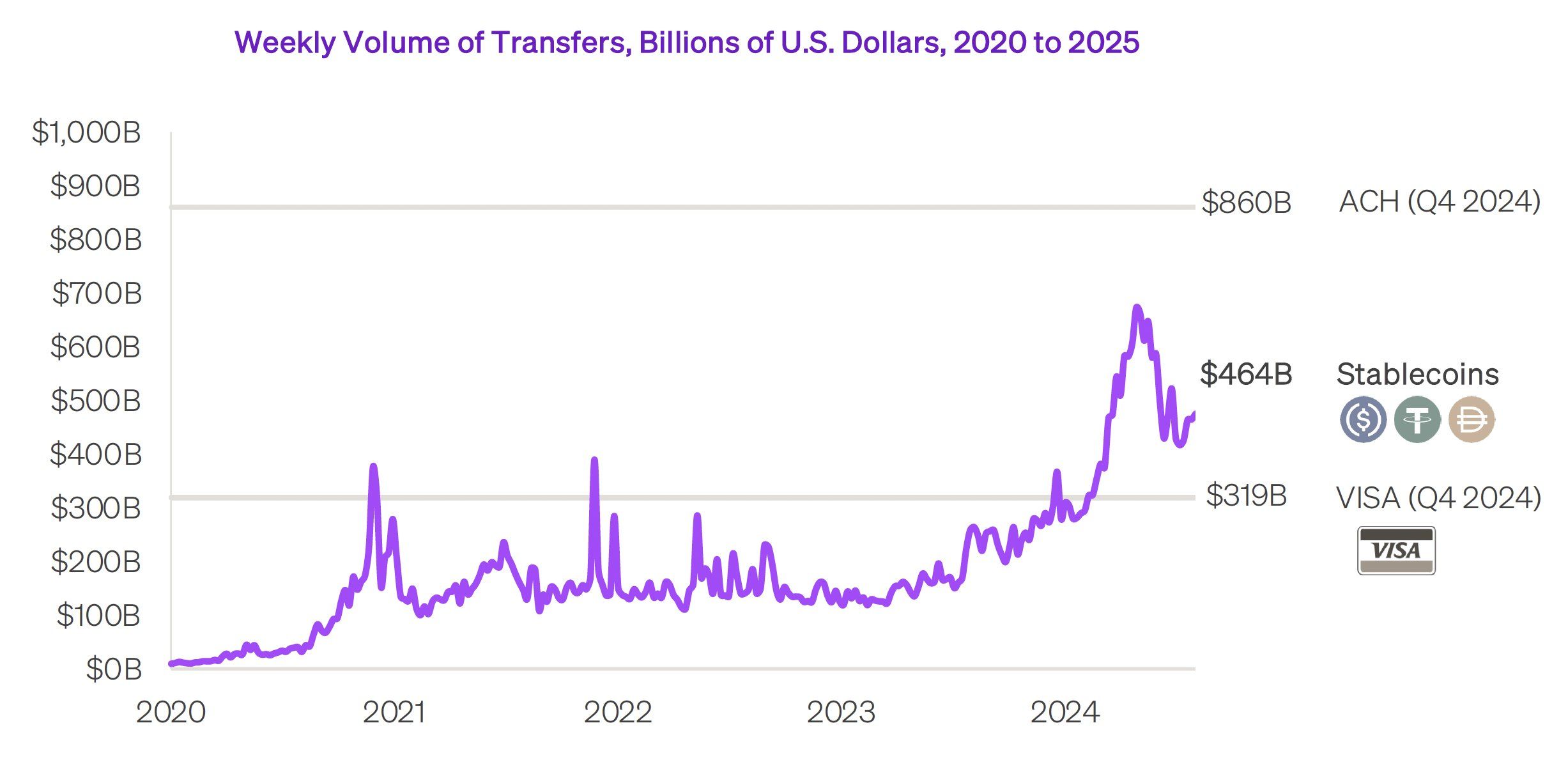

Recently, Chamath Palihapitiya, CEO of Social Capital, posted on X that the weekly transaction volume of stablecoins has exceeded that of Visa, reaching over $400 billion. He added that companies like Visa, Mastercard, and Stripe are actively embracing the trend.

Weekly Volume of Stablecoin Transfers. Source: Chamath Palihapitiya

According to the data, in Q4 of 2024, the average weekly stablecoin transaction volume reached $464 billion. That’s significantly higher than Visa’s $319 billion. A Bitwise report estimates that stablecoins processed about $13.5 trillion in total transaction volume in 2024. This marks the first time stablecoin volume surpassed Visa’s annual total.

At first glance, this seems like a major milestone, suggesting that stablecoins could reshape the future of global payments. Citigroup even projects that the stablecoin market could reach $3.7 trillion by 2030.

Not everyone shares the enthusiasm. Some experts have warned that the reported stablecoin volume might be inflated. They argue it doesn’t reflect real economic activity and shouldn’t be directly compared with traditional systems like Visa.

Joe, an advisor at Maven 11 Capital, pointed out that professional traders can generate hundreds of millions in volume using very little initial capital.

“If you have $100,000 of USDC on Solana, you can do ~$136 million of ‘stablecoin volume’ for $1 in fees,” Joe said.

He used Solana as an example. Solana is a fast blockchain with extremely low transaction fees—about $0.0036 per transaction. Joe even joked that with $3,400, someone could double weekly stablecoin transaction volumes. He implied that the metric is easy to manipulate and not truly reliable.

Dan Smith, a data expert at Blockworks Research, strongly supported Joe’s view. Dan explained that using flash loans—uncollateralized loans in DeFi—can inflate volume even further at lower costs.

Flash loans allow users to borrow large sums without collateral, as long as they repay within the same transaction. This enables volume manipulation without requiring significant capital, further casting doubt on the numbers cited by Palihapitiya.

Rajiv, a member of Framework Ventures, was even more direct. He called stablecoin volume a “useless metric.” Dan Smith agreed. He added that the unusually high volume often signals exploitative behavior within the system.

Wash Trading and Bot Trading Undermine Economic Value

One key reason experts doubt stablecoin volume is the presence of wash trading and bot trading.

Wash trading involves repeatedly buying and selling between wallets controlled by the same person or entity. The goal is to artificially inflate transaction volume. Bot trading uses automated programs to conduct trades, often for arbitrage or fake liquidity.

A $1 million stablecoin transaction might just be money transferred between two wallets owned by the same person. It adds no real economic value. This contrasts sharply with Visa, where each transaction typically represents a real purchase or payment, like buying goods or services.

Last year, Visa’s dashboard also reported that only 10% of stablecoin transactions were genuine. A wash trading report by Chainalysis found that wash trades involving ERC-20 and BEP-20 tokens could total up to $2.57 billion in volume in 2024.

[ad_2]