Over the past decade, a significant amount of bitcoin has made its way into centralized trading platforms, public and private corporations, governments, exchange-traded funds (ETFs), and derivative token projects like WBTC. With roughly 100 days remaining in 2024 after the launch of spot bitcoin ETFs in January, this analysis dives into the top ten entities holding the most bitcoin.

Examining the Top 10 BTC Holders

Currently, data from cryptoquant.com reveals that centralized crypto exchanges are holding about 2,581,607.09 BTC, a level not seen since November 2018. Even with this dip, there’s still more BTC on exchanges compared to the period from 2015-2017. For example, on Jan. 1, 2017, Cryptoquant recorded just 1.17 million BTC stored on these platforms. Beyond exchanges, the accumulation of BTC has skyrocketed since 2020, with ETFs, decentralized finance (defi) projects, governments, and both private and publicly traded corporations amassing significant amounts of bitcoin.

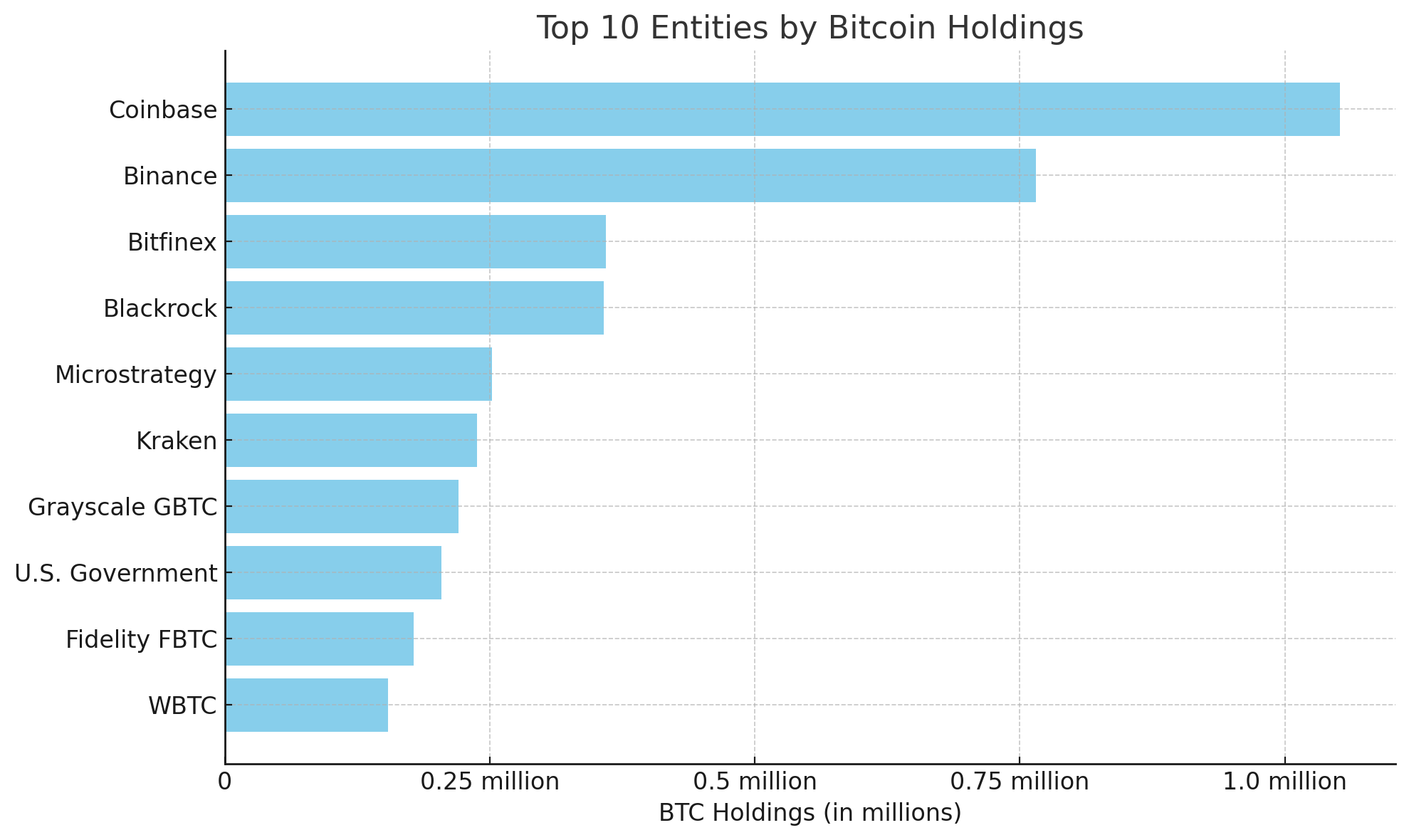

We decided to do a thorough analysis of the top ten entities following our research on the unspent coinbase rewards from 2009-2012. Like that study, this particular list leverages timechainindex.com for onchain data but our study does not include unspent block rewards and unknown individuals referred to as “Individual X.” It includes centralized exchange (cex) platforms, governments, companies, and exchange-traded products (ETPs). The data shows that as of Sept. 22, 2024, Coinbase is the largest entity in terms of the most BTC held.

Timechainindex.com highlights that the cex Coinbase holds 1,051,650.41 BTC worth $66.4 billion in 145,491 addresses. The popular cex Binance is the second largest entity today with the most BTC as it holds 765,072.92 BTC. Binance’s bitcoin is stored in 120,528 addresses. Bitfinex is the third largest holder making the top three cex platforms as the exchange holds 359,687.52 BTC in 2,161 wallets. Blackrock is the fourth largest BTC holder with 357,550.21 BTC spread across 760 addresses. It should be noted however that Blackrock’s BTC is held with Coinbase Custody.

Source: timechainindex.com and Microstrategy statements.

Microstrategy secures 252,220 BTC according to its own statements. This would place Microstrategy in the fifth spot below Blackrock, but the index only accounts for Microstrategy’s 213,996.14 BTC onchain spread across 501 addresses. The San Francisco-based cex Kraken holds 237,900.9 BTC the index’s metrics detail and the funds are stored with Kraken’s 78,023 wallets. The seventh largest bitcoin holder is Grayscale’s GBTC commanding a stash of 220,439.82 BTC that’s also held with Coinbase Custody.

The U.S. government is in the eighth position with 204,302.34 BTC and the federal authorities have the funds spread across 125 different wallets. Fidelity’s FBTC fund, which stores its BTC with its own custody solution, holds 178,191.25 BTC. Fidelity’s money is kept in 562 wallets according to the index. The last and tenth largest bitcoin holder is the WBTC project which mints derivative ERC20 tokens back 1:1 with BTC in reserves. The reserves are what makes WBTC the tenth largest holder and these funds are kept in 948 wallets.

The distribution of bitcoin among these top ten entities highlights the growing institutional interest in the asset. It also reveals that many users are still turning to cex platforms to both trade and store their bitcoin. As bitcoin becomes more integrated into various sectors, from governments to publicly listed firms, it highlights the current shift from individual ownership toward larger, consolidated holdings. This trend could shape the future of bitcoin’s liquidity and accessibility, particularly as ETFs and institutional custody solutions expand.

While Customers Own All the Crypto Held by These Top-Ranking Trading Platforms, Exchanges Hold the Keys to These Digital Assets

It’s important to highlight that while Coinbase holds two-thirds of the bitcoin owned by U.S. ETFs and the top three exchanges manage the largest BTC reserves, much of these assets belong to retail investors and high-net-worth individuals. Cex platforms offer a service, but despite these funds being customer assets, the exchanges have 100% full control over them. If a breach occurs and their cold storage wallets are compromised, those digital assets are no longer under the platform’s custody. In such cases, the exchange either compensates its customers or collapses, leaving users to suffer the consequences of their mismanagement.

This is why non-custodial wallet solutions have been recommended for over a decade—they give users full control over their own funds. While exchanges are great for trading, many have been hacked since crypto trading platforms emerged, and breaches continue to occur. To play it safe, users are advised to keep only what they can afford to lose on exchanges for trading and selling, while securing the rest of their digital assets in a non-custodial wallet. This way, they won’t fall victim to a major exchange hack that could wipe out millions in assets.

What do you think about the top ten bitcoin holders? Share your thoughts and opinions about this subject in the comments section below.