Following last week’s macro-driven liquidation cascade, Ethereum has stabilized and is showing early signs of structural recovery. Despite the sharp selloff that swept through the crypto market, ETH has successfully defended a major demand zone and is now attempting to reclaim critical levels that will determine whether this rebound evolves into a full continuation or remains a temporary relief rally.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, Ethereum rebounded strongly from the $3.4K demand zone, which aligns with the 200-day moving average and the lower boundary of the ascending channel that has guided the price since mid-2025. The sharp recovery from this zone confirms it as a high-confluence support, while ETH’s surge above the 100-day MA near $4K and the ascending midline trendline suggest that buyers are attempting to reassert directional control.

Ethereum now faces its first major obstacle around the $4.2K–$4.3K zone, where broken market structure aligns with the 0.618–0.702 Fibonacci retracement levels from the recent decline. This area serves as a decisive short-term resistance. The RSI has also shown a mild bullish divergence from oversold territory, reinforcing the potential for continued upside if momentum persists.

A daily close above $4.3K would confirm strength and open the path toward the $4.6K–$4.7K supply area, while rejection at this level could trigger another retest of the $3.8K–$3.6K range, where buyers would again be tested.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum has reclaimed its previously broken ascending trendline, turning it into short-term support following last week’s capitulation to $3.4K. The rebound has extended toward the 0.618 Fibonacci retracement zone ($4.25K), where price is now consolidating just below the key $4.3K resistance.

The $4.0K–$4.1K region now acts as the critical decision point. Holding above this level would confirm structural strength and support the recovery narrative, while losing it could invalidate the current bullish setup and expose the $3.6K–$3.4K demand block once more.

For now, the short-term structure remains constructive but not confirmed. A sustained break above $4.3K would shift market sentiment back in favor of bulls, while rejection could extend the consolidation phase for several sessions as the market continues to absorb volatility.

Sentiment Analysis

By Shayan

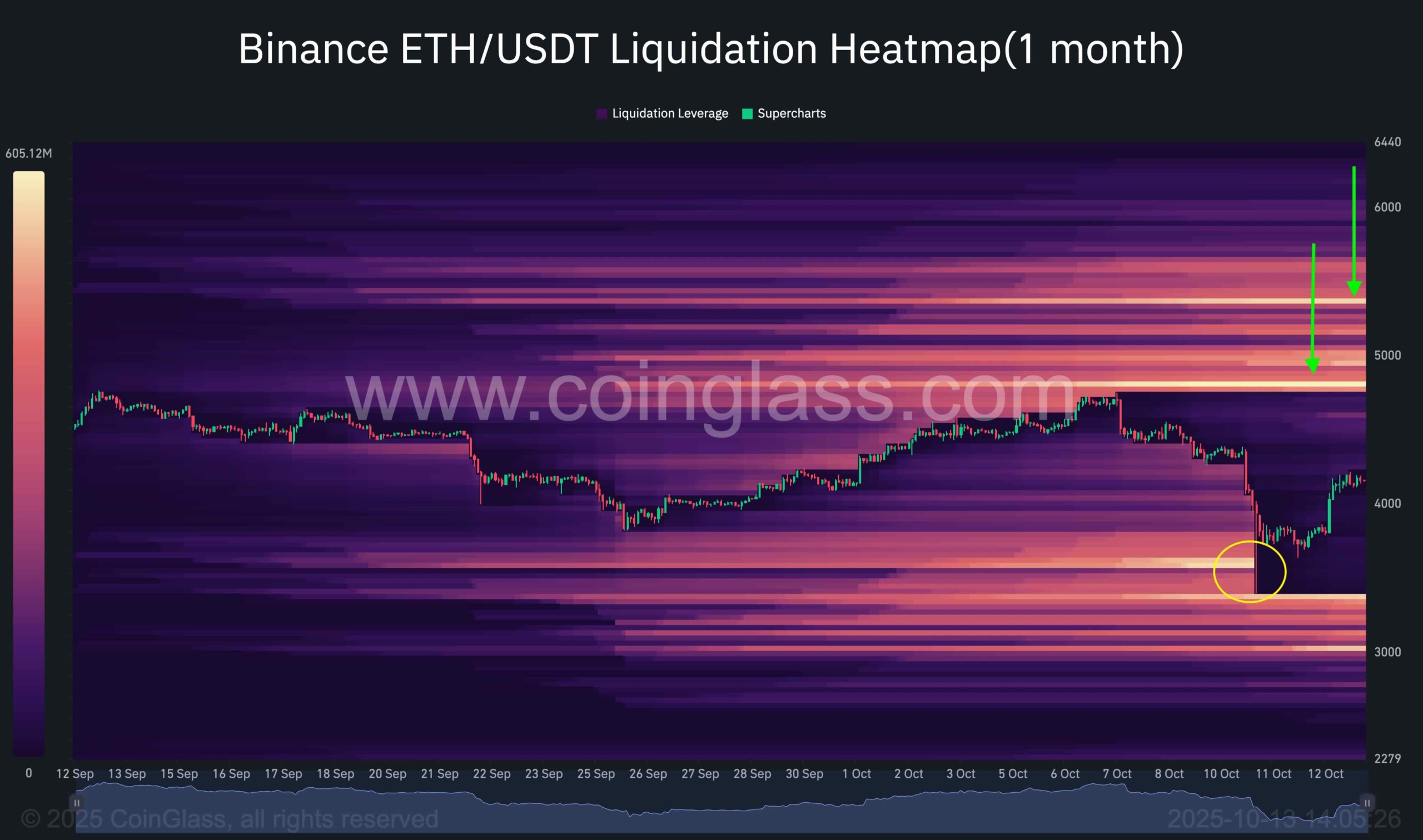

The latest 1-month Binance liquidation heatmap reveals how last week’s macro-driven crash reshaped the derivatives landscape. A massive liquidation cluster formed between $3.4K and $3.6K, marking the flush-out of heavily leveraged long positions as Ethereum briefly dipped below $3.5K. This event served as a cleansing phase for market positioning, washing out weak longs and resetting both sentiment and funding conditions.

Since that capitulation, the heatmap shows a clear absence of major liquidity pools below current price, suggesting that short-term downside pressure has eased. The decline in lower-level liquidation density indicates that the market has effectively cleared excessive leverage, paving the way for a more stable recovery phase.

In contrast, multiple high-density liquidity clusters have now developed above price, most notably around $4.8K–$5.0K and again near $5.8K–$6.0K. These zones correspond to short-side liquidity pockets and unrealized short exposure, effectively serving as future targets for potential upward moves.

If Ethereum maintains its recovery momentum and reclaims the $4.3K–$4.4K resistance zone, the market is likely to gravitate toward these upper clusters, aiming to sweep short-side liquidity. Provided no new wave of excessive leverage emerges prematurely, Ethereum appears technically positioned for a medium-term continuation, with on-chain dynamics supporting a gradual climb toward these higher liquidity targets.