Ethereum (ETH) is entering October with heightened expectations as optimism around “Uptober” fuels hopes of a strong rally.

Yet beneath the surface, several concerning signals suggest Ethereum investors may need to tread carefully.

Ethereum Faces Hidden Dangers This Uptober: 3 Risks Investors Can’t Ignore

The positive sentiment comes after the second-largest altcoin on market cap metrics recorded significant Ethereum ETF inflows in Q3 and enjoyed a broader positive sentiment across the crypto market, especially from institutions.

However, on-chain data paints a different picture, showing looming risks as investors progressively show caution.

Staking Growth Has Stalled

One of Ethereum’s biggest strengths since the Merge has been the steady rise in staked ETH. However, that trend has now stalled.

According to CryptoQuant data, the valid ETH balance of the Ethereum deposit contract has flattened since around July 20, holding steady at around 36 million ETH.

Total value of ETH Staked. Source: CryptoQuant

This stagnation points to greater caution among investors regarding staking ETH in DeFi protocols. For months, staking growth provided a structural tailwind for Ethereum, locking up supply and reinforcing the network’s security.

The chart shows that the Ethereum price rally coincided with an increase in staking, just as the lull aligned with price stagnation.

A pause in this trajectory suggests investors are weighing risks more carefully, potentially due to market uncertainty, yield compression, or capital rotation to Bitcoin.

ETF Buying Momentum Has Faded

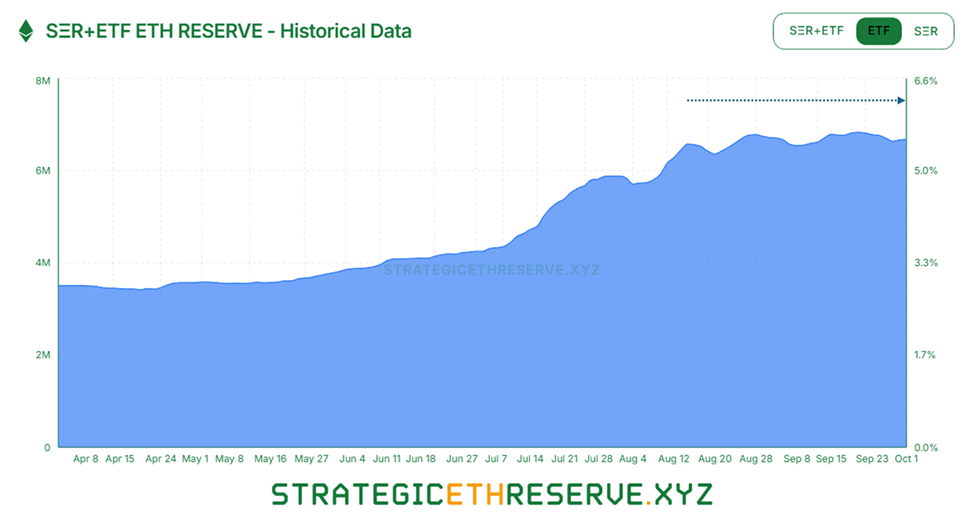

Another risk comes from Ethereum ETFs (exchange-traded funds). After initially attracting inflows earlier this year, accumulation has slowed dramatically.

Data from StrategicETHReserve.xyz shows that ETH ETF holdings have stopped rising since early August, as inflows and outflows reached a fragile balance.

Ethereum ETF Inflows. Source: StrategicETHReserve.xyz

This lack of net buying undermines a key bullish narrative. ETFs were expected to provide a steady demand base for Ethereum, similar to how Bitcoin ETFs absorbed institutional interest.

Instead, ETH ETF flows now reflect hesitation, suggesting that while buying demand exists, it only matches the selling pressure. Ethereum’s price pushing decisively higher may hinge on ETFs returning to net accumulation.

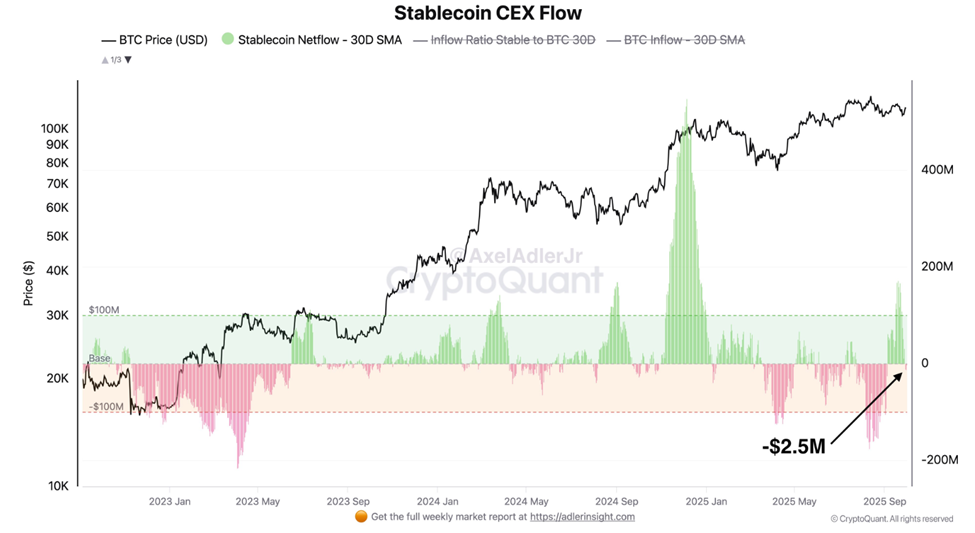

Stablecoin Liquidity Is Drying Up

Perhaps the most immediate concern is liquidity. On-chain data shows that average stablecoin netflows to centralized exchanges (CEXs) have turned negative since September 22.

Stablecoin flows into CEXs. Source: CryptoQuant

This trend, highlighted by on-chain analyst Axel Adler, indicates that less capital is available for spot buying activity.

“Average Stablecoin NetFlow to CEX has gone negative and declining since September 22. Spot liquidity is decreasing, while BTC price remains elevated. This is a concerning signal,” wrote Adler.

He added that while ETFs brought $947 million in inflows over the past few days, that support alone may not be enough to sustain a full Uptober rally without stronger spot liquidity.

Balancing Optimism with Risk

Nonetheless, Ethereum’s fundamentals remain strong, and October could still deliver upside if broader risk appetite continues to improve.

ETF inflows into Bitcoin and bullish seasonality trends are providing a supportive backdrop. Yet these risks (stalled staking, stagnant ETF demand, and shrinking spot liquidity) offer important context against overly optimistic predictions.

Understanding these undercurrents can help minimize losses if the market moves against expectations. Therefore, investors should exercise caution and conduct their own research as October could bring both opportunity and disappointment.

The post Ethereum’s Uptober at Risk? Key Data Reveals Growing Investor Caution appeared first on BeInCrypto.