Ethereum co-founder Vitalik Buterin and other prominent “whales” have offloaded millions of dollars in $ETH since the beginning of February, adding narrative fuel to a market rout that saw the world’s second-largest cryptocurrency tumble below $2,000.

While the high-profile sales by Buterin served as a psychological trigger for retail panic, a closer examination of market data suggests that the primary pressure came from a systemic unwind of leverage and record-breaking selling activity across the network.

Nonetheless, these disposals, combined with significant selling by other industry insiders, have prompted investors to question whether project leaders are losing confidence or simply managing operational runways amid extreme volatility.

Why is Buterin selling his Ethereum holdings?

In the past 3 days, Buterin sold 6,183 $ETH ($13.24M) at an average price of $2,140, according to blockchain analysis platform Lookonchain.

However, the specifics of Buterin’s transactions reveal a calculated, rather than panic-driven, strategy.

Notably, Buterin publicly disclosed that he had set aside 16,384 $ETH, valued at approximately $43- $45 million at the time, to be deployed over the coming years.

He stated the funds are earmarked for open-source security, privacy technology, and broader public-good infrastructure as the Ethereum Foundation enters what he described as a period of “mild austerity.”

In this light, the most defensible explanation for “why he sold” is mundane. It appears to be the conversion of a pre-allocated $ETH budget into spendable runway (stablecoins) for a multi-year funding plan rather than a sudden attempt to time the market top.

However, the channel through which these sales affect the market is more narrative-driven than liquidity-based. When investors see founder wallets active on the sell side during a downturn, it tilts sentiment and deepens the bearish resolve of an already shaky market.

Still, Buterin remains an $ETH whale, holding over 224,105 $ETH, which is equivalent to approximately $430 million.

Did Buterin’s $ETH sales precipitate a market crash?

The central question for investors is whether Buterin’s selling mechanically pushed $ETH below $2,000.

From a structural perspective, it is difficult to argue that Buterin’s $13.24 million sell program, by itself, breaks a major market level, given $ETH‘s multi-billion-dollar daily trading volume.

So, a sell order of this magnitude is small relative to typical turnover and lacks the volume required to consume order book depth and drive prices down significantly on its own.

However, Buterin was not selling in a vacuum. He was part of a broader exodus of large holders that collectively weighed on the market.

On-chain trackers flagged significant activity from Stani Kulechov, the founder of the DeFi protocol Aave. Kulechov sold 4,503 Ethereum (valued at about $8.36 million) at a price of around $1,857 just hours before $ETH‘s slide accelerated.

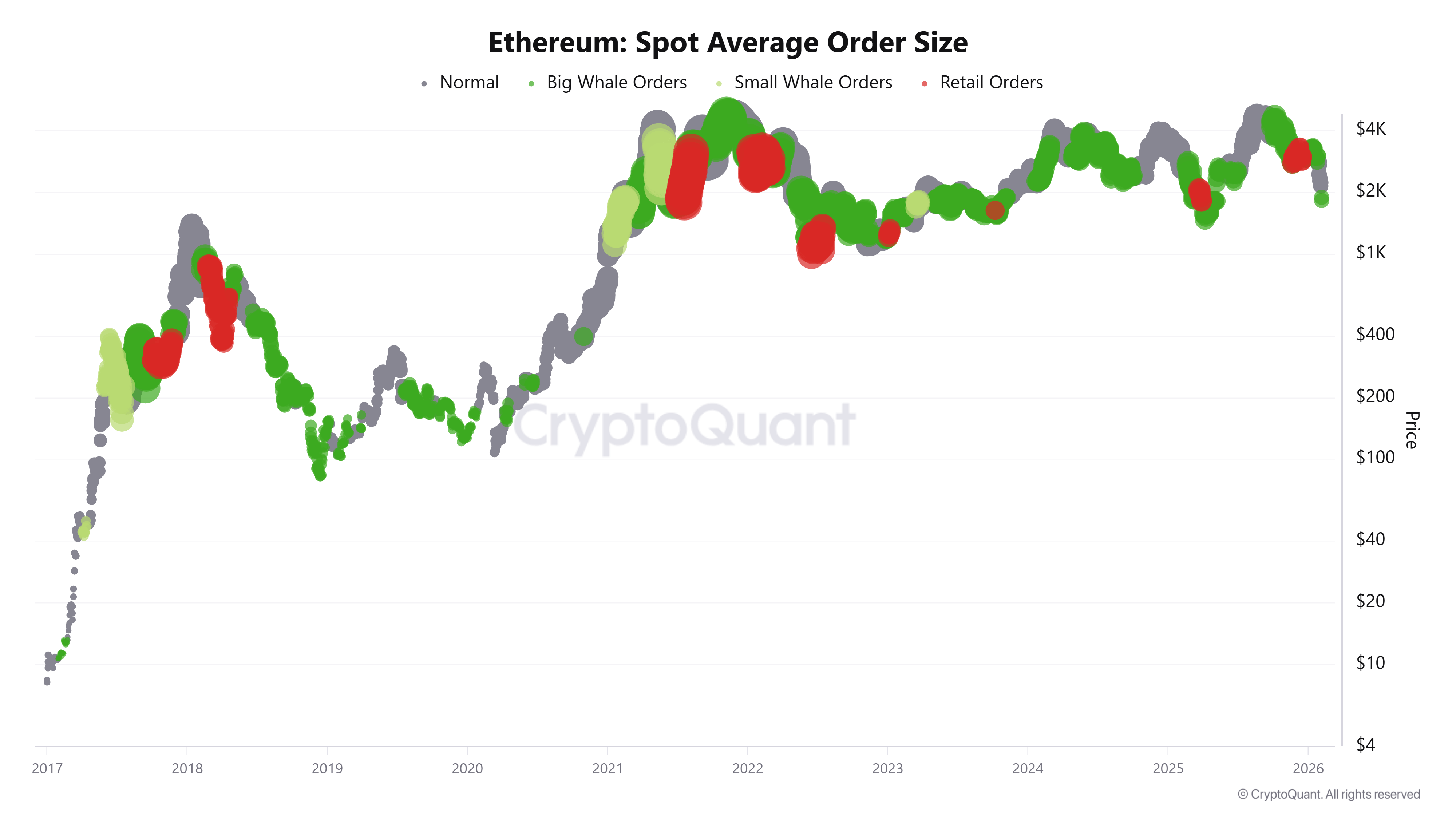

This activity is symptomatic of a broader trend. Data from CryptoQuant shows that the network has faced record selling activity this month.

The analytics firm noted that the network had seen an increase in large whale order sizes during the downturn, suggesting that high-net-worth individuals and entities were actively de-risking into the liquidity provided by the drop.

While a single whale cannot crash the market, a synchronized exit by industry leaders can create a self-fulfilling prophecy.

When liquidity is thin and leverage is stretched, these “headline flows” signal to the broader market that “smart money” is de-risking, prompting smaller traders to follow suit in a bid to preserve capital.

The real drivers behind $ETH‘s crash

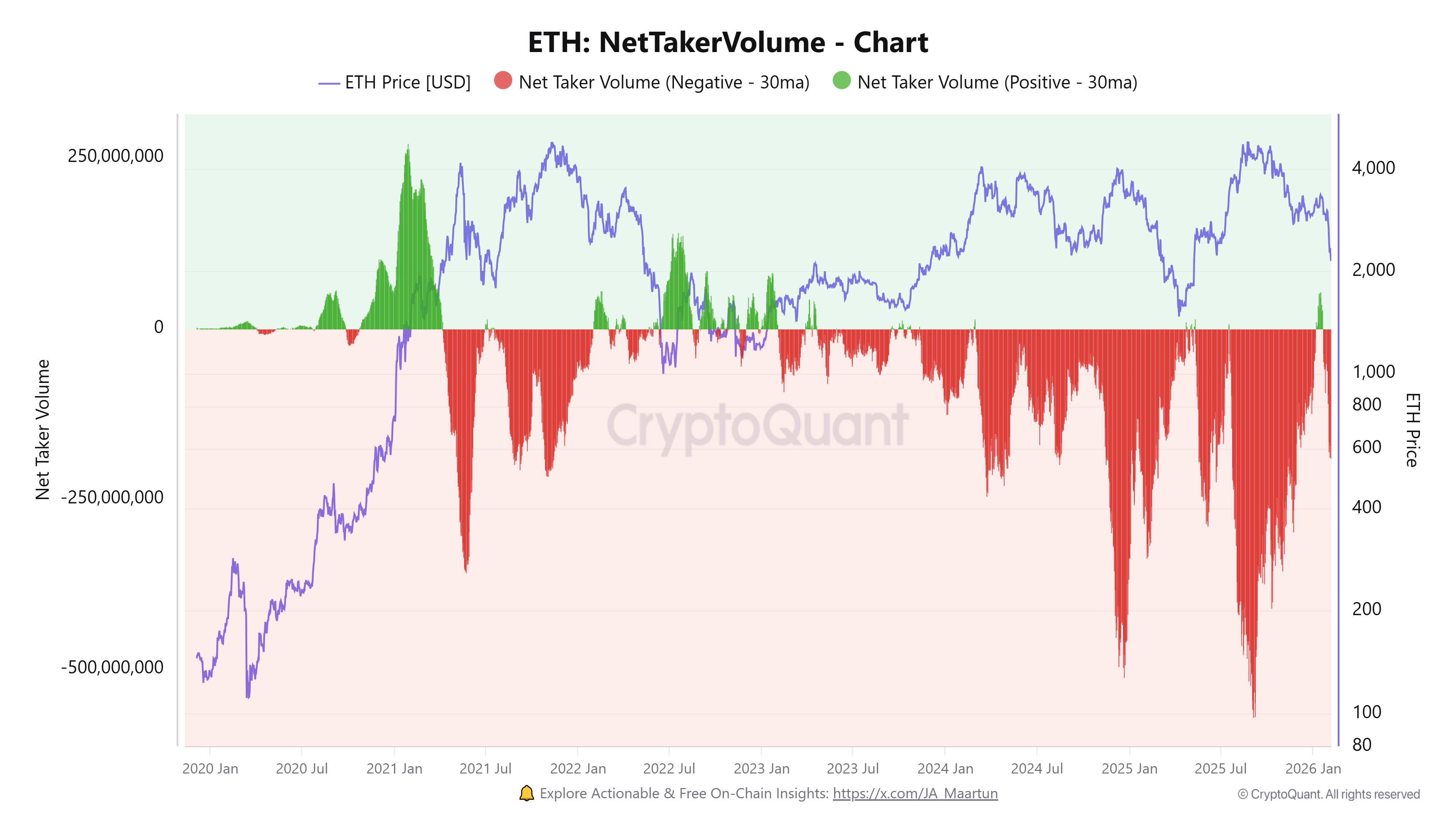

While the narrative focused on founder wallets, the bulk of the crash was driven by three distinct market forces: leverage unwinding, ETF outflows, and macroeconomic headwinds.

Data from Coinglass indicated hundreds of millions of dollars in $ETH liquidations over 24 hours during the worst of the move, with long liquidations dominating.

This created classic cascading conditions in which price declines trigger forced sales from overleveraged positions, which in turn trigger further declines and additional forced selling.

Simultaneously, institutional support evaporated. US spot $ETH ETFs have recorded about $2.5 billion of net outflows over the past four months, according to SoSo Value data.

This occurred alongside much larger outflows from Bitcoin ETFs. This represents the kind of institutional de-risking that matters more than any one wallet when the market is already sliding.

Compounding these crypto-specific issues is the macroeconomic backdrop.

Reuters tied the broader crypto drawdown to a cross-asset selloff and tighter liquidity fears. The crypto market has shed about $2 trillion from its peak in October 2025, with roughly $800 billion wiped out in the last month alone, as investors reduced risk and leveraged positions unwound.

Indicators to watch

As the market attempts to find a floor, three indicators will matter more than any whale alert.

First is liquidation intensity. If forced liquidations remain elevated, $ETH can continue to “gap” lower even without additional discretionary selling.

A decline in liquidation totals alongside stabilization is often the first sign the cascade has burned out, according to Phemex analysts.

Second is the ETF flows regime. One day of outflows is noise, but a multi-week streak changes the marginal buyer. $ETH‘s near-term path depends heavily on whether institutional flows stabilize or continue to bleed into broader risk-off behavior.

Finally, investors should watch exchange inflows and large-holder behavior.

Founder wallets are visible, but the more telling indicator is whether large holders increase deposits at exchanges (distribution) or whether coins move into cold storage and staking (accumulation). When those signals flip, the market usually follows.

The bottom line remains that Vitalik Buterin’s sales are best understood as the execution of a pre-announced funding plan tied to public goods and open-source spending, not as a sudden loss of faith.

But in a collapse driven by leverage liquidations, ETF outflows, and macro risk-off, even “small” founder sales can have disproportionate effects.

They do so not by supplying enough $ETH to break $2,000, but by adding narrative fuel to a market already searching for a reason to sell first and ask questions later.