- Ethereum ETFs record $20.3 million in outflows, extending outflow streak to three days.

- Over 80% of ETH’s supply is in profit despite the market not yet recovering from the crash in early August.

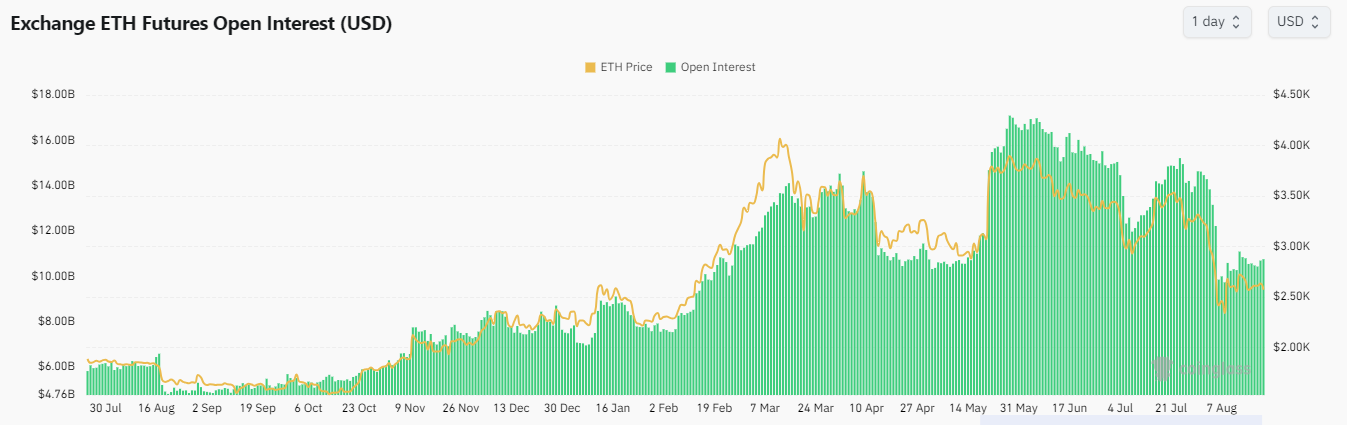

- Ethereum could continue consolidation until its open interest sees considerable growth.

Ethereum (ETH) is down nearly 1% on Tuesday as its weak open interest indicates that prices will likely remain range-bound in the coming days. The choppy price action coincides with ETH ETFs recording a third consecutive day of negative flows, with $20.3 million in net outflows on Monday.

Daily digest market movers: Ethereum ETFs, high supply in profit

Ethereum ETFs recorded net outflows of $13.5 million on Monday, stretching its streak to three days of consecutive outflows. Grayscale ETHE posted $20.3 million in outflows, Bitwise ETHW had inflows of $1.9 million, while other issuers had zero flows.

Meanwhile, despite the market’s correction in early August, IntoTheBlock’s data shows that a fair share of Ethereum’s supply is held in profit.

Global In/Out of the Money tracks the total number of coins or addresses that are experiencing profits or losses based on current prices. A coin/address is in the money if its average cost is below current prices and out of the money if otherwise.

ETH’s Global In/Out of the Money reveals that more than 80% of its supply is held in profit, with Ethereum’s price hovering around the $2,570 mark. A huge amount of supply in profit after a price dip often signals periods of consolidation in an asset’s price.

ETH’s Global In/Out of the Money

The Market Value to Realized Value (MVRV) Ratio also indicates the average profitability of all addresses that have purchased ETH within specific time frames. Values above zero indicate profitability, and vice versa if they are below zero.

ETH’s 30d, 365d, 2-year and 3-year MVRV Ratio are at -8.96%, -5.41, 12.73% and 6.67%, respectively. This indicates long-term holders (LTH) are in profit on average despite the recent market drawdown, while short-term holders are at an average loss.

ETH technical analysis: Ethereum may continue consolidating

Ethereum is trading around $2,600 on Tuesday, down about 1% on the day. In the past 24 hours, ETH saw $23.8 million in liquidations, with long and short liquidations accounting for $15.13 million and $8.68 million, respectively.

Ethereum’s open interest is at $10.69 billion, shedding more than $6 billion since reaching a record high of $17.09 billion on May 28. Open interest is the total number of unsettled long and short positions in the market. Increased OI signifies rising investor confidence and appetite for risk and vice versa when OI decreases.

ETH Open Interest

ETH’s price rallied to $3,896 when its OI reached a record high on May 28. However, the recent market correction has sent ETH’s OI back to levels it maintained for nearly a month from mid-April to mid-May. During this one-month period, ETH’s price consolidated within the $2,800 to $3,200 range. As a result, ETH is likely to consolidate near current levels until its open interest sees reasonable growth.

A move above the $2,800 price level could see ETH reclaim a major support level and help flip the market sentiment to short-term bullish.

ETH/USDT 4-hour chart

The move is evidenced in the Awesome Oscillator (AO), which rose above the 0 level to 24, posting a high when ETH made a low. This often signals a momentum reversal, meaning ETH could see a brief rise.

However, the Relative Strength Index (RSI) is trending downward and has moved below its moving average, which signals a temporary bearish view. A daily candlestick close below the $2,111 support level could trigger a massive correction for ETH.

In the short term, ETH could rise to $2,695 to liquidate positions worth $40.84 million.