Ethereum has experienced a significant downturn in recent weeks, correlating with Bitcoin’s inability to sustain its bullish run above the $40K range. This scenario has led to a decrease in Ethereum’s market dominance, as it struggles to attract buyers near its resistance levels. Nonetheless, current market conditions indicate a shift. With funding rates stabilizing from previously overheated levels and investors showing a growing interest in accumulating Ethereum during this price dip, as suggested by on-chain data, there could be a resurgence in buying interest for Ethereum.

Ethereum Is In Key Demand Zone

In the past day, Ethereum (ETH) experienced a significant price drop from its high of $2,400, leading to substantial long position liquidations by bullish investors. Data from Coinglass reveals that Ethereum saw total liquidations exceeding $51 million. Of this, bullish traders accounted for nearly $45 million in liquidated positions, while bearish traders liquidated around $6.3 million. This activity has created a more robust resistance around the $2,400 mark, as bearish forces continue to exert pressure at this level.

However, amid this rising bearish threat, there’s a hope for a bullish comeback as the funding rate now escapes the overheated region. This metric is a critical indicator for determining whether buyers or sellers are engaging in their trades with increased intensity.

The chart clearly previously showed a rising trend in funding rates, reflecting the strong increase in price. Such a pattern suggests a dominant bullish sentiment in the market. However, it’s important to recognize that high funding rates may indicate an overly exuberant state in the perpetual markets, hinting at the risk of a looming long-squeeze.

Following a recent market correction, a significant decrease in funding rates has been observed. This reduction indicates that, while the market sentiment remains predominantly bullish, there is a notable easing in the perpetual markets from their previously overheated state. As a result, there is a possibility for the price to continue its upward movement after the current correction phase concludes.

Moreover, there’s a noticeable trend of accumulation around the current low, as the price of Ethereum has impressively recovered from the $2,300 dip. Data from IntoTheBlock shows that the Netflow is now in the negative, standing at -$54 million. This indicates that outflows are exceeding inflows, implying that bullish investors are purchasing Ethereum at these lower prices and withdrawing their funds from exchanges. Such a pattern reduces the likelihood of increased selling pressure in the near future.

What’s Next For ETH Price?

Ether is currently experiencing a correction within its upward trend, with bulls aiming to maintain the price above the key support level of $2,300. ETH price witnessed a robust rejection in the last 24 hours as bears defended the $2.4K level strongly. As of writing, ETH price trades at $2,306, declining over 4.2% from yesterday’s rate.

The downward trajectory of the 20-day Exponential Moving Average (EMA) at $2,401, combined with the Relative Strength Index (RSI) staying in the oversold, suggests that the momentum is with the bears. A decline from the current level would indicate a robust selling interest at minor rallies. In such a scenario, the ETH price could potentially decline to $2,200, and upon breaching this level, it might aim for the $2,000-$2,100 mark.

Conversely, this bearish outlook will be challenged if the price continues to surge or rebounds from $2,200. In such a case, bulls might challenge the $2,400 level. Such a surge could lead the price to test buyers’ patience at $2,700.

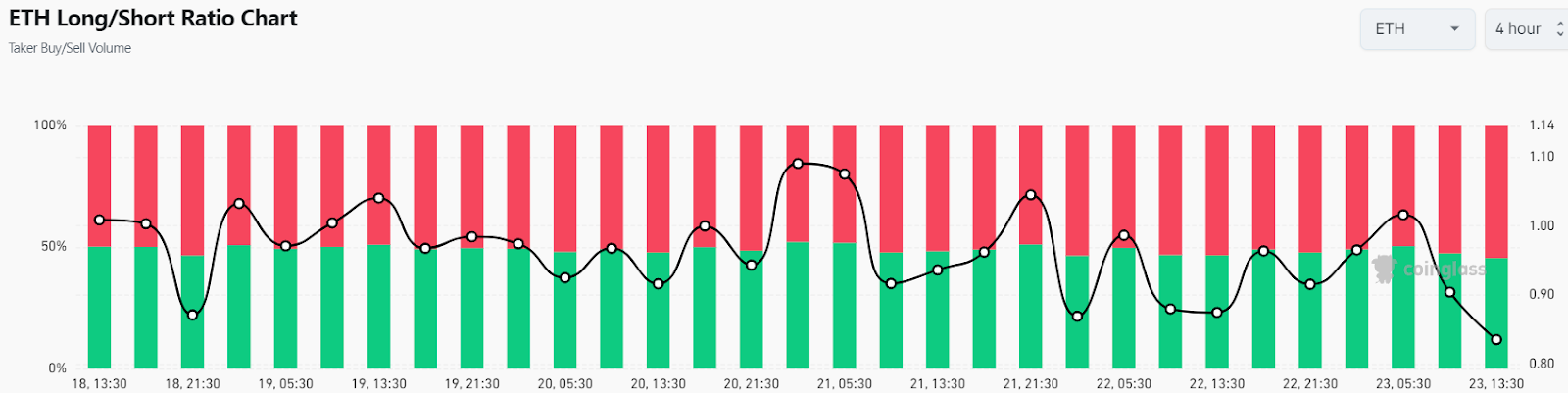

Currently, the ratio of long to short positions is decreasing significantly, with a current value of 0.8359, indicating a bearish sentiment. This suggests that approximately 55% of positions are short, anticipating a decline in the price of ETH. Conversely, 45% of positions are long, wagering on an increase in price.