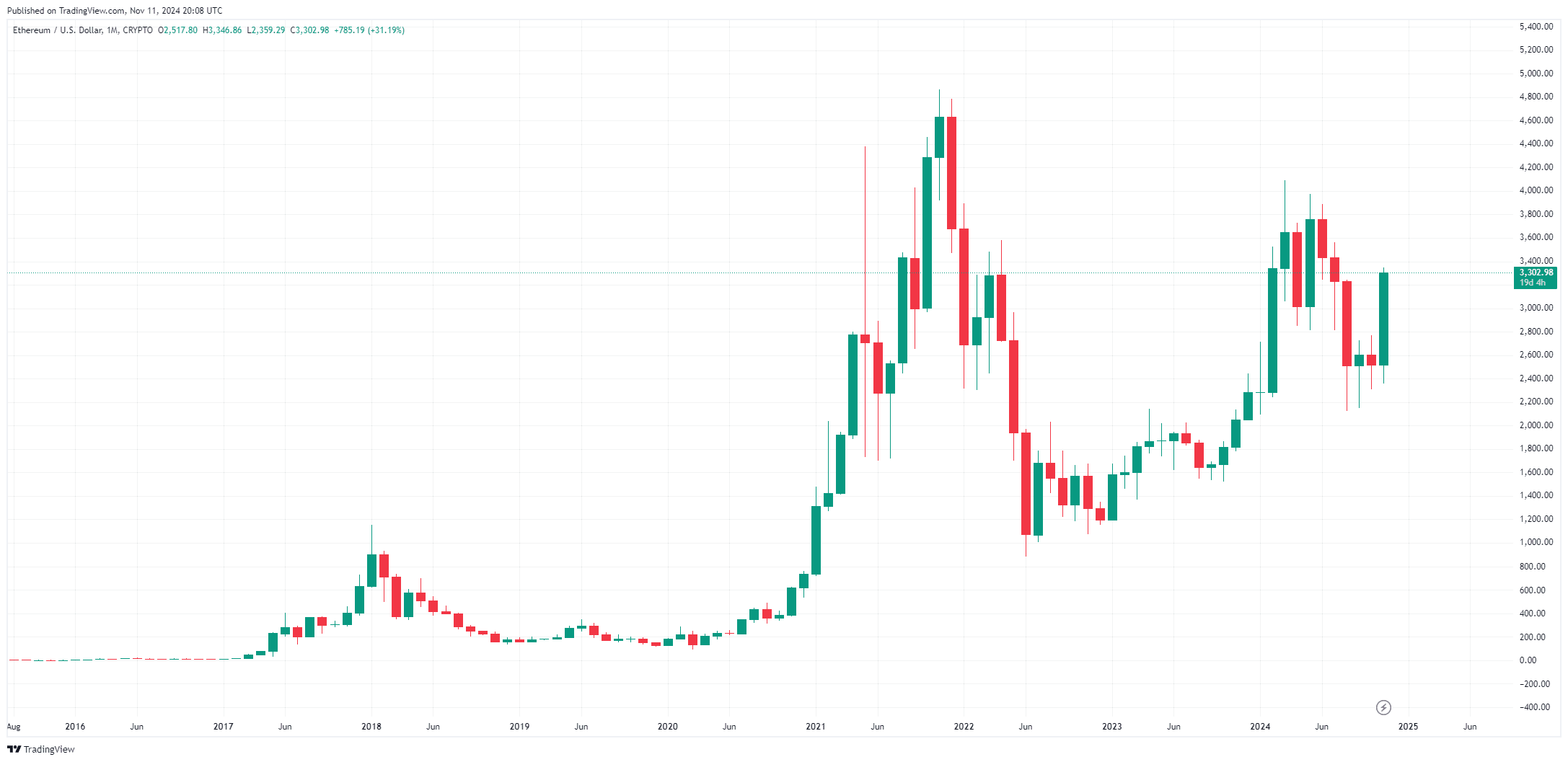

Ethereum (ETH) has captured significant attention with an unprecedented rise in investment inflows and a bullish surge in its weekly volume. Amid a remarkable 1,652% spike in ETF inflows and transaction volumes hitting record highs, Ethereum is positioned for potential new yearly highs and an extended bullish trend. Investors and traders are closely watching Ethereum’s performance as it consolidates, with the growing relevance of ETH in decentralized finance (DeFi) strengthening its role as a leading crypto asset. Just like Bitcoin and Solana have been surging to new highs and nearing new ranks, Ethereum is getting ready for its major breakout ever!

By TradingView – ETHUSD_2024-11-11 (3M)

Ethereum ETF Inflows: A New Record

Recent data from CoinShares highlights an impressive $1.98 billion inflow into cryptocurrency-based investment products, with Ethereum leading the charge. Ethereum-linked exchange-traded funds (ETFs) received a notable $157 million, marking a 1,652% weekly increase. This influx has propelled Ethereum ETFs to a cumulative $915 million inflow this year, underlining growing investor interest in traditional financial products linked to Ethereum. With Ethereum ETFs reaching a staggering $12.09 billion in assets under management, the altcoin is drawing increased adoption from those seeking alternatives to Bitcoin.

As analysts note, the surge in Ethereum’s inflows may be influenced by the current U.S. political landscape, where potential pro-crypto administrative shifts could benefit major cryptocurrencies. Ethereum’s established position as the primary alternative to Bitcoin makes it a prime candidate for this wave of interest, particularly given its applications in DeFi and blockchain innovations.

Ethereum Weekly Volume Hits New Highs

Ethereum has seen a substantial rise in trading activity, with weekly transaction volume surpassing $60 billion for the first time since July. According to IntoTheBlock, this boost in on-chain activity aligns with Ethereum’s 35% price increase, a promising sign of the network’s expanding interest and engagement. Ethereum is currently trading at $3,322, with a market capitalization of $400.29 billion and a 24-hour trading volume of $53.24 billion. A rally of this magnitude reflects a bullish breakout for ETH as it tests critical resistance levels, with investor optimism suggesting potential gains in the near future.

For ETH to sustain this upward trend, maintaining strength above current levels is essential. Many traders and analysts anticipate that Ethereum could achieve its yearly high if the momentum persists, with the broader market rally further supporting this outlook. This increased transaction volume, combined with ETH’s price rise, signals strong market confidence, which could solidify Ethereum’s bullish trajectory.

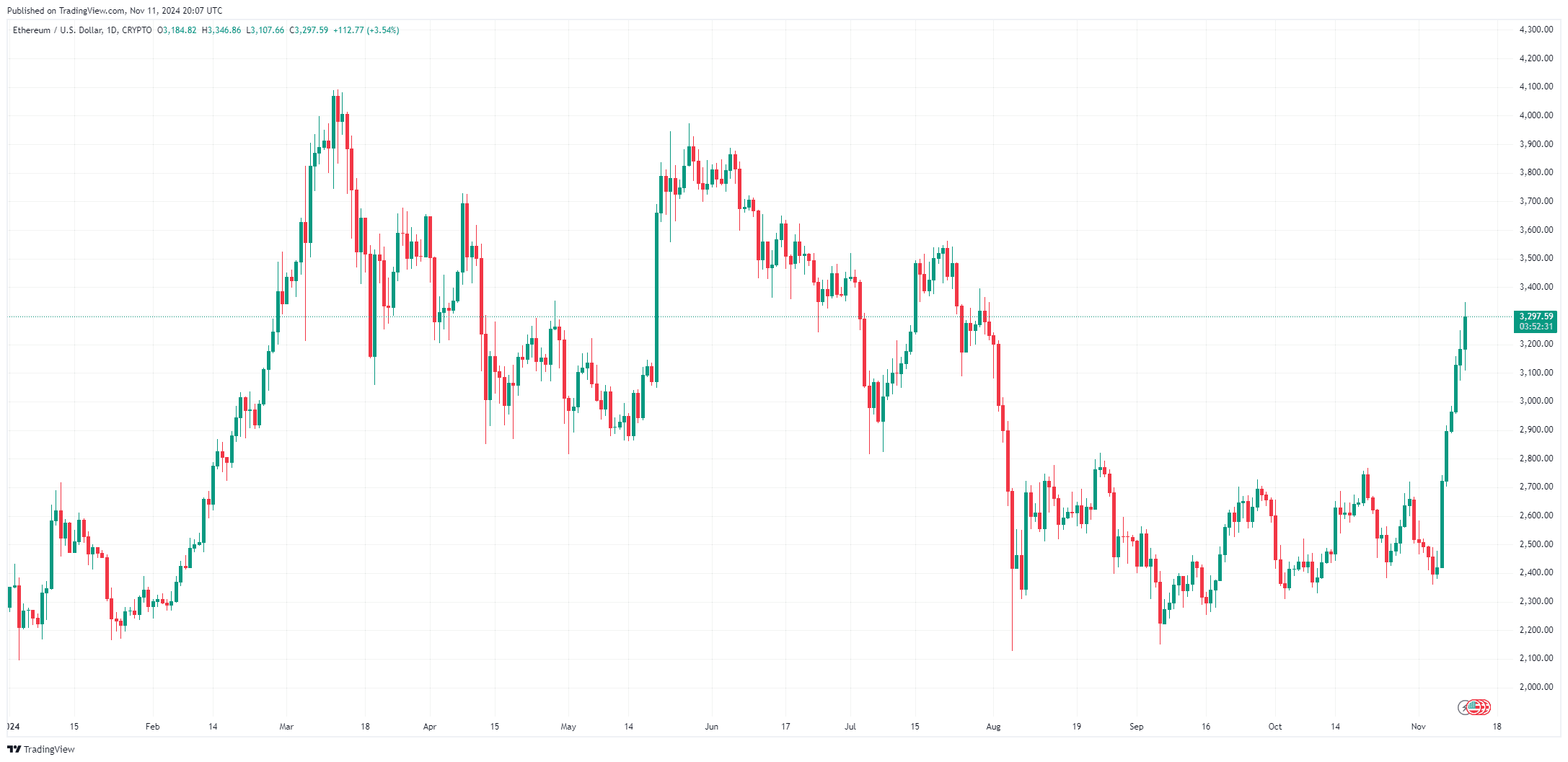

By TradingView – ETHUSD_2024-11-11 (YTD)

Ethereum Bullish Trend Amid Consolidation Phase

Following nearly eight months of consistent downtrend, Ethereum has embarked on a bullish reversal, supported by significant accumulation from “smart money” investors. The recent Ethereum price action shows a pivot from subdued activity to rapid growth, driven by renewed interest across trading platforms. IntoTheBlock data reveals Ethereum’s mainnet facilitated nearly $60 billion in transactions over the past week, indicating that both retail and institutional investors are actively trading and accumulating ETH.

Ethereum consolidates above $3,300, as currently trading around $3,322 after reaching a local high of $3,250. This consolidation phase could provide ETH price the stability needed to prepare for its next breakout, with support at the crucial $2,950 level aligning with the 200-day moving average (MA). Holding above this level would reaffirm bullish sentiment and may lead Ethereum toward a new target of $3,500. This level of support is essential for sustaining Ethereum’s momentum, with market analysts watching closely for a potential move toward the $4,000 yearly high.

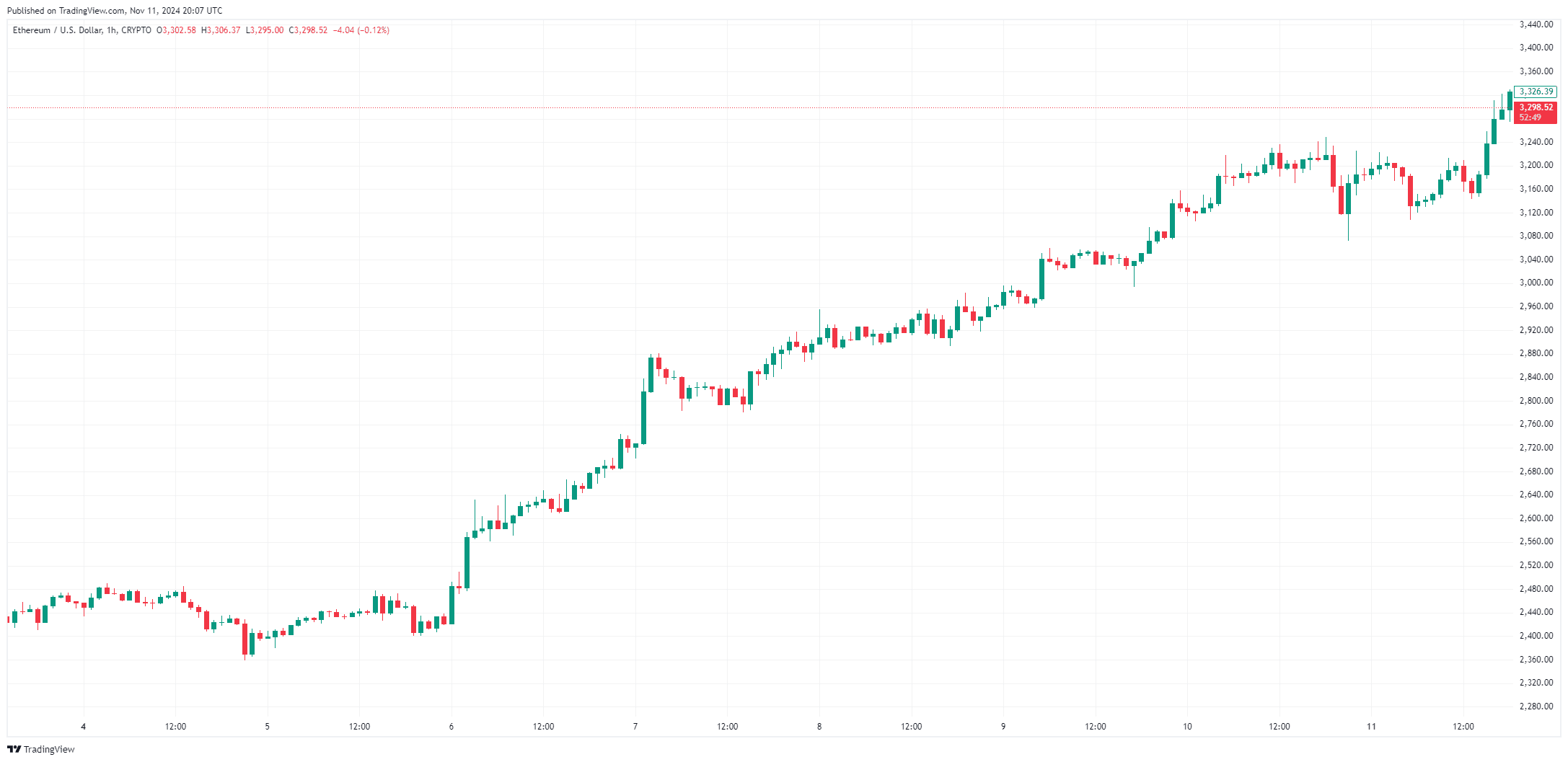

By TradingView – ETHUSD_2024-11-11 (5D)

Ethereum Price Is Getting Ready For Its Major Breakout EVER

The current consolidation period presents a strategic opportunity for Ethereum to gather momentum while absorbing any immediate selling pressure. With its growing relevance in DeFi and broader blockchain adoption, Ethereum is not only a speculative asset but increasingly viewed as a store of value. If Ethereum sustains support above key technical levels, it may soon experience another rally, positioning it for possible new all-time highs alongside broader market optimism.

Ethereum’s strength above the 200-day MA is pivotal for confirming a long-term bullish trend. While Ethereum faces volatility as trading activity heats up, the consensus among analysts is that it has the potential to break through its $4,000 target, marking a crucial milestone in its ongoing ascent.

By TradingView – ETHUSD_2024-11-11 (All)