When the Ethereum Foundation dropped a thread on Jan. 19 claiming “Ethereum is the #1 choice for global financial institutions” and backing it with 35 cited examples, it moved past the standard protocol update or developer announcement.

It read like institutional marketing: a ranked claim, a curated evidence stack, and a call-to-action funnel pointing readers to an owned landing page where financial institutions can browse live metrics and click “Get In Touch.”

That shift in tone and structure matters because it signals something more strategic than routine developer communications.

The Foundation is documenting what’s happening on Ethereum while also actively fighting for control of the narrative about which blockchain institutions will choose as their settlement layer.

And it’s doing so at a moment when competing rails, particularly Solana, have been gaining mainstream credibility in institutional tokenization stories, while Ethereum itself has been painted as slowing down.

The question isn’t whether the 35 stories are real. The question is why the Foundation chose this moment to package them into a public-facing narrative weapon, and what changed inside and outside the organization to make that move legible.

Is Ethereum comms centralized?

The clearest internal explanation is structural. In 2025, the Ethereum Foundation formalized “Comms & marketing” as an explicit management focus area, assigning it to Josh Stark as part of a broader effort to strengthen execution.

That’s a shift from the Foundation’s historically decentralized, developer-centric communications posture. Making narrative work someone’s formal responsibility means the organization can now mount coordinated, institution-facing campaigns rather than relying on ad-hoc community evangelism.

The institutions portal, institutions.ethereum.org, wasn’t thrown together for the January thread. It’s a fully built funnel with a Data Hub that displays real-time network metrics, including ETH staked, stablecoin TVL, tokenized real-world assets, DeFi TVL, and layer-2 counts.

Additionally, the funnel includes a Library that explicitly references the Foundation’s Enterprise Acceleration team’s thought leadership and updates.

The Jan. 19 post functions as top-of-funnel distribution for an already-live institutional landing page, not as a standalone announcement. That’s marketing infrastructure, not developer relations.

The story being told about Ethereum changed

Two external pressures made staying quiet costly.

First, competing institutional tokenization narratives have increasingly been attached to non-Ethereum rails. R3, the enterprise blockchain consortium whose clients include major banks, announced a collaboration with Solana in late 2024, framing it as bringing “big bank” tokenization efforts onto Solana’s infrastructure.

R3 followed up with plans for a Solana-native “Corda protocol” yield vault slated for the first half of 2026, adding more oxygen to the “institutions-on-Solana” storyline.

That’s a direct challenge to Ethereum’s positioning as the default institutional settlement layer.

Additionally, data from rwa.xyz shows that Ethereum grew by 3.72% in the tokenized real-world asset (RWA) market over the past 30 days. However, Solana, BNB Chain, and Stellar registered growth of 15.9%, 20.4%, and 35.3%, respectively, in the same period.

Although these three blockchains account for just 33% of Ethereum’s total market share, the accelerated growth rate raises an alert.

Second, mainstream outlets began framing Ethereum as losing momentum. The Financial Times explicitly used “midlife crisis” language, contrasting Ethereum with faster, cheaper rivals and questioning whether the network could maintain its dominance amid intensifying competition.

That kind of framing, published in an outlet read by the exact institutional decision-makers Ethereum wants to attract, raises the reputational cost of silence.

Put together, the Foundation faced both competitive narrative pressure and reputational framing pressure. A proactive “here are the receipts” post becomes legible as a response to the story being told about Ethereum, not a reaction to any single new development.

What the 35 stories actually prove and why it matters now

Not all of the 35 items carry equal weight, and treating the thread as a truth table rather than a press release reveals useful nuance.

Several claims are verifiably live with measurable activity. Kraken launched xStocks on Ethereum. Fidelity issued its FDIT tokenized money market fund on the network. Amundi tokenized a share class of its CASH EUR money market fund.

JPMorgan issued its deposit token on Base, an Ethereum layer-2. Société Générale’s SG-FORGE deployed its EURCV and USDCV stablecoins on DeFi protocols like Morpho and Uniswap. Stripe built stablecoin-based recurring billing into its payments stack.

These are real products with issuer announcements, on-chain contracts, and in some cases disclosed volume or assets under management.

The timing reflects a genuine shift in the competitive landscape for institutional adoption.

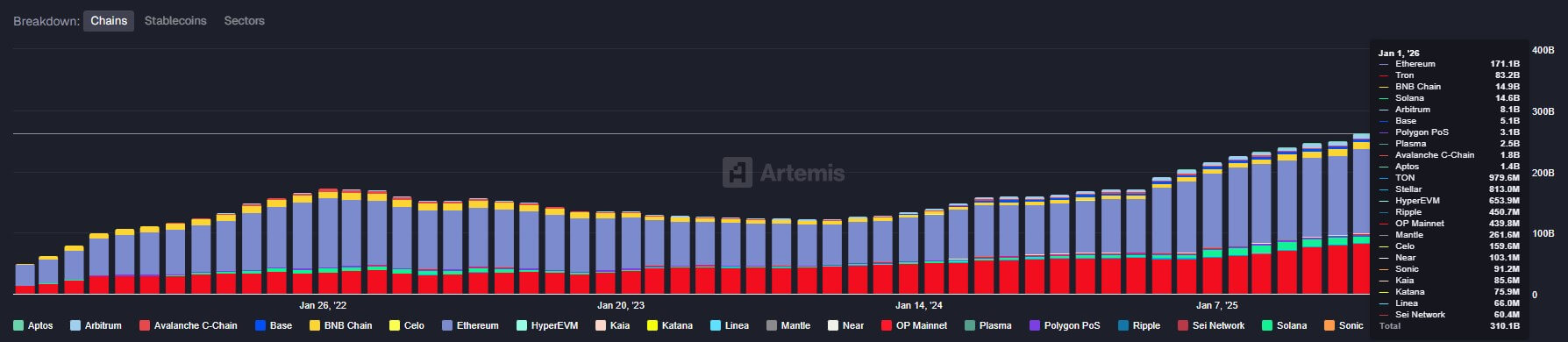

The global stablecoin market capitalization sits around $311 billion, with roughly $188 billion issued on the Ethereum ecosystem, whether on the mainnet or layer-2 blockchains.

Tokenized real-world assets tracked by RWA.xyz total roughly $21.66 billion in distributed value.

Those numbers are large enough that the “which chain wins institutions” question is no longer niche, but contested terrain with real economic stakes.

Ethereum retains structural advantages: the deepest liquidity, the most established DeFi protocols, the broadest developer ecosystem, and a multi-year head start in institutional experimentation.

However, advantages erode if the narrative shifts.

If decision-makers at banks, asset managers, and fintechs begin internalizing the story that Solana is faster, cheaper, and more aligned with institutional needs, those perceptions can become self-fulfilling as liquidity and developer attention migrate.

The same happens if these institutions believe that Ethereum is slowing down under its own weight.

The Foundation’s response appears to contest that narrative directly by arguing that Ethereum already serves as the institutional liquidity layer, backed by a curated stack of proof points and a self-service portal where institutions can verify claims and make contact.

That’s a deliberate attempt to win narrative share before the perception gap becomes an adoption gap.

The real signal

The Jan. 19 post isn’t important because it reveals new institutional deals. It’s important because it reveals that the Ethereum Foundation now treats narrative control as a formal organizational capability rather than a byproduct of developer evangelism.

The publication, the institutions’ portal, the formalized comms structure, and the explicit funding of narrative-focused initiatives like Etherealize all point in the same direction: the Foundation has decided that winning the institutional adoption story requires more than building good infrastructure.

Tapping institutional interest also requires actively shaping how that infrastructure is perceived by the institutions it wants to attract.

Whether that strategy works depends less on the quality of the 35 stories than on whether the underlying claim, that Ethereum is the default institutional settlement layer, remains true as competitors build competing rails and mainstream outlets question Ethereum’s momentum.

The Foundation is betting that proactive narrative work can prevent perception from drifting away from reality. The risk is that reality itself shifts while the Foundation is busy defending its story.