[ad_1]

Data shows the Ethereum funding rates have been quite negative in recent days. Here’s what this could mean for the cryptocurrency’s price.

Ethereum Funding Rates Have Been Under The Zero Mark Recently

As explained by an analyst in a CryptoQuant post, a short squeeze may be a possibility for the asset currently. The “funding rate” is an indicator that keeps track of the periodic fees that traders on the futures market are exchanging with each other.

When the value of this metric is positive, it means that the long contract holders are paying a premium to the short holders right now. Such a trend implies the longs outweigh the shorts currently, and hence, a bullish mentality is the dominant force in the sector.

On the other hand, negative values suggest the majority of the futures market users share a bearish sentiment at the moment as the shorts are the ones paying a fee.

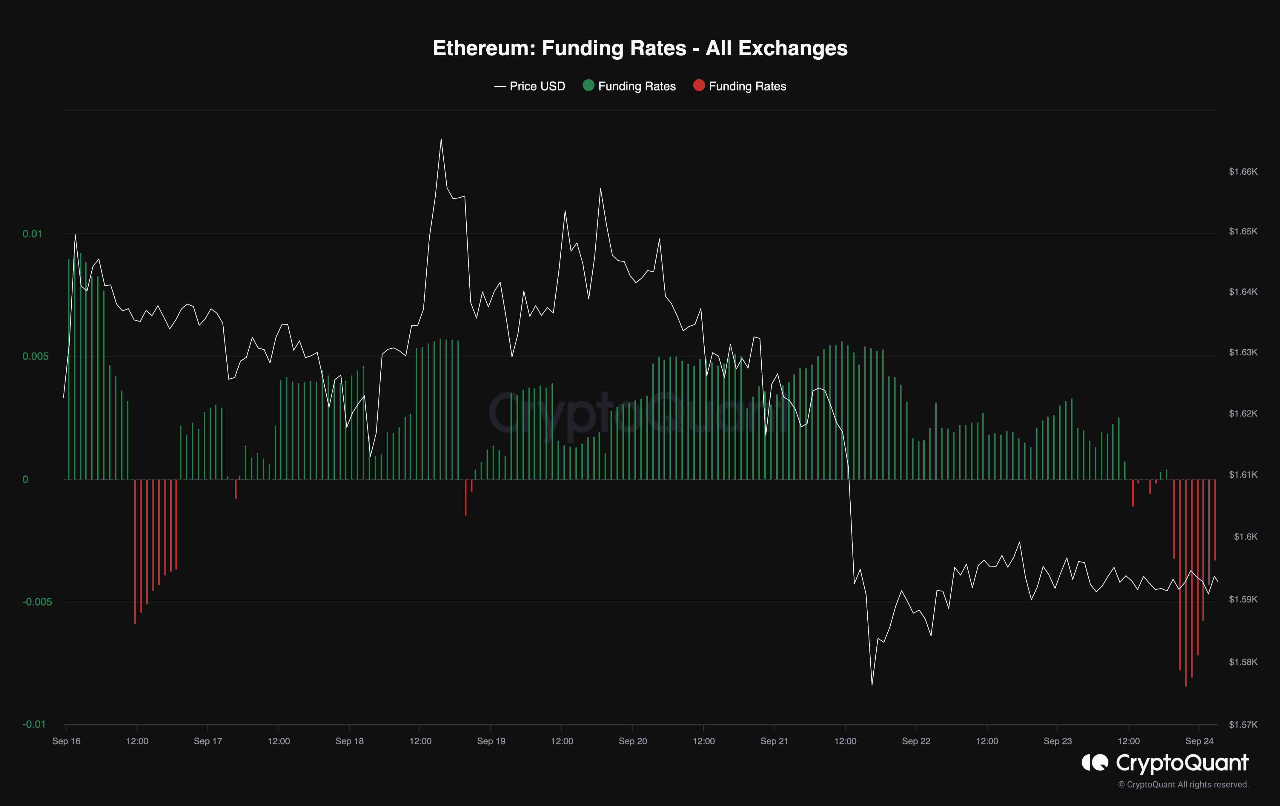

Now, here is a chart that shows the trend in the Ethereum funding rates over the past week:

Looks like the value of the metric has been quite negative in recent days | Source: CryptoQuant

As displayed in the above graph, the Ethereum funding rates had been positive until just a couple of days back, implying that the majority of the futures traders had been betting on the asset’s price to go up.

The metric’s value has plunged to the negative zone during the past day or so, however, suggesting that a complete flip in mentality has occurred among the investors.

This bearish sentiment, though, may not necessarily be bad for the price. This is because the more the mentality has become skewed in one direction historically, the more probable the price of the cryptocurrency has become to show a sharp move in the opposite direction.

One major reason why this happens is that mass liquidation events, which are popularly called “squeezes,” are more likely to involve the dominant side of the futures market.

During a squeeze, a sudden swing in the price ends up liquidating a large amount of contracts at once. Such liquidations only provide fuel for the price move that caused them, thus amplifying it further. This can lead to a cascade of more liquidations.

As shorts have piled up in the Ethereum futures market recently, the probability of a short squeeze occurring would be elevated. Naturally, if such an event does take place, the asset’s value could see a sharp rebound.

This doesn’t necessarily have to happen, of course, and if it does, it may not be soon. From the chart, it’s visible that the funding rate had remained at notable positive values for a while before the ETH price finally registered its plunge.

ETH Price

Ethereum has taken a hit of more than 3% during the past week as the asset’s price is now trading under the $1,600 level.

ETH has gone down in the last few days | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]