Ethereum has entered a critical phase as on-chain signals, technical structures, and institutional positioning converge again. Market observers report renewed interest after months of consolidation.

Consequently, analysts now revisit long-term upside scenarios, including a potential return toward the $5,000 level. The shift comes as Ethereum shows improving network engagement while price action stabilizes near key demand zones.

Besides price movement, validator activity has drawn attention across the market. Ethereum currently records heavy traffic in both entry and exit queues. More than 772,000 ETH now waits to enter staking, with activation delays extending beyond 13 days.

Meanwhile, exit queues hold over 288,000 ETH, signaling balanced participation rather than panic withdrawals. Hence, the data suggests long-term conviction rather than short-term speculation.

Additionally, Ethereum’s validator base continues expanding. Nearly one million validators now secure approximately 35.5 million ETH. That figure represents over 29% of total supply.

Staking yields hover near 2.85%, reinforcing Ethereum’s role as a yield-bearing network asset. Consequently, rising staking demand reduces liquid supply during periods of market uncertainty.

Network Strength Builds Beneath the Surface

Source: CoinCodex

Ethereum’s price trades near $2,970 after modest daily and weekly gains according to CoinCodex data. However, the broader trend remains corrective.

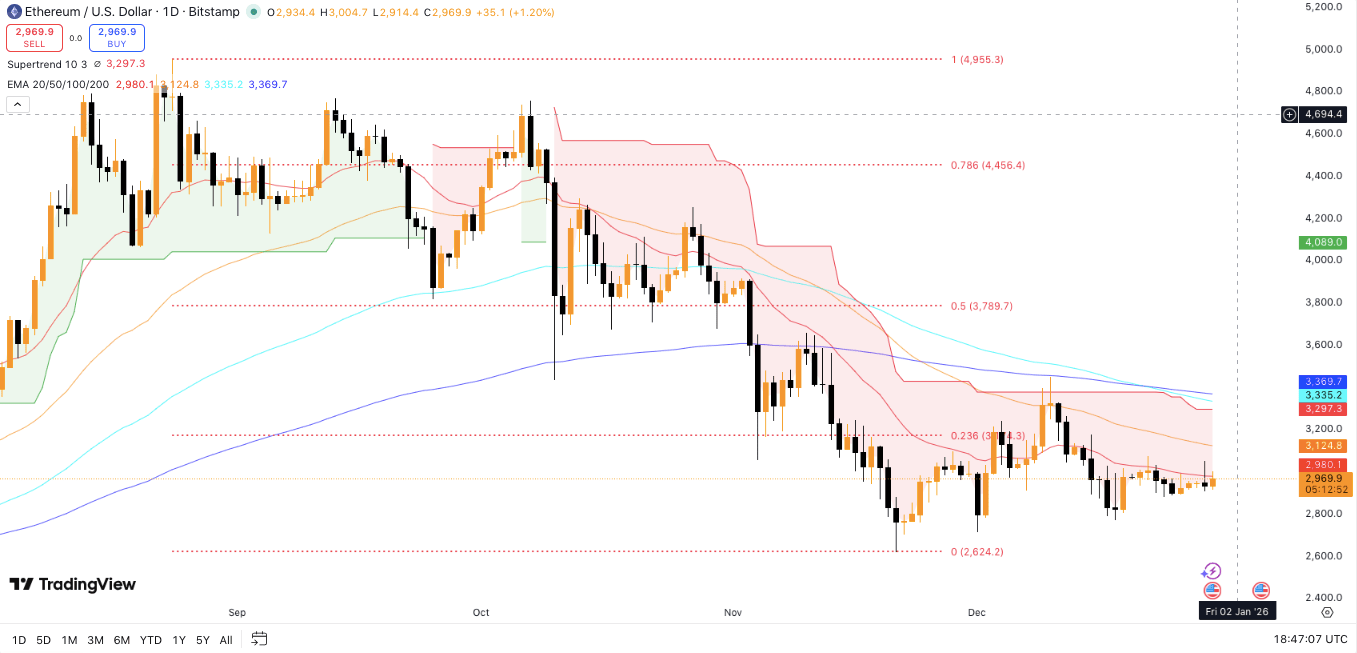

ETH Price currently sits below all major moving averages. The 200-day EMA near $3,369 continues acting as heavy resistance. Moreover, the Supertrend indicator remains bearish, reinforcing cautious short-term sentiment.

ETH Price Dynamics (Source: Trading View)

However, downside momentum appears to slow. Ethereum continues holding above the $2,950 to $3,000 range. Significantly, price also stays well above the prior cycle low near $2,624. That behavior suggests base formation rather than distribution. Hence, traders increasingly monitor breakout levels instead of new lows.

Technical projections outline several upside scenarios. A daily close above $3,125 could signal early trend improvement. That move would open room toward $3,350 and $3,400. Such a rally implies roughly 13% upside from current levels. Additionally, reclaiming the 200-day EMA could unlock further momentum toward $3,790.

Beyond that level, analysts track the $4,450 to $4,800 zone. A sustained breakout there could revive broader bullish continuation. Consequently, long-term projections again extend toward the $4,955 to $5,000 region.

Analyst Structure and ETH Institutional Accumulation

Titan of Crypto has pointed to Ethereum’s deep retracement from its prior impulsive move. The analyst highlighted $2,750 as a critical level to monitor during consolidation. Historically, similar retracement zones preceded strong recoveries during prior cycles.

Moreover, Bitcoinsensus has identified a Wyckoff Accumulation structure forming on Ethereum’s higher timeframes. The pattern suggests late-stage consolidation with potential strength expansion. Phase D characteristics often precede decisive trend reversals when confirmed by volume.

Institutional behavior further supports the narrative. Tom Lee’s Bitmine has significantly expanded its Ethereum holdings. The firm added over 44,000 ETH in a recent purchase valued near $130 million. Consequently, Bitmine now controls roughly 4.11 million ETH.

Additionally, Bitmine has already staked more than 408,000 ETH. The firm plans further validator expansion through the MAVAN network beginning in 2026. Its strategy focuses on long-term accumulation and yield optimization. Hence, institutional confidence aligns with improving on-chain metrics.