[ad_1]

Ethereum (ETH) traded around the $2,200 range, emerging from a recent dip under $2,000. At this position, ETH is showing signals of being undervalued based on its historical performance.

Ethereum (ETH) has been actively traded in the past three months, as whales strategically rolled over their positions. The decision to avoid holding and sell near local tops has been one of the reasons for the ETH price weakness.

Whales, on the other hand, tried to reabsorb ETH at a lower price, achieving a generally lower average. Holders with accumulation at $3,500 were the first to distribute their coins, then return for more buying around the $2,500 range.

Buyers that first accumulated ETH at $3,500 used active selling and re-buying to decrease their cost basis to $3,200.

Actively trading whales also sold near the local top of $2,500, re-buying lower. Most ETH rallies were used to re-distribute coins, as ETH showed a long-term downward trend. ETH is also down to 0.025 BTC, keeping traders on the alert for additional price dips.

ETH enters underpriced zone

Close to $2,000, ETH is now touching the undervalued zone based on a ratio of market price to realized price. The active selling meant whales retained a higher realized value, while the current market value was underpriced in comparison.

The Market Value to Realized Value (MVRV) ratio is giving an underpriced signal when it falls below 1. Values below 1 mean a chance to buy at levels close to the average purchase price for both retail and whale buyers.

Accumulating at this level, however, does not guarantee a rally, as there are also bearish predictions for more ETH capitulations.

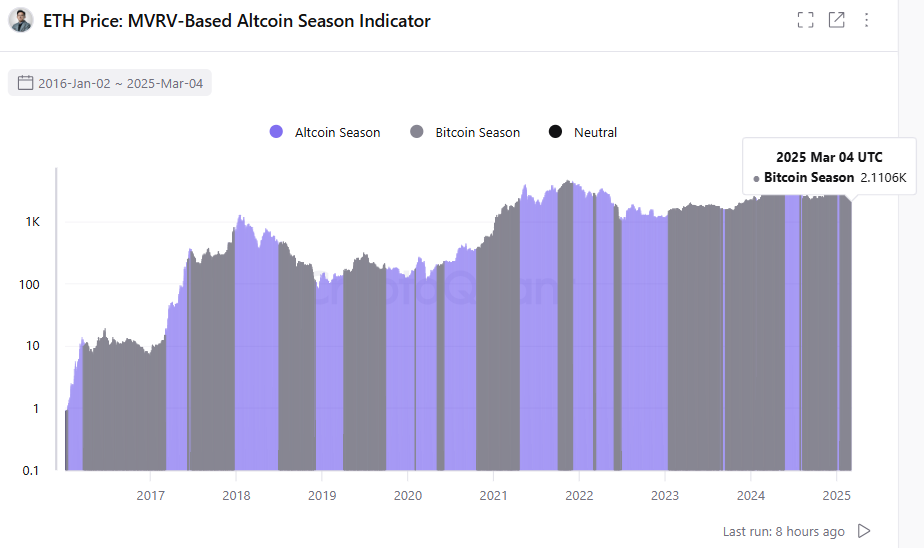

The current MVRV chart for Ethereum is also historically showing the market is in a Bitcoin season. The current values suggest ETH and altcoins may be underpriced compared to previous cycles.

ETH realized price also indicates a Bitcoin season, with altcoins undervalued. | Source: Cryptoquant

The current price levels are still not a guarantee for a rally, as some altcoins have lost their appeal and may have a difficulty in rebuilding demand.

ETH remains a controversial bid

ETH has been showing an oversold signal for weeks, but this has not led to a price rally. One of the reasons is the attempt to realize gains fast, while re-buying near lows. ETH whales have expected a rally above $4,000, later attempting to lower their average entry price.

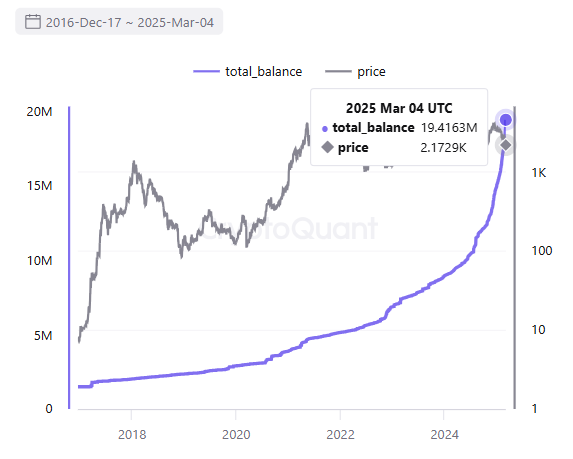

Despite the price weakness, ETH has been entering more accumulation addresses. ETH retains its utility as part of the DeFi ecosystem, and can be used as collateral or as a liquidity token. ETH saw a peak inflow into accumulation addresses in January.

In total, over 19M ETH are held in accumulation addresses. ETH is relatively more accessible than BTC, and shows different behaviors for its cohorts of holders.

Ethereum (ETH) is flowing into accumulation addresses, but whales are not acting as long-term holders. | Source: Cryptoquant

Overall, small-scale holders of 100-1000 ETH have realized the highest price at over $2,600. Some of the biggest ETH whales, which may also correspond to DeFi addresses or pools, have the lowest realized price at around $2,300. For ETH, the larger the whale’s holdings, the lower the realized price.

The current staked ETH realized price is at $2,775, suggesting some stakers may be underwater. The $2,800 level is seen as one possible selling point, where a big cohort of holders may decide to sell. Based on current data, staked ETH is also in the undervalued zone. Any hike above $2,800 would be beneficial to the entire ETH DeFi ecosystem, leading to expanded value, more secure loan opportunities and higher earnings.

ETH is currently pressured as there is still a loss of belief in the utility of the network. While ETH still carries multiple legacy projects, the chain has not reached the promised levels of growth. The Ethereum Foundation’s approach is also seen as too abstract, leading to stagnant price growth.

[ad_2]