Ethereum (ETH) is showing signs of a likely recovery as market analysts predict a price range between $4,000 and $8,000 in the coming months. Technical patterns, on-chain data, and institutional interest further reinforce this outlook, indicating the token may be preparing for a strong upward move.

Ethereum (ETH) Holds Above Key Support as Analysts Predict Breakout

Ethereum has maintained a long-term ascending trendline despite recent market volatility. According to Crypto General, the cryptocurrency has been respecting this trendline with no intentions of breaking below it anytime soon, suggesting that the asset is still in a bullish structure.

Yet the token’s price has been consolidating, but analysts believe it could soon attempt to break past key resistance levels. Meanwhile, a chart shared by market analyst Ted shows that the ETH cryptocurrency has recently broken out of a symmetrical triangle pattern, which historically signals the start of an uptrend.

$ETH worst seems to be over.

Big network upgrades are coming next month along with the approval of staking features for Ethereum ETFs.

We are just one god candle away from $4K.🚀 pic.twitter.com/sKcSsrXyqh

— Ted (@TedPillows) February 14, 2025

The analyst also pointed out that major network upgrades and the possible approval of staking features for Ethereum ETFs could serve as catalysts for price growth. As a result, Ted stated that Ethereum is just “one god candle away” from reaching $4K.

Key Resistance Levels That Could Drive ETH Higher

The ETH token currently trades above $2,600, and analysts have outlined key resistance zones that could determine its next move. For instance, the chart by Crypto General marks $4,104, $4,110, $4,817, and $6,082 as critical price levels. If Ethereum surpasses these resistance zones, the price could accelerate toward the higher range of $6,000 to $8,000.

The cryptocurrency’s breakout from a long-term consolidation phase strengthens the argument for an upward move. Analysts emphasize that the market structure remains bullish as long as ETH respects the trendline and holds key support levels.

On-Chain Data Shows Growing Accumulation by Large Holders

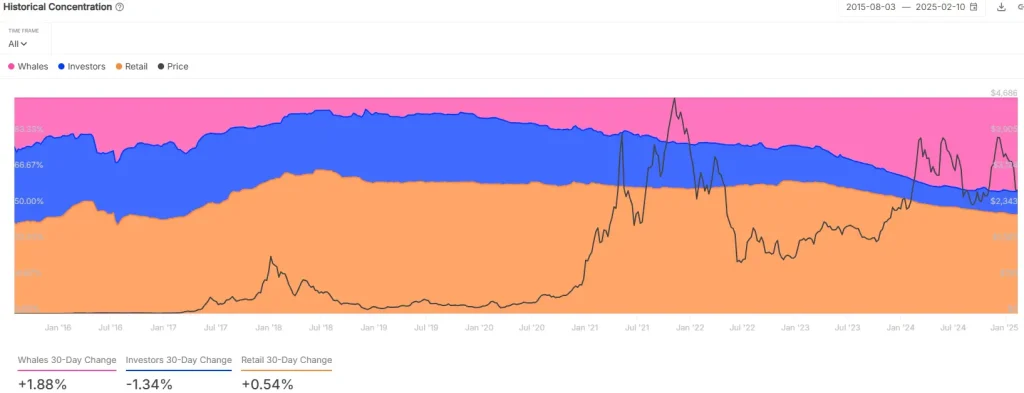

Ethereum’s Historical Concentration data shows that whales and retail investors have increased their holdings. As of February, whales control 43.61% of the ETH token supply, while retail investors hold 45.8%. Over the past month, whale holdings have risen by 1.88%, while retail investors added 0.54% to their holdings.

The Global In/Out of the Money metric indicates that 74.64% of ETH cryptocurrency holders are in profit at current prices. The largest accumulation zone is between $2,257 and $2,578, which suggests this range is a strong support area.