Ethereum (ETH) once again dipped to extremely low fees, showing the outflow of users. Gas prices moved down under 1 gWEI, or as low as $0.06 for regular transactions.

Ethereum (ETH) signals lowered demand for transactions, as gas fees slide under 1 gWEI. This is the first period of low fees since September 2024, as ETH continues to trade around $2,700 with a more bearish sentiment.

Ethereum gas fees fell as low as $0.06 based on their valuation under 1 gWEI, after an outflow of activity from the network. | Source: Etherscan

As a result, basic swaps went as low as $0.06, while complex routing, NFT actions, token swaps and other on-chain activities slid under $1. The cheap gas conditions appeared a few days ago, but the drop under 1 gWEI only happened in the past 24 hours. ETH can still have spikes in activity and gas prices. The recently low gas fees are also used to renew the XEN token minting contract.

Ethereum until recently levied fees for some of the swaps of over $25, making it usable only for older crypto holders and whales. The chain, however, drove out users who wanted to play with small sums, as even a simple swap or bridging transaction destroyed profits. As a result, daily active users fell toward 477K in 24 hours, after a brief spike above 700K per day at the end of January.

As a result of the low gas fees, ETH production is also expanding, with inflation at 0.56%. Each week, another 12,345.53 ETH are distributed to validators.

The slowdown of usage is not only affecting Ethereum, but its entire L2 ecosystem. Blob fees are back to negligible levels, falling from around 84 ETH per day down to 62.65 ETH from all L2. Those fees are burned to diminish the supply of ETH, but the burn has slowed down lately. Active addresses on all L2 chains are down 24% for the past week, sliding from an all-time peak at the end of January.

Even Base counts a 30% slide in its daily transaction count since its peak in early January. Most chains are also paying significantly lower rents to the L1 Ethereum layer, down over 90% in the past week. The low L1 rent signals diminished usage in addition to the optimized schedule.

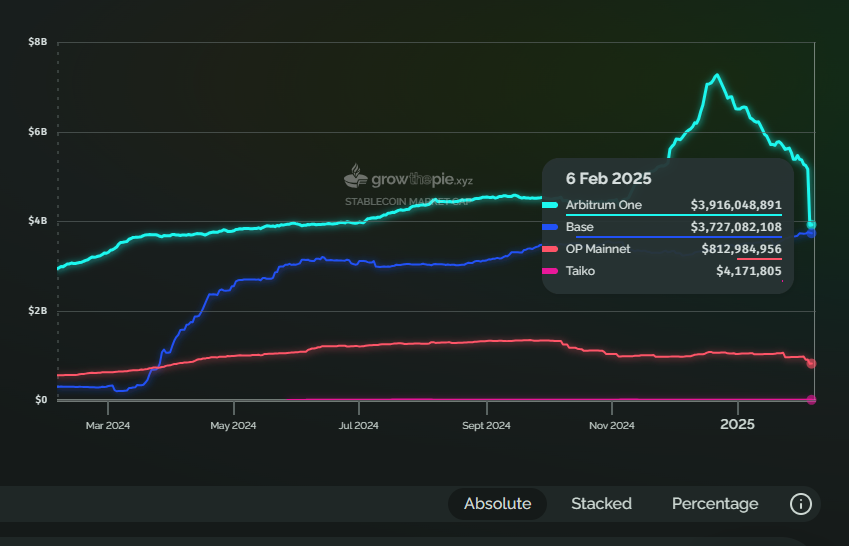

The other big shift for L2 chains is the outflow of stablecoins. Arbitrum’s supply peaked over $7B, then saw a series of outflows to Ethereum, retaining just 3.91B.

Arbitrum (ARB) saw the biggest outflow of stablecoins as Tether readjusted its token balances for USDT. | Source: GrowThePie

The outflow of users and liquidity from the Ethereum ecosystem sets a question on the future of having an altcoin market. Ethereum remains the most common chain for new projects, including the still-ongoing VC-backed and ICO launches. However, a weakening demand from users puts a question on whether the market will be able to absorb those tokens.

Traffic shifts to Phantom and the Solana ecosystem

After traffic shifted to the Solana ecosystem, all related apps are getting ahead of Ethereum in terms of fees. Briefly, Phantom wallet went ahead of Ethereum in terms of 24-hour fees. On a usual day, the wallet brings in over $469K, with up to $30.54M on a monthly basis. Phantom’s activity rallied just after the announcement of adding wider multi-chain and multi-currency support. As Solana and meme token usage turned global, Phantom now reflects asset prices in 16 world currencies.

Solana’s main ecosystem apps, Jito, Raydium, Pump.fun and Meteora are still among the top 10 fee producers. The chain shows a shift in users, as small-scale traders pick Solana as a high-risk, high-return venue.

Ethereum, however, is not entirely lost. The chain still carries high-scale DeFi activity, while holding enough liquidity to satisfy whale-sized trades and transactions.

Tether and Circle remain the two busiest fee producers, as stablecoins are still Ethereum’s main use case. More USDT has flowed back to Ethereum due to its higher liquidity and access to centralized exchanges. Ethena (ENA) is also the second-biggest producer of fees in the past 24 hours, after market volatility tested the resilience of USDe and sUSDe.

The current Ethereum activity reflects the recent market capitulation of ETH. Open interest crashed in the past week, from $16B down to $11B after a series of liquidations. ETH traded at $2,736.96, with negative funding rates on Kraken and Deribit. Despite the recent liquidation, nearly 70% of positions are still longing ETH.

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews – FREE Cheat Sheet