The Bybit Hack has shaken the market today, with over $1.46 billion in ETH stolen, marking one of the largest security breaches in history. As the stolen assets are being liquidated, Ethereum’s price dropped by 5% in a straight line, impacting key technical indicators.

Speculation is growing about Bybit’s next moves, with some suggesting a potential market buyback to compensate users, which could create significant buying pressure. However, it remains uncertain how Ethereum’s price will behave in the coming days as the situation continues to unfold.

Will Bybit Hack Lead to a Strong Buyback?

Earlier today, one of the largest crypto exchanges, Bybit, was hacked. Over $1.46 billion worth of Ethereum was stolen from its hot wallets, marking one of the largest security breaches in crypto history.

CEO Ben Zhou confirmed that attackers tricked Bybit’s security system, leading wallet signers to unknowingly approve changes to the smart contract logic, giving the hacker control.

The stolen ETH is being liquidated, causing Ethereum’s price to drop by over 4%. After the assets were stolen, the hacker’s addresses started to send money to dozens of different wallets.

Bybit Hacker Transfers. Source: Nansen.

Some users are speculating about Bybit’s next moves to recover users’ funds.

Some analysts claim that if Bybit can’t recover the stolen $1.5 billion, they might market-buy ETH to maintain users’ funds, potentially creating bullish buy pressure. However, nothing guarantees this will happen or when, as Bybit’s next steps are still unfolding.

Recently, Arkham published on X that a Bybit Cold wallet transferred more than $500 million to another Bybit wallet, suggesting the exchange could be getting ready to prepare funds for user reimbursements following the hack.

Indicators Suggest Stolen Assets Impacted Ethereum Price

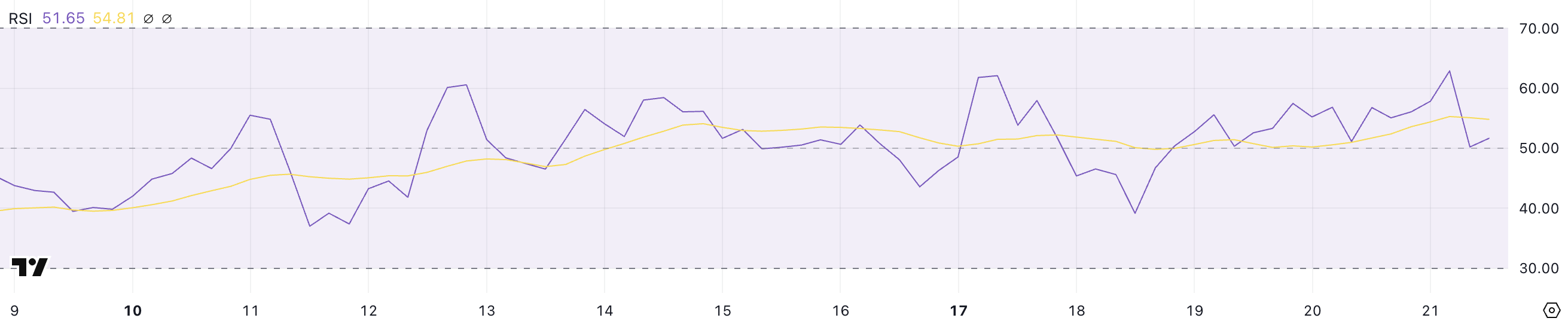

The recent hack impacting Bybit caused Ethereum’s Relative Strength Index (RSI) to drop sharply from 62.8 to 51.6 in just a few hours.

This rapid decline indicates a sudden loss of buying momentum, reflecting increased selling pressure as the stolen ETH was liquidated.

Although the RSI is still above the neutral 50 mark, the sharp drop suggests that bullish sentiment has weakened considerably.

ETH RSI. Source: TradingView.

With ETH’s RSI at 51.6, it remains in a neutral zone, showing balanced buying and selling pressure. Notably, ETH’s RSI has been neutral since February 3, reflecting a period of consolidation and market indecision.

If the RSI drops below 50, it could signal bearish momentum, while a rise above 60 would indicate renewed buying interest.

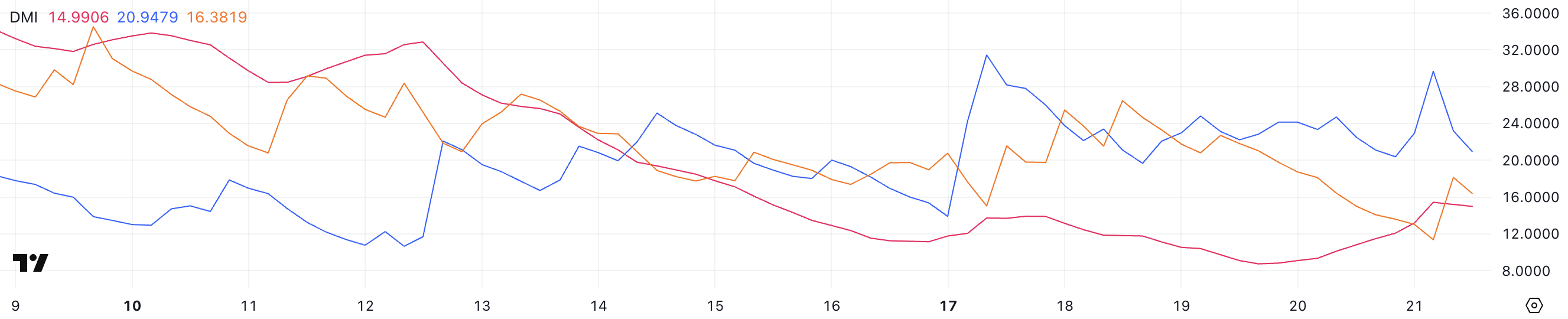

Ethereum’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) is currently at 14.9, indicating a weak trend.

ETH DMI. Source: TradingView.

Meanwhile, the +DI has dropped from 29.6 to 20.94, showing a decline in buying pressure since the Bybit hack. Conversely, the -DI has risen from 11.3 to 16.3, demonstrating selling pressure as the stolen Ethereum has been liquidated.

This shift suggests a change in market sentiment, with sellers gaining more control over the price movement.

The ADX measures trend strength, with values below 20 indicating a weak or non-existent trend, regardless of direction. The decline in +DI and rise in -DI suggest that bullish momentum has weakened while bearish pressure is increasing.

With the ADX still low, ETH is likely to remain in a consolidation phase, lacking strong directional movement. However, if -DI continues to rise above +DI, ETH could face more selling pressure, potentially leading to a further price decline.

How Will Ethereum’s Market Change Following the Hack?

If liquidations continue or user confidence weakens following the Bybit hack, ETH could soon test the support at $2,551.

A break below this level could lead to a decline toward $2,160, signaling increased selling pressure.

ETH Price Analysis. Source: TradingView.

Conversely, if Bybit manages to recover the stolen assets or if significant buying pressure emerges, ETH price could test the resistance at $3,020. Breaking this level could push the price higher to $3,442, its highest point since the end of January.