Ethereum reached a notable milestone earlier this month when the US Securities and Exchange Commission (SEC) approved options trading for several spot exchange-traded funds (ETFs). The move is expected to increase liquidity, attract interest from institutional investors, and solidify Ethereum’s position as a major cryptocurrency.

Yet Ethereum’s smaller market cap relative to Bitcoin means it is also vulnerable to gamma squeezes, thereby increasing investor risks. BeInCrypto consulted an expert in derivatives trading and representatives from FalconX, BingX, Komodo Platform, and Gravity to analyze the potential impact of this new characteristic.

Ethereum ETF Options Gain SEC Approval

The Ethereum community rejoiced earlier this month when the SEC approved options trading for existing Ethereum ETFs. This approval marks a significant regulatory development for digital assets.

This week marked the official debut of options trading for spot Ethereum ETFs in the United States. BlackRock’s iShares Ethereum Trust (ETHA) was the first to list options, with trading commencing on the Nasdaq ISE.

Shortly after, a broader availability of options followed, including those for the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini Trust (ETH), as well as the Bitwise Ethereum ETF (ETHW), all of which began trading on the Cboe BZX exchange.

This move allows a wider range of investors, beyond crypto traders, to benefit from hedging and speculation opportunities on Ethereum’s price through options on familiar investment vehicles like ETFs without direct ownership.

The timing of this news is particularly positive, as Ethereum has been losing some ground in the market lately.

Options Trading to Bolster Ethereum’s Market Position

A significant decline in market confidence surrounded Ethereum this week, with BeInCrypto reporting its price had plummeted to its lowest point since March 2023. This drop coincided with a broader market downturn, worsened by Donald Trump’s Liberation Day.

Further fueling this bearish sentiment, the ETH/BTC ratio has reached a five-year low, highlighting Bitcoin’s growing dominance over Ethereum.

ETH/BTC ratio. Source: TradingView.

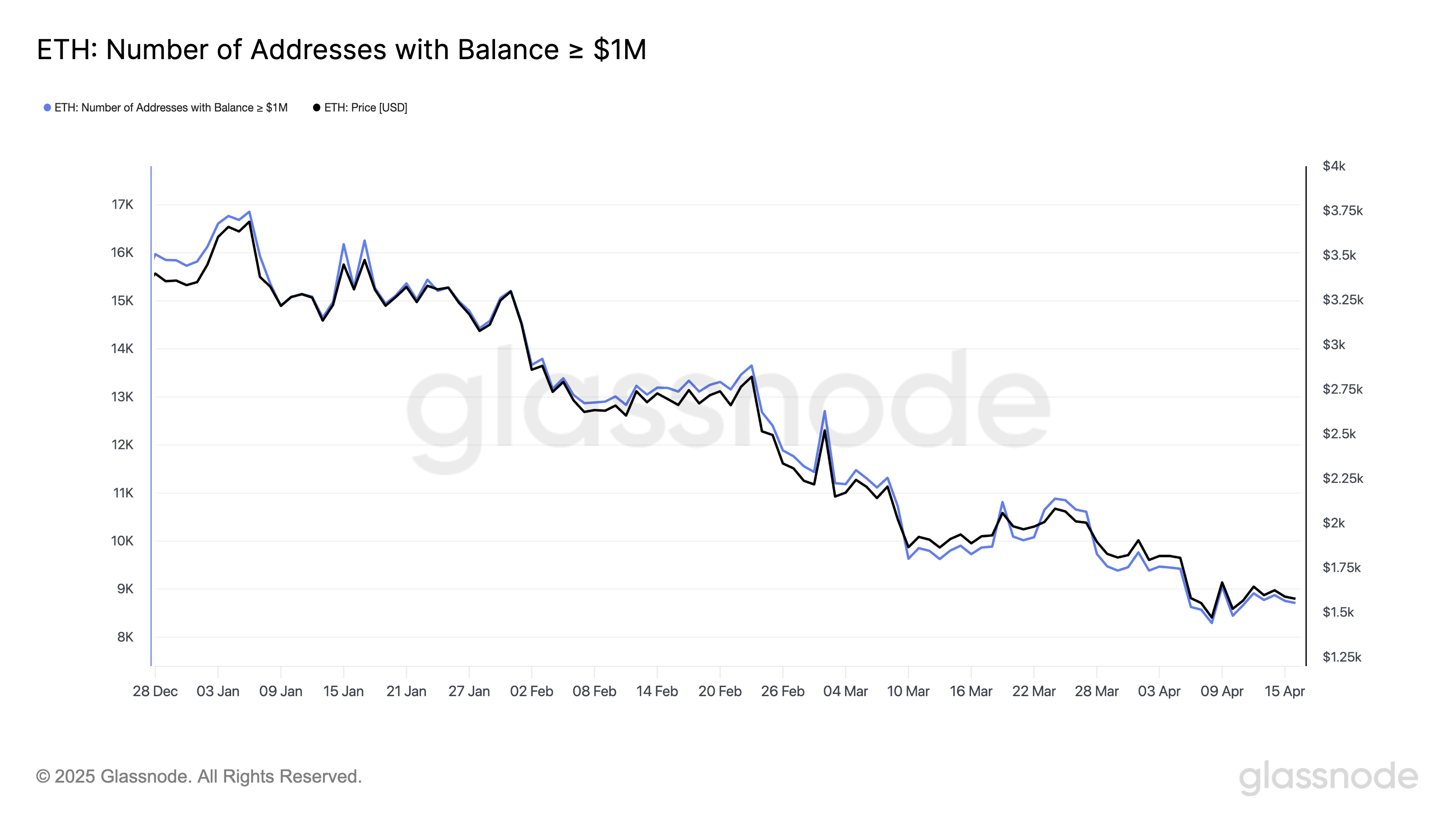

Meanwhile, large Ethereum holders are increasingly selling off substantial amounts, putting downward pressure on their prices. Ethereum’s value has fallen sharply by 51.3% since the beginning of 2025, and investor confidence has waned, as evidenced by a decrease in addresses holding at least $1 million in ETH.

Holders with at least $1 million worth of ETH. Source: Glassnode.

With options trading now accessible to more traders, experts anticipate that Ethereum’s market position will improve.

“ETH’s been leaking dominance, stuck sub-17%. Options give it institutional gravity. It becomes more programmable for fund strategies. More tools mean more use cases, which then in turn means more capital sticking around,” Martins Benkitis, CEO and Co-Founder of Gravity Team, predicted.

This newfound accessibility of options trading will create additional opportunities for investors and the broader Ethereum ecosystem.

Greater Investor Access and Liquidity

The SEC’s approval of Ethereum ETFs in July 2024 was significant because it allowed traditional investors to enter the crypto market without directly holding the assets. Now, with options trading also available, these benefits are expected to be even greater.

“It will provide additional opportunities for portfolio diversification and create more avenues for ETH-based products. With options beyond the limited Bitcoin ETF offerings, investors may reconsider how they allocate their funds. This shift could result in more sophisticated trading strategies and greater participation in Ethereum-based products,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

The Ethereum ETF market will naturally become more liquid with increased participation through options trading.

High Trading Volumes and Hedging Demands

The SEC’s fresh approval of options trading for Ethereum ETF investors suggests that the market will likely initially experience a high trading volume. As a result, market makers must be prepared.

An increase in call options will require institutional market makers to hedge by buying more Ethereum to meet demand.

“This is the canonically accepted dynamic of options markets bringing better liquidity to spot markets,” explained derivatives trader Gordon Grant.

Ethereum will also secure a unique advantage, particularly in institutional trading, enhancing its perceived quality and driving optimism among key market participants.

“ETH just got a serious institutional tailwind. With options now in play, Ether is stepping closer to BTC in terms of tradable instruments. This levels up ETH’s legitimacy and utility in hedging strategies, narrowing the gap on Bitcoin’s dominance narrative,” Benkitis told BeInCrypto.

Yet, rapid surges in options trading could also have unintended consequences on Ethereum’s price, especially in the short run.

Will Investors Suffer a Gamma Squeeze?

As market makers rush to acquire more of the underlying asset in case of a higher volume of options calls, Ethereum’s price will naturally increase. This situation could lead to a pronounced gamma squeeze.

When market makers hedge their positions in this scenario, the resulting buying pressure would create a positive feedback loop. Retail investors will feel more inclined to join in, hoping to profit from Ethereum’s rising price.

The implications of this scenario are especially pronounced for Ethereum, considering its market capitalization is notably smaller than that of Bitcoin.

Retail traders’ aggressive buying of ETHA call options could compel market makers to hedge by acquiring the underlying ETHA shares, potentially leading to a more pronounced effect on the price of ETHA and, by extension, Ethereum.

“We believe option sellers will generally dominate in the long-run but in short bursts we could see retail momentum traders become massive buyers of ETHA calls and create gamma squeeze effects, similar to what we’ve seen on meme coin stocks like GME. ETH will be easier to squeeze than BTC given it is only $190 billion market cap vs BTC’s $1.65 trillion,” Joshua Lim, Global Co-head of Markets at FalconX, told BeInCrypto.

Meanwhile, Grant predicts arbitrage-driven flows will further exacerbate price swings.

Arbitrage Opportunities Expected to Emerge

Experienced investors in options trading may pursue arbitrage to gain profits and reduce risk exposure.

Arbitrage involves exploiting price differences for the same or nearly identical assets across different markets or forms. This is done by buying in the cheaper market and selling in the more expensive one.

According to Grant, traders will increasingly look for and exploit these price differences as the market for ETH options on different platforms develops.

“I would expect more arbitrage behaviors between deribit CME and spot eth options and while one sided flows across all three markets could be temporarily destabilizing, greater liquidity through a diverse array of venues should ultimately dampen the extrema of positioning driven dislocations and the frequency of such dislocations. For instance, it appears –anecdotally as the data is still inchoate– that vol variance on btc is declining post intro of iBit options,” he explained.

While arbitrage activity is expected to refine pricing and liquidity within the Ethereum options market, the asset continues to operate under the shadow of Bitcoin’s established market leadership.

Will Landmark Options Approval Help Ethereum Close the Gap on Bitcoin?

Though Ethereum achieved a major landmark this week, it faces competition from a major rival: Bitcoin.

In late fall of 2024, options trading started on BlackRock’s iShares Bitcoin Trust (IBIT), becoming the first US spot Bitcoin ETF to offer options. Though not even a year has passed since the original launch, options trading on Bitcoin ETFs experienced strong trading volumes from retail and institutional investors.

According to Kadan Stadelmann, Chief Technology Officer of Komodo Platform, options trading for Ethereum ETFs will be comparatively underwhelming. Bitcoin will still be the cryptocurrency of choice for investors.

“Compared to Bitcoin’s Spot ETF, Ethereum’s ETF has not seen such stalwart demand. While options trading adds institutional capital, Bitcoin remains crypto’s first mover and enjoys a greater overall market cap. It is not going anywhere. It will remain the dominant crypto asset for institutional portfolios,” Stadelmann told BeInCrypto.

Consequently, his outlook does not include Ethereum’s market position surpassing Bitcoin’s in the immediate term.

“The once-promised flippening of Bitcoin’s market capitalization by Ethereum remains unlikely. Conservative and more-monied investors likely prefer Bitcoin due to its perceived safety compared to other crypto assets, including Ethereum. Ethereum, in order to achieve Bitcoin’s prominence, must depend on growing utility in DeFi and stablecoin markets,” he concluded.

While that may be the case, options trading doesn’t harm Ethereum’s prospects; it only strengthens them.

Can Ethereum’s Options Trading Era Capitalize on Opportunities?

Ethereum is now the second cryptocurrency with SEC approval for options trading on its ETFs. This single move will further legitimize digital assets for institutions, increasing their presence in traditional markets and boosting overall visibility.

Despite recent significant blows to Ethereum’s market position, this news is a positive development. Although it might not be sufficient to surpass its primary competitor, it represents a step in the right direction.

As investors get used to this new opportunity, their participation level will reveal how beneficial it will be for Ethereum.