Ethereum ( ETH) derivatives traders are back in full swing, with open interest, volume, and options activity all flashing signs of renewed energy across futures and options markets.

ETH Max Pain Sits Near $3,300 as Traders Eye Key Expiry Levels

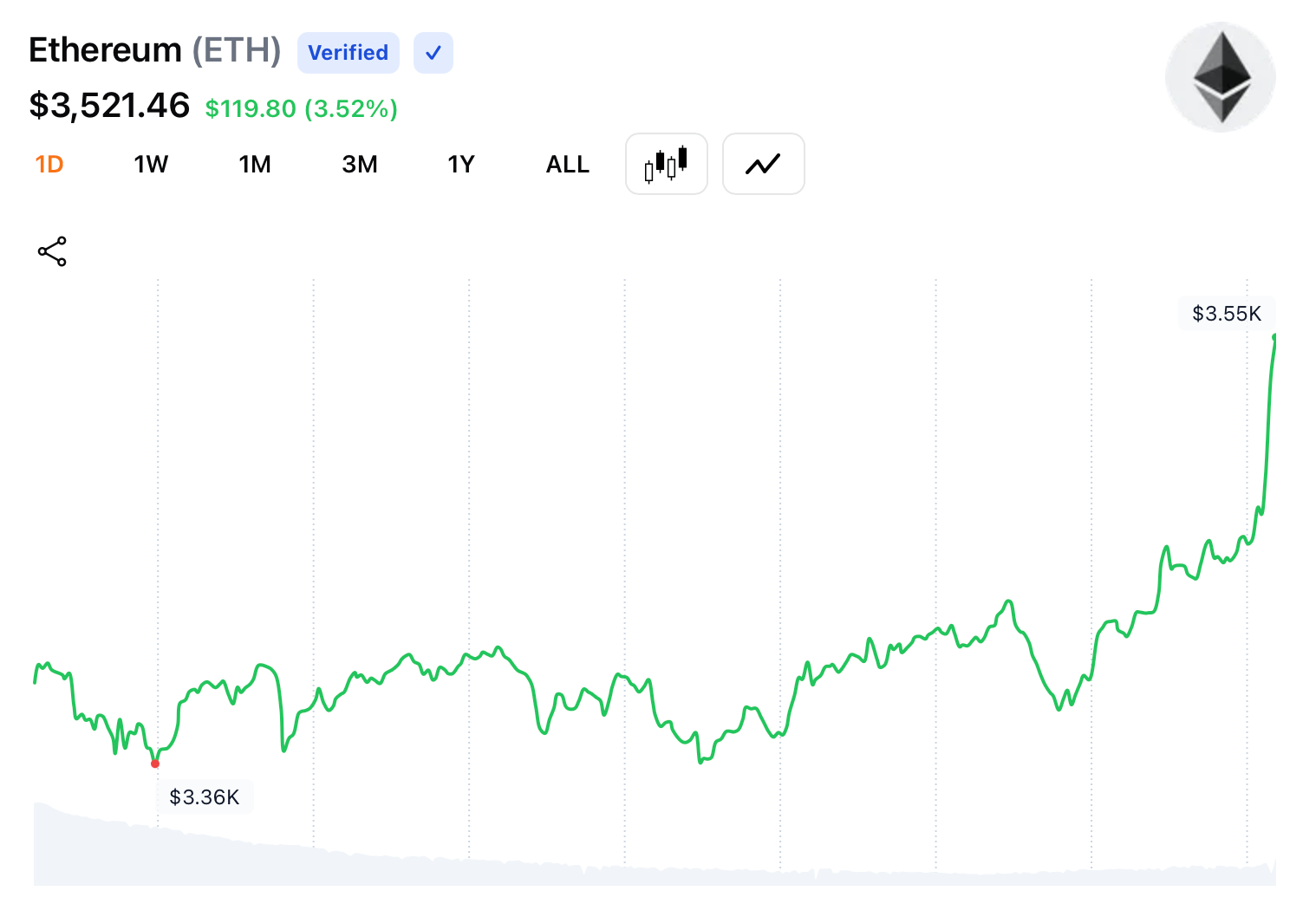

At 10 a.m. Eastern time on Nov. 9, ethereum (ETH) traded at $3,521, up more than 3% on the day but still 28% below its all-time high of $4,946.

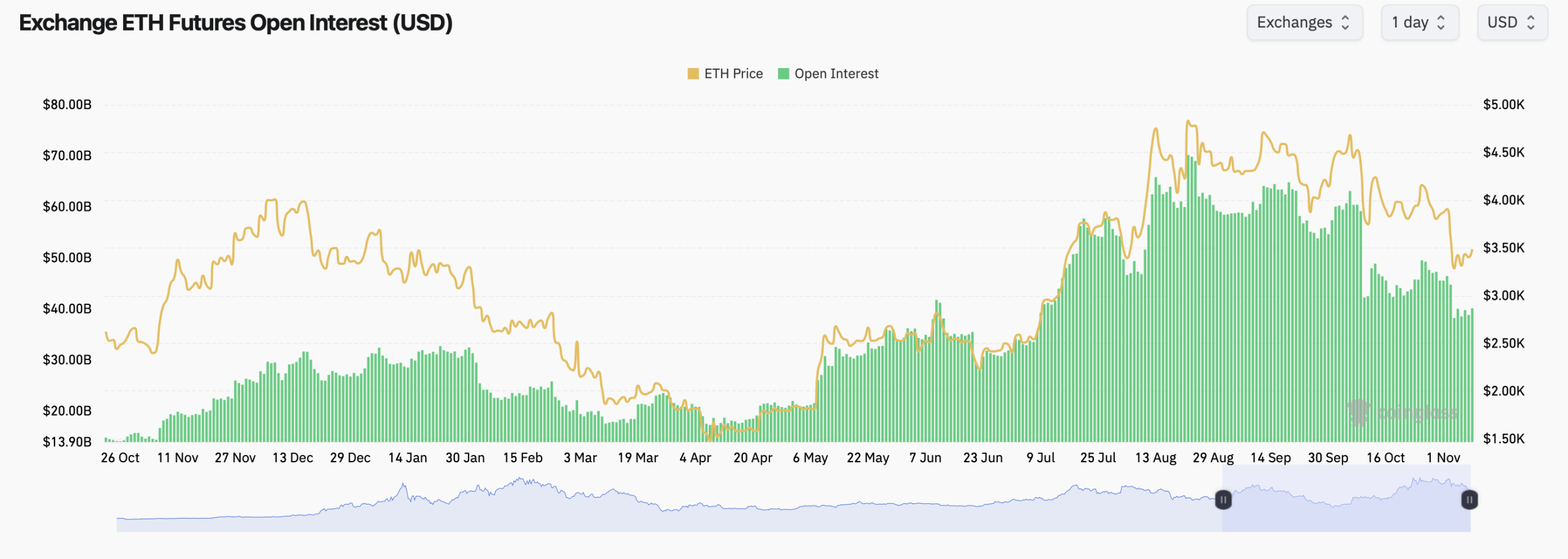

The second-largest crypto asset’s futures market tells a story of strong participation, with total ETH futures open interest hovering around $40.11 billion across exchanges, representing roughly 11.5 million ETH in aggregate exposure, according to Coinglass data.

Binance leads the pack with $8.15 billion in open interest, narrowly outpacing CME’s $7.57 billion, which continues to attract institutional flow. OKX holds $2.35 billion, while Bybit and Gate round out the top five with $2.86 billion and $3.88 billion, respectively. Kucoin saw the sharpest intraday jump with a 20.2% rise in open interest, a signal that retail activity is spiking.

Open interest across all exchanges rose 2.52% over 24 hours, with noticeable inflows to Binance and CME, both logging gains above 3%. Meanwhile, Gate climbed 10.43% in daily OI, while Bitget added 8%, highlighting a mix of aggressive short-term positioning. MEXC and BingX showed outflows, dropping 16.5% and 20.5%, respectively.

The steady uptick in open interest mirrors a wider recovery in market sentiment. Over the past three months, ETH futures open interest has rebounded from late September lows, tracking spot price moves above the $3,000 mark. The correlation between ETH price and derivatives exposure remains tight, pointing to how traders are leaning into leveraged positions as volatility creeps back.

The options market is still decisively tilted toward the bulls. Across major venues, calls account for 65.05% of total open interest, compared with 34.95% for puts. Total open interest for ETH options sits above 2.1 million ETH in calls versus 1.13 million ETH in puts, suggesting traders are positioning for a potential breakout or continuation above $3,500.

Daily options volume echoed the bullish tilt, with 58.15% in calls versus 41.85% in puts, totaling 184,321 ETH in calls and 60,675 ETH in puts. That mix shows traders are more inclined toward upside exposure rather than hedging against downside risk—at least for now. On Deribit, the biggest crypto options exchange, traders are piling into long-term bets that ethereum could climb well above current prices.

The most popular contracts are call options for December 2025 with strike prices of $6,000, $5,000, and $4,000, showing confidence in higher future values. Over the past 24 hours, the ETH-28NOV25-4600-C contract saw the most activity with 7,008 ETH traded, while Bybit’s ETH-27MAR26-500-P- USDT—a put option—logged 3,824 ETH in volume, showing that while many traders are betting on gains, some are still hedging against a drop.

Across major options venues—Deribit, Binance, and OKX—the max pain point (the strike price where the most options expire worthless) clusters between $3,300 and $3,600. This suggests that options sellers would benefit most if ETH gravitates toward that range by expiration. Deribit’s curve showed a steep climb in notional value at the $3,900–$4,200 levels, indicating bullish skew, while Binance’s and OKX’s charts reflected lighter exposure and smoother curves near $3,400.

The takeaway: traders expect ETH to consolidate in the mid-$3,000s in the near term, though December expirations could bring heavier directional plays.

While futures traders are steadily adding exposure, the options desk is tilted toward directional optimism. The combination of high call OI and steady futures growth signals that institutional and retail traders alike are betting that the next leg for ethereum will be higher—especially if the broader market maintains liquidity and bitcoin holds above six figures.

FAQ ❓

- What is ethereum’s current price?Ethereum trades at $3,484 per coin as of Nov. 9, 2025, up over 3% today.

- Which exchange holds the most ETH futures open interest?Binance leads with $8.15 billion in ETH open interest, followed by CME at $7.57 billion.

- What is ethereum’s options market bias?Calls dominate with 65% of open interest, showing bullish positioning.

- Where is ETH’s max pain point currently?Max pain sits near $3,300–$3,600 across major exchanges like Deribit, Binance, and OKX.