Ethereum price today: $3,870

- Ethereum ETFs’ recent consistent inflows could push ETH to new highs just as Bitcoin ETFs did Bitcoin’s.

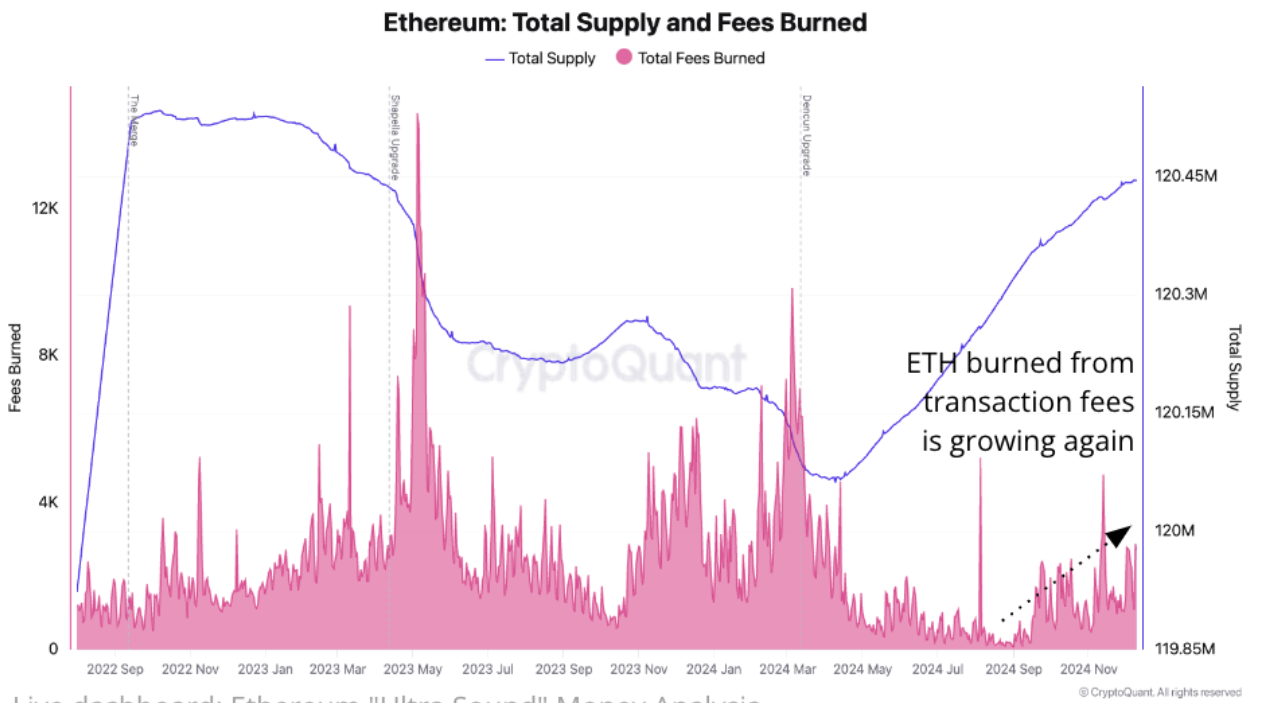

- Increased network activity has driven up the fees burned on Ethereum, leading to a contraction in the growing ETH supply.

- Ethereum needs to overcome the selling pressure near the $4,000 psychological level.

Ethereum (ETH) is up 1% on Thursday as it aims to tackle the selling pressure near the $4,000 psychological level. On-chain data shows that ETH has begun seeing increased bullish momentum, which could push its price to a new all-time high above $5,000.

Ethereum ETF flows and increased network activity could boost ETH to new all-time high

In a report on Wednesday, CryptoQuant’s analyst highlighted that Ethereum could rally above $5,000 if its developing demand and supply dynamics continue.

Since reaching a low of 2.716 million ETH in September, Ethereum exchange-traded funds (ETFs) have witnessed significant growth, rising to a record high of 3.43 million ETH. “This trend could have far-reaching implications for Ethereum’s price dynamics, as sustained buying pressure from ETFs may contribute to upward price momentum,” noted CryptoQuant’s analyst.

Ethereum ETFs Historical Holdings

Considering Bitcoin’s charge to new all-time highs since the launch of Bitcoin ETFs, Ethereum could soon get its own share of similar bullish sentiments as its recent ETF flows mark the first time the products are seeing sustained inflows.

Notably, ETH ETFs recorded $102 million in inflows on Wednesday, extending their streak of positive flows to 13 consecutive days.

Meanwhile, Ethereum network activity has seen a notable uptick in 2024, with total daily transactions rising to between 6.5 and 7.5 million, up from 5 million in the previous year. The total number of contract calls on the Main chain has also seen a similar rise in 2024.

The heightened network activity has helped boost the amount of ETH burned via transaction fees, rising from 80 ETH on August 30 to 2.7K ETH in December, per CryptoQuant data. This has calmed the rate of ETH supply growth — which accelerated after the Dencun upgrade in March — in the past few months.

Ethereum Total Supply and Fees Burned

In conclusion, the analysts noted that valuation metrics based on ETH’s realized price indicate that the top altcoin could grow to an upper limit of $5,200 in the current market cycle.

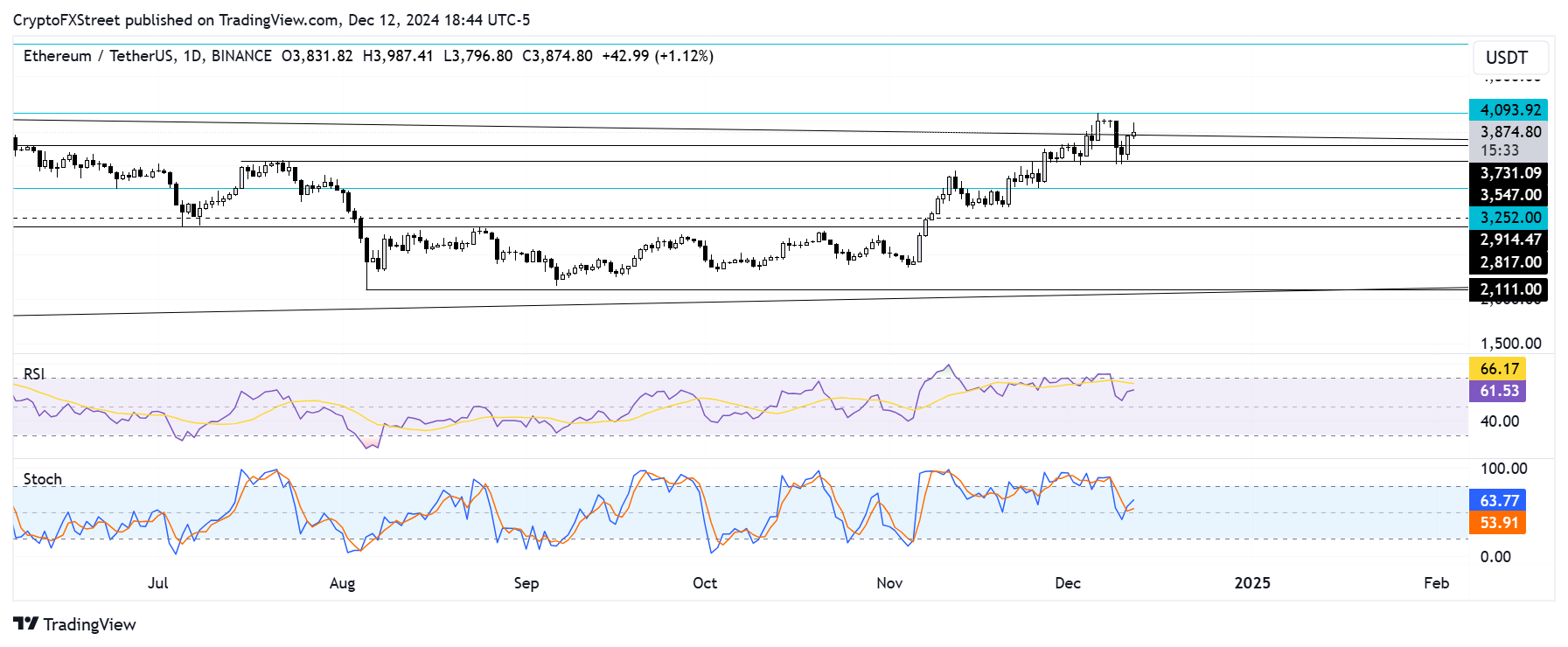

Ethereum Price Forecast: ETH faces a major hurdle near the $4,000 psychological level

Ethereum is up 1% after sustaining $57.17 million in liquidations in the past 24 hours, according to Coinglass data. The total liquidated long positions are $26.4 million, while short liquidations accounted for $30.77 million.

The top altcoin has moved above the upper boundary of a key descending trendline. If it continues rising, it faces a major hurdle near the $4,000 psychological level, where it had previously seen high selling pressure.

ETH/USDT daily chart

A move above $4,093 will see ETH setting a new yearly high. However, a rejection could send its price toward the $3,550 level.

The Relative Strength Index (RSI) and Stochastic Oscillator momentum indicators are above their neutral levels, indicating dominant bullish sentiment.

A daily candlestick close below $3,550 will invalidate the thesis.