[ad_1]

Ethereum (ETH) extended its streak of underperforming against Bitcoin (BTC). The token fell under 0.029 per BTC during the most recent market correction.

Ethereum (ETH) has yet to stop its sliding trend against Bitcoin (BTC). The token has now fallen to 0.027 per BTC, testing levels not seen since 2020. ETH already crossed the 0.030 BTC boundary, which was its baseline level just before the 2021 bull market.

ETH has now completed an unwanted value roundtrip against BTC, after peaking at 0.085 BTC in December 2021. ETH’s downward trend has found little relief since the market crash of 2022, continuing to slide despite the token’s growing utility.

The biggest problem for ETH is that none of the use cases from the past five years were good enough to establish the token’s influence against BTC. At some point, the NFT boom, the expansion of Web3, blockchain games, and DeFi were the hottest developments in the crypto space. Yet, none of those developments had a sufficient effect on ETH price, despite the chain still being key to most current crypto activities.

ETH had a dynamic trading day on February 3, falling as low as $2,080 with the biggest number of liquidations and selling since August 2024. Within hours, smart money started buying again, taking the token up to $2,900. ETH then stabilized around $2,709.72, though still raising questions on its potential to regain the $4,000 level and move to a higher price range.

Validators slowly leave the network

The biggest bid for the value of ETH is that the token could be used to secure the network through staking. Later, liquid staking and re-staking were added, tapping the value of idle ETH.

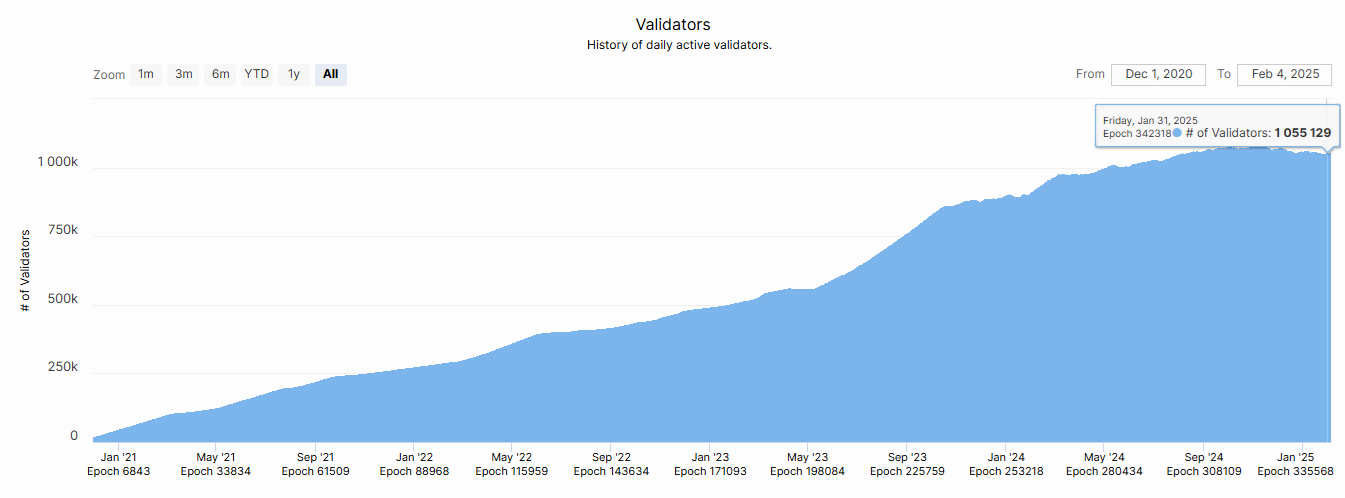

After peaking in September 2024, Ethereum validators started giving up on the network. Validators reached more than 1,080,000 at one point, but about 25,000 have given up on producing and validating blocks.

Ethereum’s network sees an outflow of validators since Q4, 2024. | Source: Beaconscan

Deposits into the Beacon Chain contract have also shown a trend of slowing down. ETH still pays out to validators, and some staked their tokens at prices as low as $1,400. However, the recent market turbulence means fewer ETH holders are willing to stake for the long term.

One of the reasons for the outflow of staking is the uncertainty around the status of ETH as ultra-sound money. ETH was deflationary for only a few months, later returning to inflation between 0.30% and 0.60%. The supply of ETH rises by over 300K to 900K tokens per year, depending on inflation and the burn rate, which reflects the level of transactions.

Ethereum is still relatively expensive to use, especially for the new cohort of traders who are used to fast on-chain activity and quickly shifting between tokens. Ethereum remains the leading legacy network for DeFi due to its liquidity and the available ERC-20 stablecoins. However, even that traffic is quickly shifting to cheaper networks.

Solana, Base, and partially TRON continue to draw in new stablecoin minting while also offering growing DEX liquidity, tokens, NFTs, and other accessible on-chain activities. In the last few months, traffic shifted to Solana’s Raydium, which accounted for nearly 30% of all DEX activity.

L2s retained value and did not boost ETH

Ethereum’s Dencun Upgrade opened the doors to extremely cheap activity on L2 chains. Currently, even the busiest networks like Base pay less than $5,000 to secure their blocks on Ethereum. Top users like Taiko still pay under $40K, as activity decreased following the initial hype period. L2 chains rely on organic traffic, and only a few have retained the best apps and DEX.

L2 chains did manage to scale Ethereum, taking some of the DEX traffic. Ethereum retained DEX activity for whale-sized deals, especially when switching between wrapped assets and stablecoins.

Blob fees burn only around 80 ETH per week, while the chain produces over 11,700 for the same time frame. The real-time usage of blobs and other types of fees shows the L1 is not built to extract value from the L2 chains. The validators that took the risk of staking ETH still rely on the block reward and the balance of inflation to achieve their returns. Additionally, L2 chains can alter their posting schedule to L1, deliberately decreasing the rent paid to validators.

Cryptopolitan Academy: Are You Making These Web3 Resume Mistakes? – Find Out Here

[ad_2]