USDE is the flagship stablecoin product of Arthur Hayes-backed Ethena Labs. It’s a synthetic dollar that uses a “delta-neutral” strategy to maintain its peg with the U.S. dollar.

USDE is Quietly Leading the Niche Stablecoin Market

The $212 billion stablecoin market is currently dominated by Tether (USDT) and USDC, but a new entrant has quietly risen to third place less than a year after launching.

Ethena Labs launched USDE in February 2024 as a yield-bearing crypto-native synthetic dollar that purports to use derivative instruments to eliminate the volatility of the stablecoin’s crypto collateral, a strategy known as delta hedging.

The company’s idea of creating a derivative-based synthetic dollar was originally conceived by BitMEX founder Arthur Hayes who eventually participated in Ethena’s $6 million seed round in 2023.

Within months of launching, USDE which boasts double-digit yields for investors, has rocketed past longtime decentralized finance (defi) staple Dai, a stablecoin launched by the Sky project (formerly Makerdao) in 2017. Ethena’s marquee product has already generated more than $250 million in revenue and is on the verge of a $6 billion market capitalization.

(USDE Dune dashboard / Entropy Advisors)

Tom Wan, Head of Data at crypto advisory firm Entropy Advisors told Bitcoin.com that while Tether and USDC dominate the stablecoin market, there is enough room for niche players to thrive.

Wan explained:

On one hand, the dominance of USDT and USDC has grown from 72% to 88% since 2022, solidifying their position through advantages like superior liquidity, integration in cefi [centralized finance] and defi ecosystems, payment utility, and cross-chain operability. Breaking into this duopoly is extremely challenging for new entrants. On the other hand, there are opportunities for innovation in underserved areas.

Wan said one such area is payments, which he believes is underdeveloped and has exponential growth potential.

“Payment-focused stablecoins remain underdeveloped,” Wan said. “Blockchains like Solana and L2s like Arbitrum and Base are positioned to host new payment-centric stablecoins, unlocking a massive use case and driving future growth in the sector.”

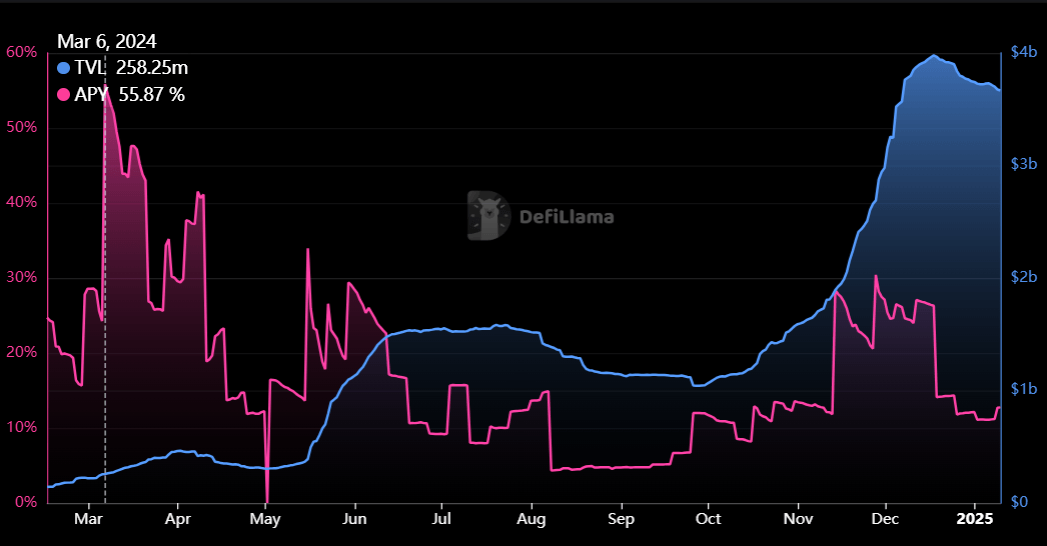

One key reason for USDE’s impressive growth trajectory is the double-digit yield it generates for investors, currently at 12.75% but with an all-time high of nearly 56% in March 2024, according to Defi Llama. Wan explained that while traditional fiat-based stablecoins like Tether and USDC generate revenue from creating and redeeming tokens and from collateral interest, USDE has a more defi-centric revenue model.

(Historical USDE yield on Ethereum only / DeFi Llama)

“For Ethena, revenue comes from three streams: basis trading, staking, and stablecoin yields,” Wan said. “The revenue is currently used for distributing interest to USDE stakers and funding the USDE reserve fund.”

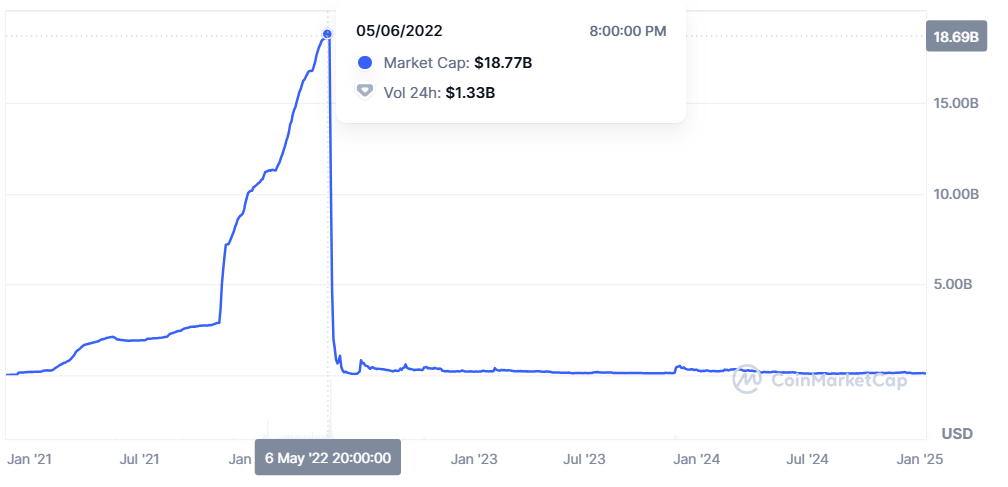

(Historical Terra market capitalization / CoinMarketCap

Ethena’s stablecoin isn’t the first novel approach to stablecoin design. Algorithmic stablecoin terrausd (UST), the brainchild of now disgraced founder Do Kwon, reached a $19 billion market capitalization in 2022 before imploding, in one of the most catastrophic failures in crypto history.

“The core difference here…is that the backing is real collateral that’s sitting behind the stable rather than our own governance token,” said Ethena founder Guy Young on Laura Shin’s Unchained podcast when asked about the difference between USDE and UST.

“It really is a very weak surface level argument to compare what Ethena is doing to Luna,” Young added. Luna was UST’s companion governance token.