[ad_1]

According to an X post, on-chain analysts noticed that the $USDe ticker was bought on Hyperliquid some hours ago today, March 18, 2025. Now, the user is speculating that the ticker purchase suggests Ethena is going to deploy on the Hyperliquid L1 chain.

“Did Ethena really buy the ticker? Or was someone else trying to psyop people?” The user asked before proceeding to connect dots based on the on-chain evidence they cited.

Ticker $USDe was bought on Hyperliquid 3 hours ago.

This suggests Ethena is going to deploy on Hyperliquid but… did Ethena really bought the ticker? Or was someone else trying to psyop people?

Let’s check onchain.

The ticker was bought by… pic.twitter.com/GyGqxeREo3

— Ericonomic (@ericonomic) March 18, 2025

Where the onchain evidence led

After Ericonomic (@ericonomic) found out the ticker $USDe was bought on Hyperliquid, he decided to look on-chain to see if he could find out if the move was made by Ethena or bad actors.

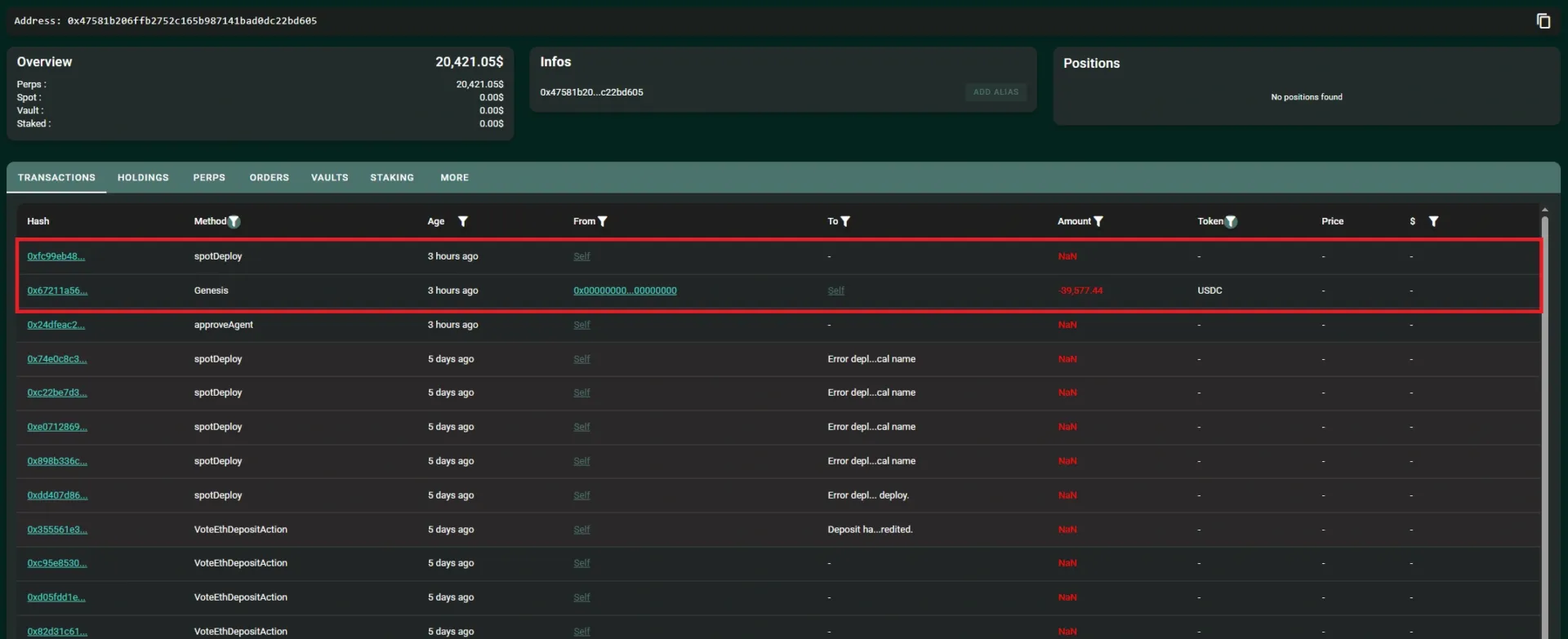

According to on-chain analysis that traced the wallet addresses involved, the ticker was bought by wallet address 0x47581b206ffb2752c165b987141bad0dc22bd605. The wallet was funded by 0x643Dbbc80Bb5432f646fEDFa4091a9b205E87Ae4, a wallet that appears to be linked with an Ethena deployer, which is an externally owned account (EOA) used for deploying smart contracts or managing operations.

The address that bought the $USDe ticker was funded by an address linked to Ethena Deployers EOAs. Source: Ericonomic

Further tracing of the transactions showed that 0x643 was funded by 0x796Ee28CE42BF7bd43A09aCd43FAd0aACD7C3b29, another address linked to Ethena’s development multisig, which has ENS names like etheinainsurancefund and ethenaops, and is referenced in Ethena’s documentation.

Another wallet, 0xFF0458EA5F864717B05D79BF456a8b70767A7EF5, which was funded by the Ethena deployer 0x643, also reportedly sent funds to Hyperliquid to set up a 4-8 multisig, which suggests Ethena is preparing infrastructure on the L1 blockchain.

Apparently, these develoopments are strong evidence of Ethena’s involvement, which led Ericonomic to conclude his post by declaring that Ethena is indeed planning to deploy on Hyperliquid.

Ericonomic ended his post by writing that Ethena might be waiting for Hyperliquid to enable the HyperEVM<>HyperCore token bridge before fully deploying.

In the comment section, many seemed to agree with Ericonomic. One user, @0xnutzs, recalled a proposal from last year as proof of Ethena’s interest in Hyperliquid.

The governance proposal on Ethena’s forum was dated October 17, 2024, and titled “Hyperliquid Ethena Liquidity and USDe Integration.” It requested that Ethena integrate Hyperliquid as an eligible venue for a portion of its hedging flow, subject to technical and legal due diligence.

It had been an official suggestion within Ethena’s community, and it triggered speculation among those who keep an eye on Ethena’s governance activities. The excitement started to build, but then as time passed, people realized something weird; Ethena stopped talking about the topic after the proposal.

This likely fueled even more speculation as people wondered why they were keeping quiet about it; could there be technical, legal, or strategic issues causing delays, or had the integration been completely abandoned?

If the proposal had been approved, or if it eventually got approved, the integration would be implemented in a controlled manner with Risk Committee guidance as Ethena hedging flow scales alongside the growth of Hyperliquid, with maximum initial proposed allocations.

The proposal, which outlined synergies between Hyperliquid and Ethena also requested that the Ethena Risk Committee do its due diligence of Hyperliquid’s suitability as a potential hedging venue. It has been months since then, and the committee is quiet. That’s why many are now wondering if the committee is still doing its due process or whether Ethena is making moves under the radar.

Hyperliquid could be a suitable venue for Ethena’s USDe

Hyperliquid is a relatively new L1 that has proven to be more than just a project that people abandoned after receiving airdrops, as in the case of projects like Starknet.

Hyperliquid ranked third in DeFi in 24-hour revenue on behind Tether and Circle. Source: Defillama

Hyperliquid is a layer-1 blockchain that also functions as a DEX that affords its users perks like fast and low-cost trading. Since it burst into the space, it has gained significant attention and has even seen something similar to a cult forming around it.

The DEX now has over 200,000 total users and usually records daily volumes that range between $1-4B. It now has over $1B in open interest (OI), which dwarves other on-chain perpetual DEXs in potential. It is even borderline comparable to the biggest CEXs.

In October, Hyperliquid was at regular intervals accounting for roughly 40% of on-chain perpetual volumes, according to a report from Artemis. Ethena no doubt realizes that Hyperliquid, with its robust and high-performing trading infrastructure, could greatly enhance its operational capabilities, hence the interest.

There is also the fact that platforms share the same drive to satisfy their users first before anything else while remaining scalable.

Following its token generation event last year November, Hyperliquid airdropped about 31% of its 1 billion total supply and achieved a $1.7B market cap on the first day, peaking at a $5.1 billion fully diluted valuation (FDV).

By early 2025, its FDV had reportedly climbed to $34B, but according to data from CoinGecko, it has fallen and currently rests around $13.3M. Despite this, Hyperliquid is considered a top L1/ perpetual DEX that Ethena could leverage to proliferate its $USDe stablecoin in tems of volume and adoption.

[ad_2]