Ethereum (ETH) whales are capitalizing on falling prices as the second-largest cryptocurrency continues to trend downward, breaking the critical $4,000 level.

The decline has divided market sentiment. While some analysts warn of a looming bear market, others interpret the drop as a prime opportunity for long-term accumulation.

Whale Accumulation Rises Despite Ethereum’s Bearish Turn

According to the latest data from BeInCrypto Markets, ETH dipped 1.84% over the past 24 hours, below $4,000. At the time of writing, the altcoin was trading at $3,943.

Ethereum (ETH) Price Performance. Source: BeInCrypto Markets

Furthermore, BeInCrypto’s latest analysis indicated that the market was turning bearish on ETH, which risks sliding further. Economist and known crypto critic Peter Schiff even declared that the altcoin has entered a bear market.

“Ethereum just tanked below $4,000. Despite all the Ethereum Treasury company buying, the #2 crypto is now in an official bear market, down 20% from its August record high. Bitcoin is next,” Schiff said.

However, this is not an outlook many crypto whales share. Instead, they continue to buy the Ethereum dip.

Analytics firm Lookonchain reported that over the past two days, 15 wallets received 406,117 ETH, valued at approximately $1.6 billion, from major platforms. These included Kraken, Galaxy Digital, BitGo, and FalconX.

“You’ll get one more opportunity to load on ETH. Whales have already started accumulating, and soon institutions will do the same,” analyst Cas Abbé declared.

This buying activity is further evidenced by the rising inflows into accumulator addresses, indicating strategic buying by large holders, or whales, during the downturn. According to analyst Darkfost, these are the wallets that have carried out at least two transactions of a minimum ETH amount while never performing a single sell.

“We can therefore associate this type of address with long-term holder behavior,” the analyst noted.

In the latest activity, nearly 400,000 ETH were added to such wallets in a single day. Notably, on September 18, these addresses set a record by absorbing approximately 1.2 million ETH.

“This is a historic first for Ethereum. Some players are clearly not joking around, and some of these addresses could be linked to entities offering ETH ETFs, which have seen demand surge recently,” Darkfost added.

Furthermore, the behavior aligns with market optimism that ETH’s dip is a buying opportunity. In a recent post on X (formerly Twitter), Altcoin Gordon suggested that ETH is nearing a long-term buying zone, predicting appreciation by December.

“ETH is entering my long-term buying zone. Accumulate at these levels and you’ll thank me in December,” he wrote.

$ETH is now entering the buy zone.

I hope you didn’t FOMO at the top. pic.twitter.com/2ChzR2vnRh

— Ted (@TedPillows) September 25, 2025

Market strategist Shay Boloor argued that while many investors are panicking over Ethereum’s dip below $4,000 and labeling it a bear market, the broader picture suggests otherwise. He pointed out that major financial figures such as Tom Lee, Stanley Druckenmiller, Peter Thiel, and more have all shown support for Ethereum, signaling confidence despite the recent pullback.

“At the same time, the US govt needs stablecoins to support treasury demand. Most of that supply sits on ETH. Smells like opportunity under $4,000,” Boloor stated.

Leveraged Traders Hit by Ethereum’s Dip

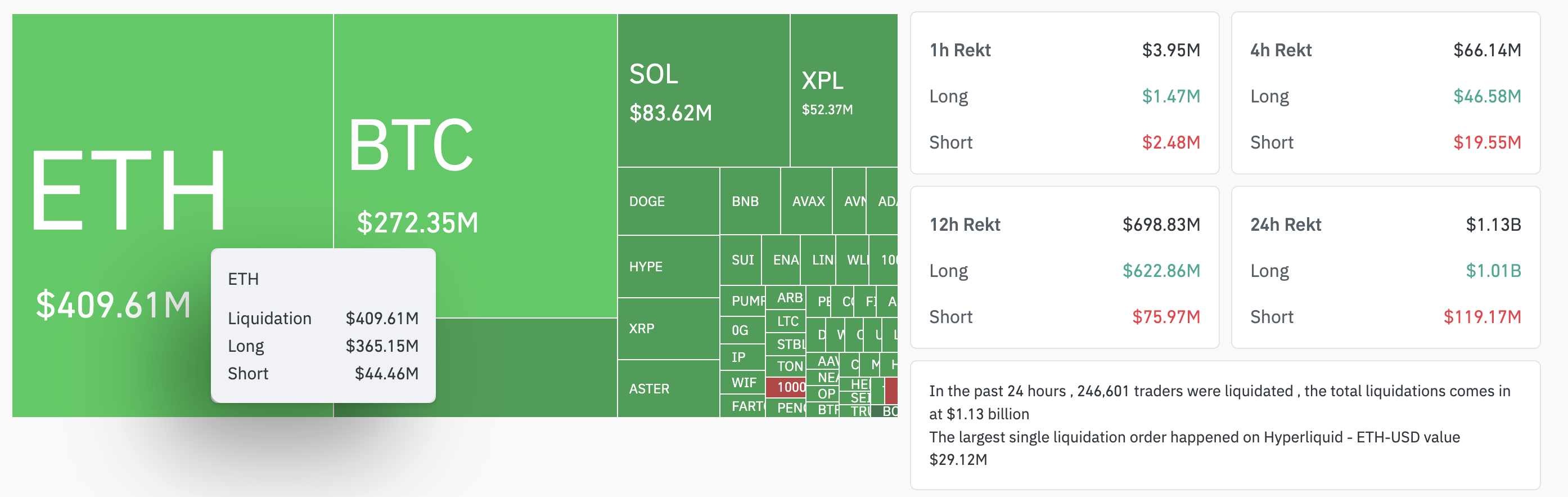

Meanwhile, the overall market decline has inflicted significant pain on leveraged traders. Data from Coinglass showed that over the past 24 hours, 246,601 traders were liquidated across the cryptocurrency market, totaling $1.13 billion.

Crypto Liquidations. Source: Coinglass

Ethereum accounted for the majority, with $409.6 million in liquidations. Over $365 million came from long positions. The largest single liquidation was a $29.12 million ETH-USD order on Hyperliquid.

Today we’re seeing the largest ETH long liquidations since September 2021

The last time this happened $ETH went up 46% the month after 🔥 pic.twitter.com/jYqrEYbRIo

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) September 25, 2025

Darkfost noted that Ethereum has just experienced one of its sharpest declines in Open Interest since the start of 2024, following a wave of liquidations that cleared out overleveraged positions.

The biggest reduction was seen on Binance, where more than $3 billion was wiped out on September 23 and another $1 billion yesterday. Meanwhile, Bybit and OKX recorded drops of $1.2 billion and $580 million.

“Historically, such resets often follow periods of excessive leverage that push Open Interest higher, as was the case for ETH, which had been attracting a large share of market attention. Once liquidations accumulate and reduce Open Interest, selling pressure tends to ease, creating conditions for the market to stabilize and sometimes even recover,” he revealed.

Thus, while short-term volatility persists, the combination of whale accumulation and market signals suggests that the current dip may precede upward momentum. Market observers will monitor upcoming economic indicators and institutional flows for further clues on ETH’s trajectory. As of now, the cryptocurrency remains down from its all-time high but shows signs of resilience through strategic buying.

The post ETH Whales Buy the Dip as Ethereum Breaks $4,000 Support appeared first on BeInCrypto.