[ad_1]

Ethereum treasury firm, Blockchain Technology Consensus Solutions (BTCS), is using DeFi lending protocol Aave to generate yield and buy more Ether. The CEO, Charlie Allen, disclosed this on X, noting it is farming yield through the platform.

According to Allen, the Nasdaq-listed company deposited $100 million in Lido staked ETH (stETH) on Aave at a 3% yield per annum(APY), and borrowed $30 million USDT from the protocol at a 5% rate. It has now used the $30 million stablecoins loan to buy more ETH, which it is staking at 4% APY.

🔁 How @NasdaqBTCS Uses @aave for Leveraged ETH Yield

Deposit $100M stETH @ 3% APY → $3M/year

Borrow $30M USDT @ 5% → $1.5M/year cost

Buy ETH with USDT, stake it @ 4% → $1.2M/yearNet Yield = $3M − $1.5M + $1.2M = $2.7M/year

➡️ Net APY on $100M: 2.7%

➡️ Effective ETH…— Charles Allen 🐢🦄 (@Charles_BTCS) July 22, 2025

Allen noted that the strategy enables BTCS to generate a net yield of $2.7 million per annum (2.7%) on the $100 million worth of staked ETH, a move described by Allen as an effective ETH exposure and just a tip of the iceberg of what the company is doing.

This is not the first time that BTCS will borrow on Aave to buy ETH, with the company taking a $2.34 million USDT loan on the protocol back on July 14 to buy ETH. At the time, it added the loan to cash in hand and purchased 2,731 ETH worth $8.23 million at the time.

Meanwhile, some observers believe that BTCS is taking on a huge risk with its strategy, given the risk of liquidation if the ETH price should fall. One of such users noted that staking alone would have generated 4% APY. However, other users have clarified that the firm is depositing staked ETH on Aave; therefore, the yield from staking is not included in the 2.7% APY.

BTCS enters the top ten ETH holders

Interestingly, BTCS is one of the leading ETH strategic reserve companies that has been busy accumulating the token in the lead-up to its recent price surge. According to the Strategic ETH Reserves tracker, the company has almost 56,000 ETH after completing the purchase of 23,000 ETH on July 21.

With the move, it is now in the top ten ETH holders, even though it remains far behind Sharplink Gaming, the biggest public company holding ETH with over 360,000 Ether accumulated in less than two months. Interestingly, Bitmine also holds more than 300,000 ETH.

However, BTCS does not rely only on staking and yield generation from DeFi protocols. Allen noted that the company is also selling equity, integrating with Rocket Pool, and building blocks in the Ethereum ecosystem. In an earlier post, he claimed the company is a pioneer in the crypto industry and will continue to lead.

The claim is premised on BTCS being the first crypto mining firm to go public in 2014. It has also been accumulating BTC and ETH for its balance sheet since 2018 with the introduction of Digital Assets Treasury, and became the first public company to distribute a dividend payable in Bitcoin in 2022.

Unsurprisingly, its ETH accumulation and treasury management practices had a positive effect on its stock value. Yahoo Finance data shows that BTCS is up 150% year-to-date and has gained 172% in the past month alone. The stock is currently trading around $6.

Aave sees growing institutional adoption

Meanwhile, the move by BTCS highlights how crypto-native organizations are increasingly turning to Aave to generate yield. Speaking on the BTCS move, founder Stani Kulechov noted that any treasury company should use Aave to generate yield.

Interestingly, only a few months ago, the Ethereum Foundation borrowed $2 million worth of GHO stablecoin from Aave, signaling a shift from selling ETH. The Foundation had also deployed 45,000 ETH to several DeFi protocols, including Aave, Compound, and Spark, with Aave getting most of the capital.

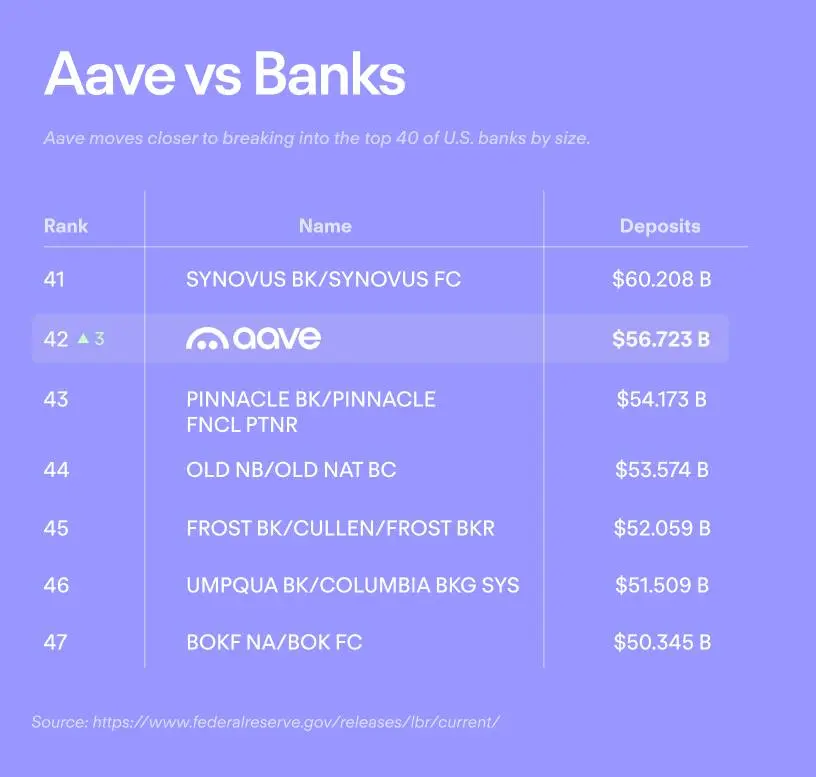

Aave closing in on top 40 US biggest banks (Source: Kolten)

With the growing institutional adoption, Aave deposits have reached $56.72 billion, enough for it to rank 42nd on the list of biggest US banks.

[ad_2]