This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

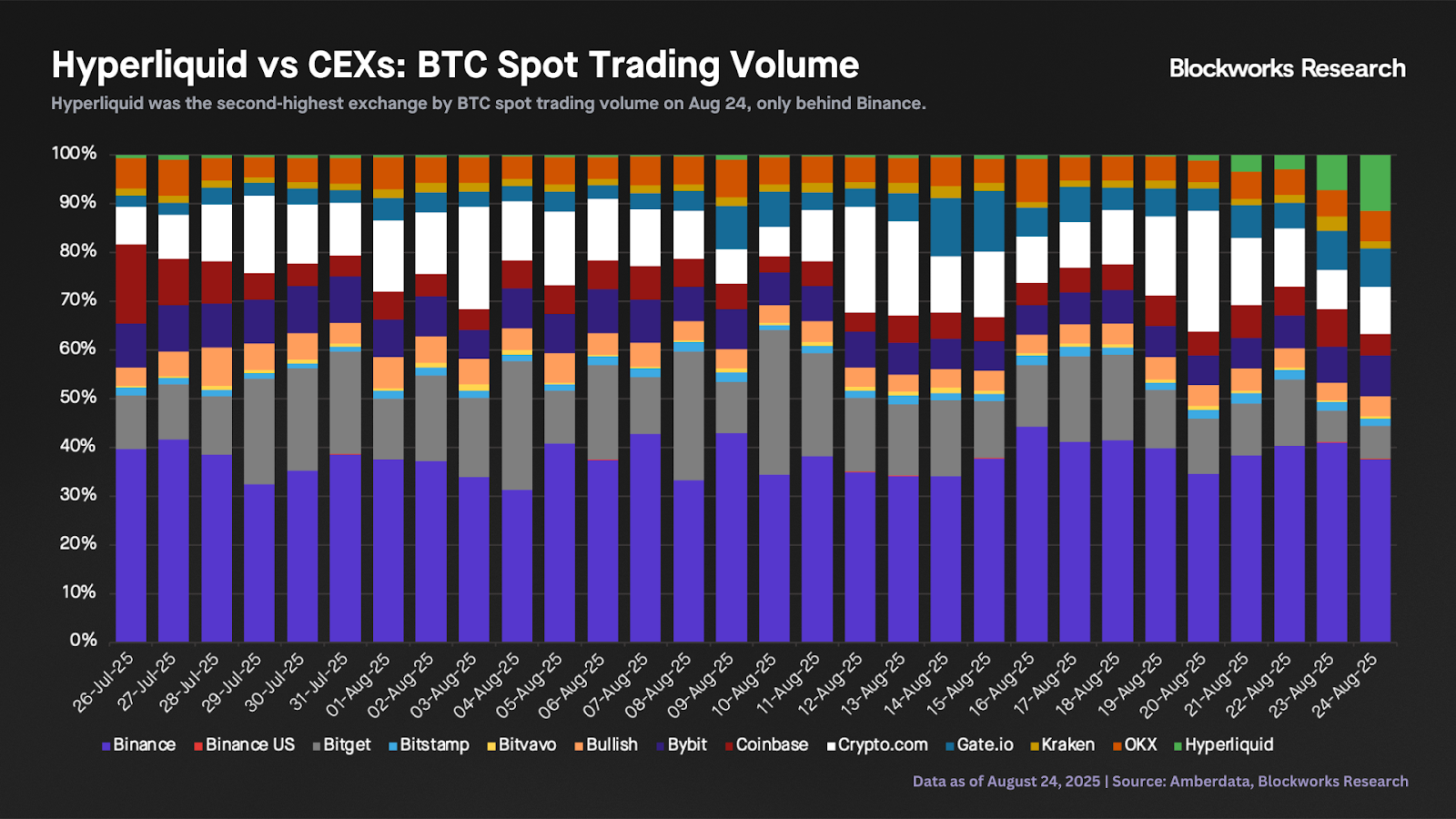

Hyperliquid’s spot volumes have seen a significant rise, particularly when compared to CEXs. Over the weekend, an unknown entity deposited and sold ~22.1k BTC to rotate into ~555k ETH, valued at over $2.4 billion. This surge in spot volumes positioned Hyperliquid as the second-highest exchange by BTC spot trading volume on Aug. 24, with a 12% market share, behind only Binance (38%). This is a substantial increase from Hyperliquid’s 30-day average daily market share of ~1%.

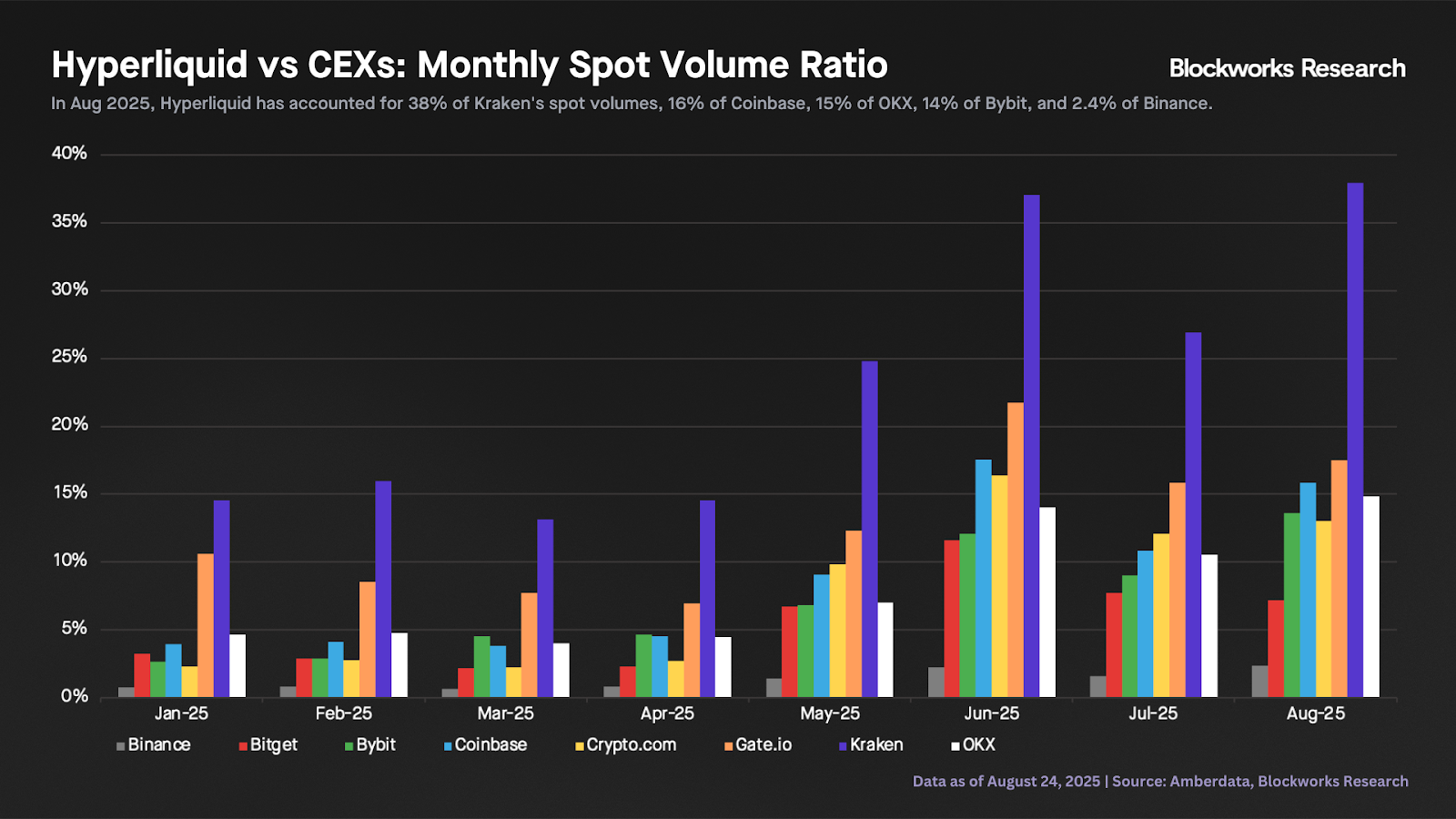

Stepping back, we can compare Hyperliquid’s monthly spot trading volumes against various CEXs (including all assets, not just BTC). We observe a consistent rise in Hyperliquid’s share of spot volumes year to date. This month, Hyperliquid accounted for 38% of Kraken’s spot volumes, 16% of Coinbase, 15% of OKX, 14% of Bybit, and 2.4% of Binance. Although all figures represent a significant rise from the beginning of the year, they also show that Hyperliquid still has a long way to go to flip some of the largest CEXs.

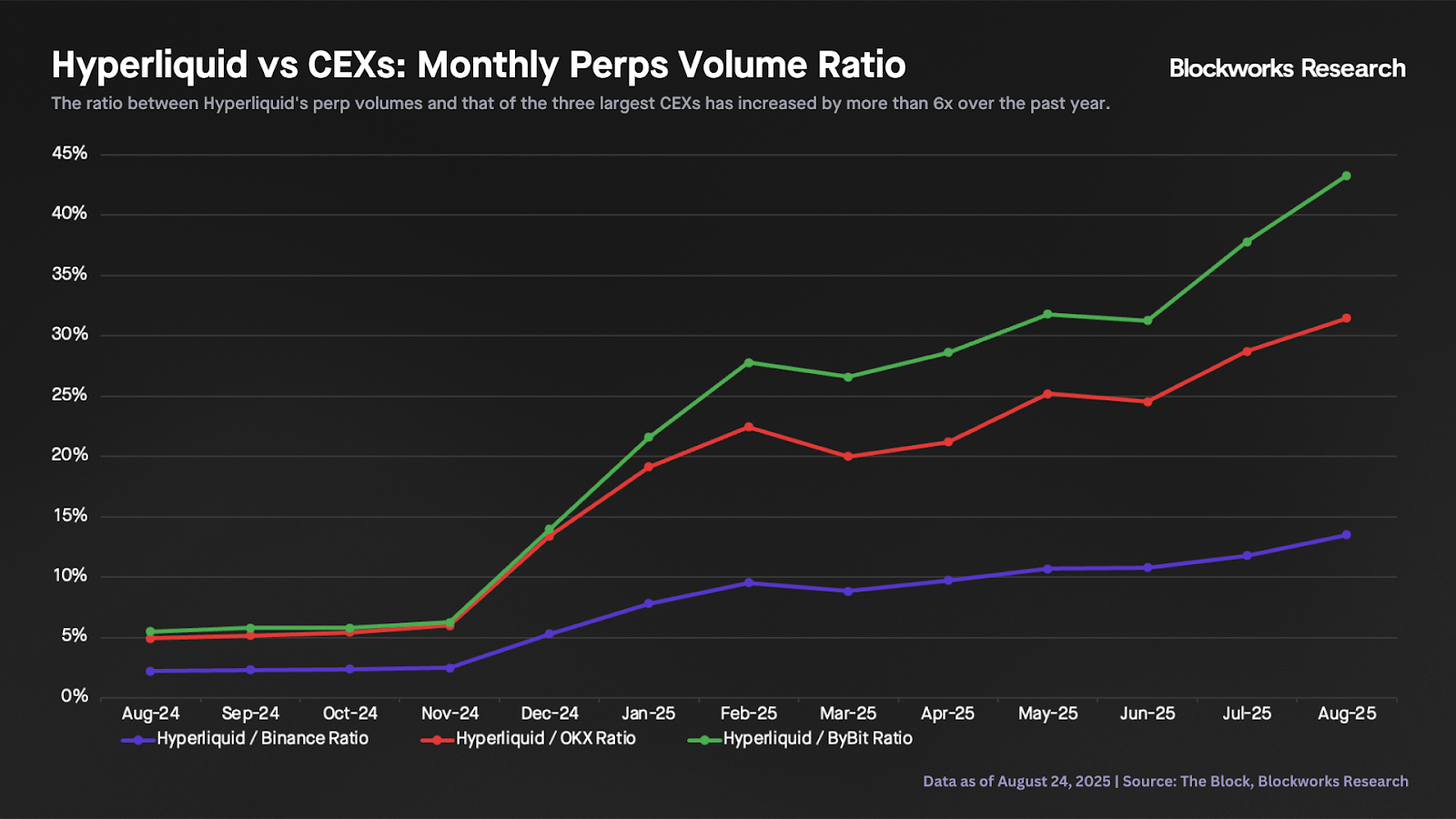

Regarding perpetual futures volumes, Hyperliquid has been growing significantly faster than its centralized counterparts. The chart below shows that the ratio between Hyperliquid’s perp volumes and that of the three largest CEXs has increased by more than 6x over the past year. Hyperliquid’s monthly perps volumes now represent almost 14% of Binance’s futures volumes, up from just 2.2% a year ago.