[ad_1]

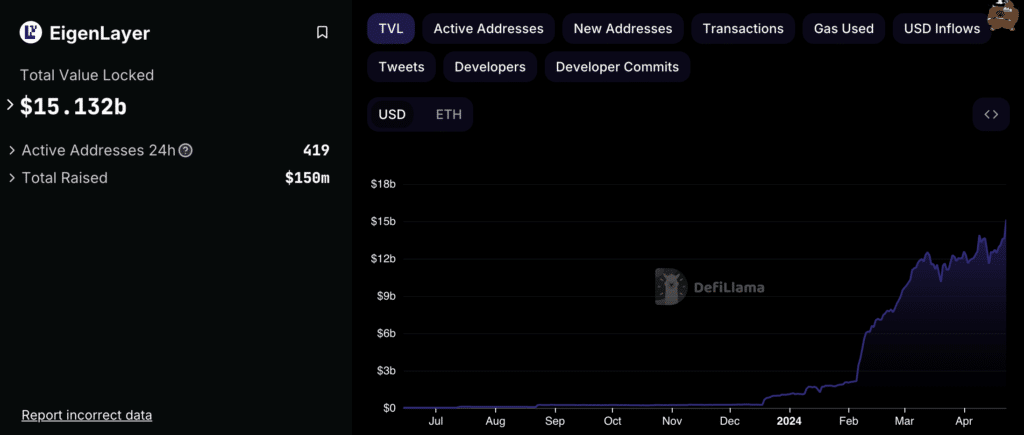

The total value of locked funds in the EigenLayer restaking protocol exceeded $15.1 billion.

According to DefiLlama, the project team lifted restrictions on pool limits, which caused a noticeable increase in total value locked (TVL). This figure was $11 billion at the beginning of March, increasing by $4 billion in less than two months.

Source: DeFiLlama

EigenLayer’s TVL still needs to be improved to reach Lido Finance’s liquid staking protocol, which sits at $29.6 billion.

You might also like: Glassnode: Restaking brings new yield opportunities for Ethereum community

In April, EigenLayer reached 115,000 unique users, according to Dune Analytics. In early April, the protocol announced the launch of the mainnet and introduced functionality for operators and restakers. Users now have access to several new features. In addition, this year, the developers promised to launch intra-protocol payments.

Announcing: EigenLayer ♾ EigenDA Mainnet Launch pic.twitter.com/bTp5BfnsKE

— EigenLayer (@eigenlayer) April 9, 2024

EigenLayer founder Sreeram Kannan said the protocol increases the utility of Ethereum and provides economic security to the asset.

Our goal is to make @eigenlayer eventually permissionless on the staking assets.

———–

When any asset can be staked, what asset *will* be staked?

———–

– There is a common misconception that lower volatility assets are better. Is USDC the lowest volatility asset then?… https://t.co/YOrPlgprtB— Sreeram Kannan (@sreeramkannan) April 15, 2024

Kannan, an assistant professor at the University of Washington, developed the protocol in 2021. It is based on Ethereum and allows customers to withdraw cryptocurrency and extend crypto security to new network applications such as bridges and oracles.

You might also like: EigenLayer nears $7b TVL, becoming 4th largest restaking protocol

[ad_2]