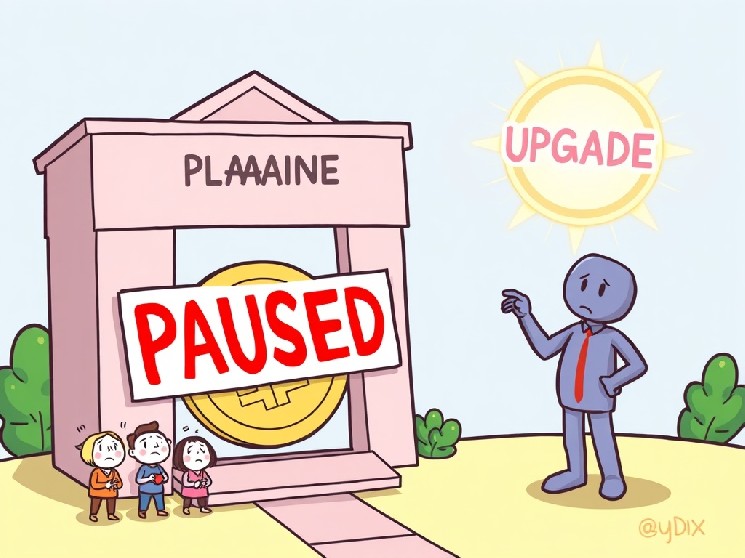

South Korean crypto exchange Bithumb recently announced a temporary halt to DYDX deposits and withdrawals. This crucial move, set to begin at 9:00 a.m. UTC on September 2nd, is in preparation for a significant network upgrade for the dYdX (DYDX) token. Understanding the reasons behind such suspensions is key for any cryptocurrency user, ensuring you remain informed and prepared for market fluctuations and operational changes.

Why Are DYDX Deposits and Withdrawals Being Suspended?

Exchange suspensions of services like DYDX deposits and withdrawals are not uncommon in the fast-evolving world of cryptocurrency. They typically occur for essential reasons that ultimately benefit the users and the network’s long-term health. In this case, Bithumb is supporting a vital network upgrade for dYdX.

Network upgrades are fundamental for:

- Enhanced Security: Implementing new protocols to protect user assets and data more effectively.

- Improved Scalability: Allowing the network to handle a larger volume of transactions more efficiently, reducing congestion and fees.

- New Features and Functionality: Introducing innovations that can improve the dYdX platform’s utility and user experience.

- Maintaining Stability: Ensuring the underlying blockchain infrastructure remains robust and reliable.

Bithumb’s decision reflects its commitment to providing a secure and stable trading environment. By temporarily pausing DYDX deposits and withdrawals, the exchange ensures a smooth transition during the upgrade process, minimizing potential risks or disruptions that could arise from attempting transactions on an unstable or transitioning network.

What Does This Mean for Your DYDX Funds on Bithumb?

It’s natural to feel concerned when you hear about a suspension of services, but rest assured, this temporary halt does not mean your funds are at risk. Your dYdX (DYDX) assets held on Bithumb remain safe and secure within the exchange’s custody. The suspension primarily impacts your ability to move DYDX in or out of the exchange.

Here’s what you need to know:

- Trading Unaffected: Typically, trading of DYDX pairs on Bithumb will continue as usual during the suspension period, unless otherwise specified by the exchange.

- No New Deposits: You will not be able to deposit DYDX tokens into your Bithumb account after the specified time.

- No Withdrawals: You will also be unable to withdraw DYDX tokens from your Bithumb account.

- Temporary Measure: This is a short-term measure designed to protect your assets and ensure the integrity of the network during the upgrade.

Users are strongly advised to avoid attempting any DYDX deposits and withdrawals once the suspension begins. Any such transactions might fail or, in rare cases, lead to funds being stuck or delayed until the network upgrade is complete and services resume.

Preparing for the Temporary Halt of DYDX Deposits and Withdrawals

To navigate this temporary service interruption smoothly, a little preparation goes a long way. Being proactive can help you avoid any last-minute stress or inconvenience. Here are some actionable insights:

- Complete Transactions Early: If you need to deposit or withdraw DYDX from Bithumb, ensure you complete these transactions well before the 9:00 a.m. UTC deadline on September 2nd.

- Stay Informed: Regularly check Bithumb’s official announcements page, their social media channels, or the dYdX project’s official communication channels for updates regarding the upgrade status and the resumption of services.

- Set Reminders: Mark your calendar for the suspension time. This simple step can prevent accidental attempts at transactions during the downtime.

- Understand the Benefits: Remember that these upgrades are for the long-term health and efficiency of the dYdX network, which ultimately benefits all users.

While the temporary suspension of DYDX deposits and withdrawals might seem like an inconvenience, it’s a necessary step for a healthier and more robust dYdX ecosystem. Bithumb is acting responsibly to facilitate this crucial technical improvement.

In conclusion, Bithumb’s temporary suspension of DYDX deposits and withdrawals is a proactive measure to support a vital network upgrade. This ensures a more secure, scalable, and feature-rich dYdX platform for everyone. Stay updated with official announcements, plan your transactions accordingly, and look forward to the enhanced capabilities that this upgrade will bring.

Frequently Asked Questions (FAQs)

1. When will Bithumb suspend DYDX deposits and withdrawals?

Bithumb will temporarily suspend DYDX deposits and withdrawals starting at 9:00 a.m. UTC on September 2nd.

2. Why is Bithumb suspending DYDX services?

The suspension is to support a crucial network upgrade for the dYdX (DYDX) token, aiming to enhance security, scalability, and introduce new features.

3. Are my DYDX funds safe during the suspension?

Yes, your dYdX (DYDX) assets held on Bithumb remain safe and secure within the exchange’s custody. The suspension only affects the ability to deposit or withdraw.

4. What should I do before the suspension of DYDX deposits and withdrawals?

If you need to deposit or withdraw DYDX, complete these transactions before the September 2nd deadline. It’s also advisable to monitor Bithumb’s official announcements for updates.

5. Will I still be able to trade DYDX on Bithumb during the suspension?

Typically, trading of DYDX pairs continues as usual during such suspensions, unless Bithumb specifies otherwise. The halt primarily affects deposits and withdrawals.

Was this information helpful in understanding Bithumb’s update? Share this article with your fellow crypto enthusiasts on social media to keep them informed about important updates regarding DYDX deposits and withdrawals and Bithumb’s operational changes!

To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency exchanges and their impact on digital asset management.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.