In this post:

- dYdX reviewed the BONK integration, proposing a branded frontend to capture 50% of the protocol fees.

- The decentralized finance (DeFi) exchange advanced three partnership proposals, including CCXT, Foxify, and CoinRoutes, enhancing ecosystem involvement.

- dYdX adjusted fee distribution, increasing stakers’ and buybacks’ shares to strengthen incentives.

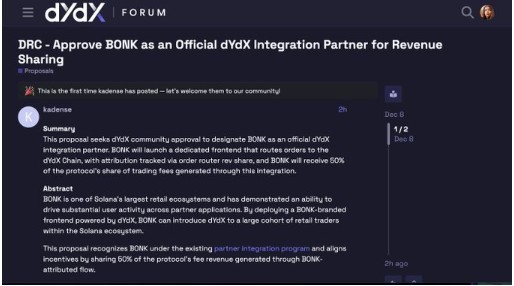

On December 8, dYdX governance announced that it is reviewing a proposal to formally integrate BONK as a partner through its Partner Revenue Share Program. dYdX stated that the strategy introduces a BONK-branded frontend that funnels transactions to the dYdX Chain, allowing it to receive 50% of protocol fees from its attributed order flow.

BONK is one of Solana’s biggest retail ecosystems. According to dYdX, the integration of BONK provides a strong distribution channel for Solana traders. The non-custodial trading protocol further stated that the integration of BONK provides a trusted brand among Solana users.

BONK partnership increases dYdX growth

dYdX governance is considering a new proposal to approve @bonk_inu as an official dYdX integration partner under the Partner Revenue Share Program.

The proposal outlines a dedicated BONK-powered frontend routing orders to the dYdX Chain, with 50% of the protocol’s fee revenue… pic.twitter.com/hPTAVPrQoS

— dYdX Foundation (@dydxfoundation) December 8, 2025

dYdX revealed that its partnership with BONK will expand the protocol’s presence throughout the Solana ecosystem. The non-custodial trading protocol claimed that the collaboration with BONK can significantly raise the volume of new retail takers.

The decentralized crypto trading platform allowed community feedback. dYdX stated that if no huge objections emerge, BONK will present the on-chain governance proposal for a vote on Thursday, December 11, 2025.

According to the partner integration program, governance-approved partners can earn a portion of the protocol fee, strengthening collaboration incentives, increasing liquidity, and promoting community-driven growth.

In October, dYdX announced a new proposal for a 50/50 distribution between buybacks and stakers to expand dYdX’s impact.

The proposal aimed to modify the previous fee distribution, with 40% allocated to stakers, 25% to the Buyback Program, 25% to Megavault, and 10% to the Treasury SubDAO. According to the decentralized crypto trading platform, the proposed new distribution increased to 50% Stakers, 50% Buyback Program,0% Treasury SubDAO, and 0% Megavault.

dYdX revealed that Treasury SubDAO currently holds more than 60 million DYDX tokens, negating the need for 10% allocations. According to dYdX, Megavault will benefit from higher token prices and more activity on the system.

The decentralized crypto trading platform claimed that by allocating a bigger share to stakers and buybacks, the trading platform increases buy pressure and staking incentives. dYdX further claimed that the increase in buy pressure and staking incentives may result in a positive feedback loop.

dYdX expands partnerships with integration proposals

dYdX governance has already advanced three similar proposals, demonstrating its continued dedication to increasing partner involvement throughout its ecosystem.

On November 3, CCXT sent an on-chain governance proposal to the dYdX community for approval to become an official dYdX integration partner and take part in the partner revenue share program. dYdX proposed to be eligible to collect 50% of the protocol’s share of trading fees created through CCXT integration under the current system described in the dYdX Rev Share documentation.

According to dYdX, the integration will enable CCXT users to route orders to dYdX with minimal frictions, increasing user engagement and overall liquidity. The dYdX DeFi exchange revealed that revenue share guarantees that CCXT remains in line with dYdX’s long-term performance by profiting in proportion to the flow it generates.

CCXT will facilitate smooth communication between trading systems and developers by adding native support for dYdX Chain markets. Additionally, attribution and fee sharing will be monitored via Builder codes.

On November 19, Foxify submitted a proposal to the dYdX community for approval to become an official integration partner of dYdX. According to the proposal, dYdX will be eligible to collect 50% of the revenue made by users who onboard and trade using the Foxify platform.

Foxify is the first A-book prop firm on Web3 that offers straight-to-live funded accounts. According to the proposal, Foxify will receive 50% of the protocol fees from traders using the Foxify trading platform.

Notably, Foxify will incorporate dYdX Chain as a supported execution venue for both funded and unfunded users straight into the Foxify trading platform.

On September 15, CoinRoutes sent a proposal to the dYdX community to become an integration partner of dYdX. The blockchain-based derivatives exchange will receive 50% of the integration revenue shares under the framework.

The dYdX announcement revealed that CoinRoutes’ integration with the dYdX Chain will allow its professional and institutional trading clients to access deep liquidity on dYdX easily, increasing the protocol’s order flow and volume.