[ad_1]

As Hyperliquid seeks to develop an in-house stablecoin, some of the largest protocols in decentralized finance (DeFi) are courting governance voters in an effort to secure the USDH ticker and manage the ecosystem’s stablecoin.

However, Haseeb Qureshi, managing partner at crypto investment firm Dragonfly, claims a ‘backroom deal’ has already been concluded.

“Hearing from multiple bidders that none of the validators are interested in considering anyone besides Native Markets. It’s not even a serious discussion, as though there was a backroom deal already done. Native Markets’ proposal came out almost immediately after the USDH RFP was announced, implying they had advanced notice,” complained Qureshi on X.

CL, the anonymous crypto trading cat and spokesperson for Hypurrscan (which commands 15% of the voting power), verbalized support for Native Markets under Haseeb’s post. However, Alex Svanevik, the founder of Nansen, which runs the largest Hyperliquid validator at The Hypurr Collective, strongly objected to Qureshi’s accusations.

Svanevik retorted, “Factually incorrect…our teams have put a ton of effort into reviewing proposals and speaking with bidders to find the best alternative for HL. I’ve literally been receiving DMs and phone calls non-stop this week from USDH bidders. In ALL cases, we have proactively engaged with them.”

Native Markets

Over the last week, the race to launch USDH has heated up, with formal proposals floated by DeFi heavyweights like Sky (formerly Maker), Ethena, Paxos, and Agora. It should be noted that Dragonfly is invested in both Agora and Ethena, which have launched USDH proposals and are competing for the right to launch Hyperliquid’s stablecoin.

Haseeb’s accusation is directed towards the Native Markets proposal, which calls for the stablecoin to be natively minted on the HyperEVM, while maintaining GENIUS Act compliance and inheriting the fiat rails of its issuer Bridge, a Stripe subsidiary.

Stripe announced its upcoming permissionless Layer 1, Tempo, just last week, and could potentially simplify the process of onramping fiat to Hyperliquid, which currently requires onchain bridge solutions.

The Native Markets team includes Max Fiege, who was previously at Liquity and Barnbridge, and former President and COO of Uniswap Labs, Anish Agnihotri.

Unlike other proposals, which suggest using the majority of USDH revenues to buy back HYPE, Native Markets proposes 50% of reserve yield going to the Hyperliquid Assistance Fund for HYPE buybacks, while the other 50% is reinvested in USDH growth.

Ethena vs Sky vs Paxos

Paxos swooped in late overnight with a revamped proposal, which includes a partnership with PayPal that will see HYPE listed on PayPal and Venmo, including free on and off ramps, $20 million in ecosystem incentives, and an “AF-first incentive structure” where Paxos does not earn fees until TVL milestones are reached.

In the saga’s latest development, Bhau Kotecha, the co-founder of Paxos, expressed that he is open to Paxos and Native Markets working together.

This was inspired by a tweet from investor Mike Dudas, who said, “Isn’t the obvious $usdh solution to simply merge the native markets & paxos proposals? Native markets in the front (hl native, deep ecosystem ties & roots). Paxos in the back (genius compliant, issuer has scaled to tens of billions, paypal/venmo distribution).”

Simultaneously, USDT0, the cross-chain variation of Tether’s USDT stablecoin, announced it would not be throwing its hat in the ring.

In addition to the official proposals, these protocols are also appealing to the Hyperliquid community. The Agora proposal was accompanied by a public address on X from Jan van Eck, the CEO of the $130 billion VanEck investment firm, while Ethena has taken a more humorous approach by parodying Eminem’s verse from the song “Stan”, with a tongue-in-cheek note to Hyperliquid founder Jeff Yan.

Sky’s proposal in particular attracted attention after co-founder Rune Christiansen published it in the Hyperliquid Discord last night. Sky’s USDH proposal highlighted Sky and DAI’s successful track record, but also mentioned that Hyperliquid would receive 4.85% APR on all USDH issued on Hyperliquid, that Sky would potentially deploy its $8 billion balance sheet on Hyperliquid, and a $25 million grant to create “Hyperliquid Star,” meant to autonomously grow DeFi on Hyperliquid.

Synthetic dollar protocol Ethena hit back with its own proposal on Sept 9, which envisions USDH backed 100% by USDtb, Ethena’s stablecoin backed by BlackRock’s BUIDL fund. Ethena’s proposal also vowed to return “at least 95%” of USDH reserve revenue to the Hyperliquid ecosystem in the form of HYPE purchases, and “a minimum of $75m in a mix of cash and token incentives to grow HIP-3 front-ends.”

Sky and Ethena issue the third and fourth-largest stablecoins by market capitalization, only trailing Circle’s USDC and Tether’s USDT. Ethena’s USDe is worth nearly $13 billion, while Sky’s DAI is worth roughly $5 billion; however, both combined still fall well short of the market leaders, with USDC’s market capitalization at $72 billion and USDT’s at $169 billion.

While traditional institutions and DeFi protocols continue to up the ante, HyperEVM builders are focused on the mission ahead. Charlie, a contributor at Felix Protocol, told The Defiant that “the real work on this whole USDH setup starts when launch happens, as the real question will be about scaling to $5 billion.”

He referenced a recent post on X, clarifying that for USDH to have a real impact on Hyperliquid, it needs to focus on more than just rebates or HYPE buybacks. “I wouldn’t discount USDT/USDe/USDC also coming to play this incentive game if this is the path they see to come win supply. [We] need to see a clearer path to shake USDC dominance for these USDH proposals to become more interesting.”

It is worth noting that while Tether’s USDT0 subsidiary withdrew its name from the race earlier today, it is unclear if that officially rules Tether out, and Circle has been silent on the matter so far.

Hyperliquid’s Growth

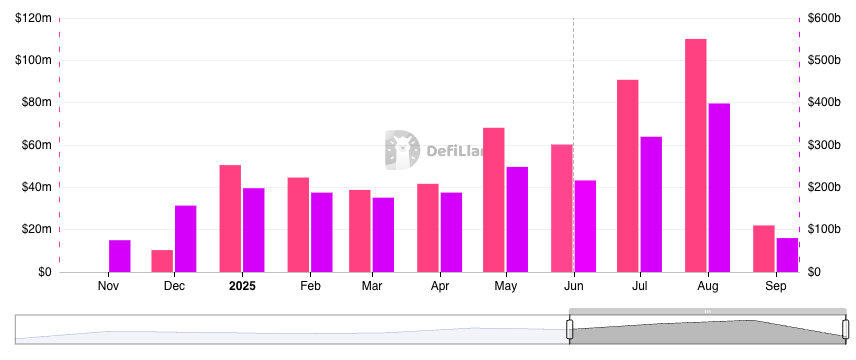

The perpetuals exchange and Layer 1’s growth has been a recurring theme in 2025.

Hyperliquid accounts for more than 35% of all crypto revenue today, generating $1.28 billion annualized, with 99% of that revenue going to the Hyperliquid Assistance Fund to buy back HYPE tokens.

Revenue and Perpetuals Volume – DeFiLlama

Hyperliquid’s Layer 1 blockchain, the HyperEVM, has been in a consistent uptrend since its mainnet launch in February, and is now the eighth-largest blockchain by total value locked (TVL) with $2.6 billion, after beginning 2025 with $400 million.

Meanwhile, the HYPE token has been one of crypto’s top-performing assets since its launch in November 2024. The token debuted at roughly a $3 billion fully diluted valuation and has surged more than 1700% since its launch, hitting an all-time high of $55.7 overnight.

[ad_2]